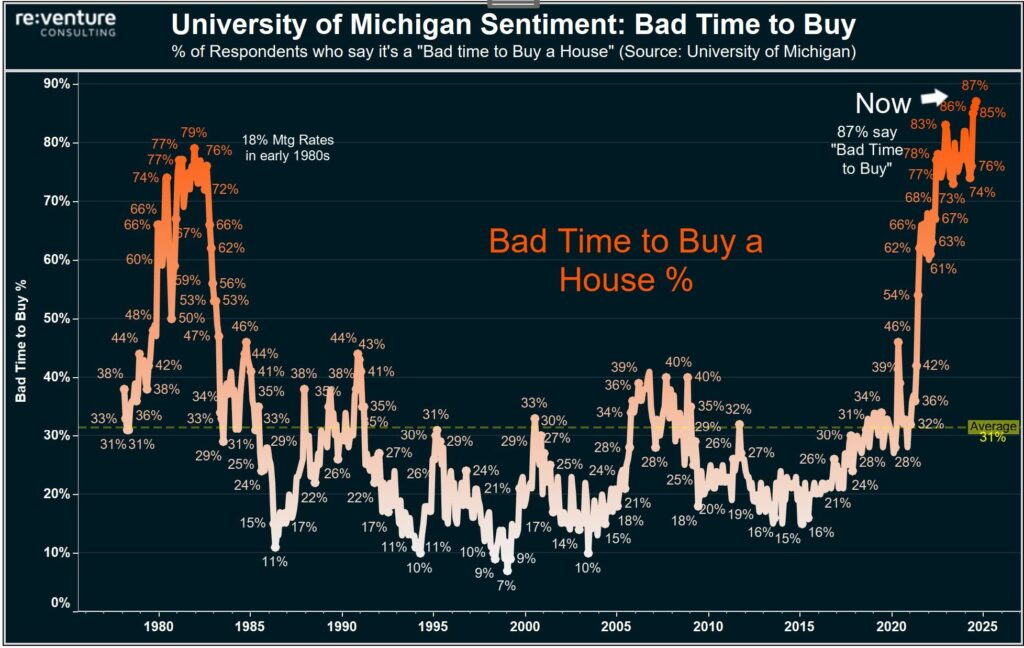

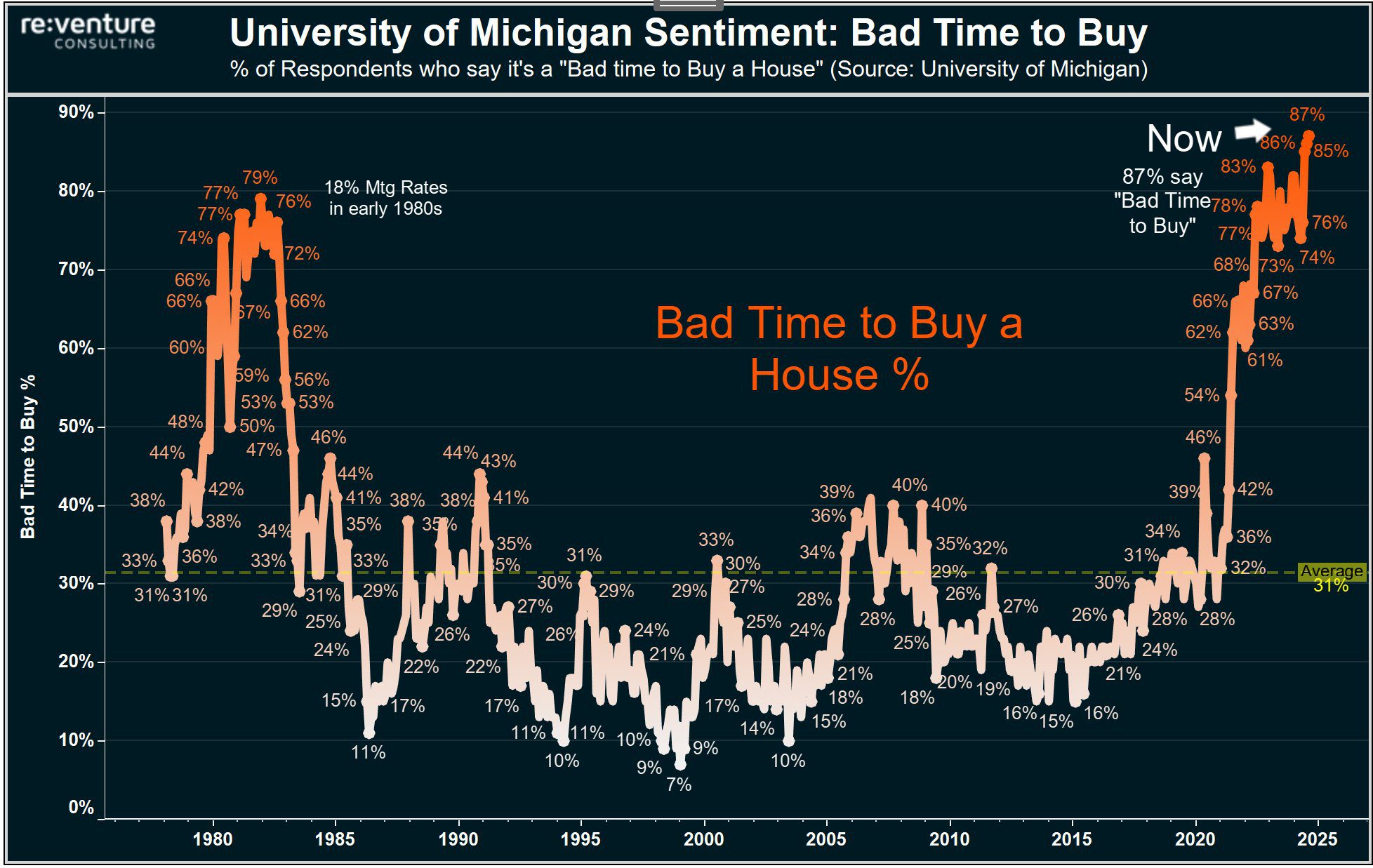

A record 87% of Americans now think it’s a bad time to buy a home, which is more than twice as high as the 2008 peak.

During the 2008 Financial Crisis, only 40% of Americans believed it was a bad time to buy a home, according to Reventure. Even in the early 1980s, when mortgage rates soared to 18%, people were less negative than they are now. Back then, the highest level of pessimism reached 79%, which is still 8 percentage points lower than today.

This is by far the most pessimistic sentiment in the housing market’s history. Despite mortgage rates slightly easing, homebuyer demand remains weak. Rising home prices continue to push many potential buyers out of the market. Home prices have been steadily increasing, while affordability has become a significant issue, leaving many prospective buyers feeling that homeownership is out of reach.

During the 2008 Financial Crisis, when the housing market collapsed and caused widespread economic instability, consumer sentiment was relatively less negative compared to now. Back then, just 40% of Americans felt it was a bad time to buy a home, reflecting the severity of today’s housing challenges.

Even in the early 1980s, when interest rates reached a record high of 18%, sentiment did not reach the levels of pessimism seen today. At that time, the highest percentage of people who believed it was a bad time to buy a home was 79%, 8 points below today’s figure. This means that, despite the economic hardships of the past, the current housing market is seen as even less favorable for buyers.

The combination of persistently high home prices, tight inventory, and economic uncertainty has driven consumer sentiment to historic lows. Many buyers have simply given up, waiting for conditions to improve, but with no significant signs of relief on the horizon, this pessimism may continue for the foreseeable future.

This unprecedented level of negativity underscores how difficult it is for Americans to navigate today’s housing market, far surpassing previous housing crises, including the 2008 Financial Crisis and the high-interest-rate environment of the 1980s. Even though mortgage rates have seen slight decreases, the affordability gap remains a major barrier for many potential homeowners, further fueling this record pessimism.

In conclusion, with home prices continuing to rise and affordability deteriorating, the housing market is currently seen as more challenging than ever, leading to the most pessimistic sentiment ever recorded in the U.S. housing market. This record level of negative sentiment reflects broader concerns about the state of the economy and housing affordability, with many potential buyers opting to sit on the sidelines and wait for more favorable conditions.

Udpate (October 9th, 2024)

U.S. home loan interest rates surged to 6.36% last week, the largest jump in over a year, driven by strong economic data. The 30-year fixed mortgage rate rose 22 basis points, reflecting reduced expectations of future Fed rate cuts, per the MBA.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment