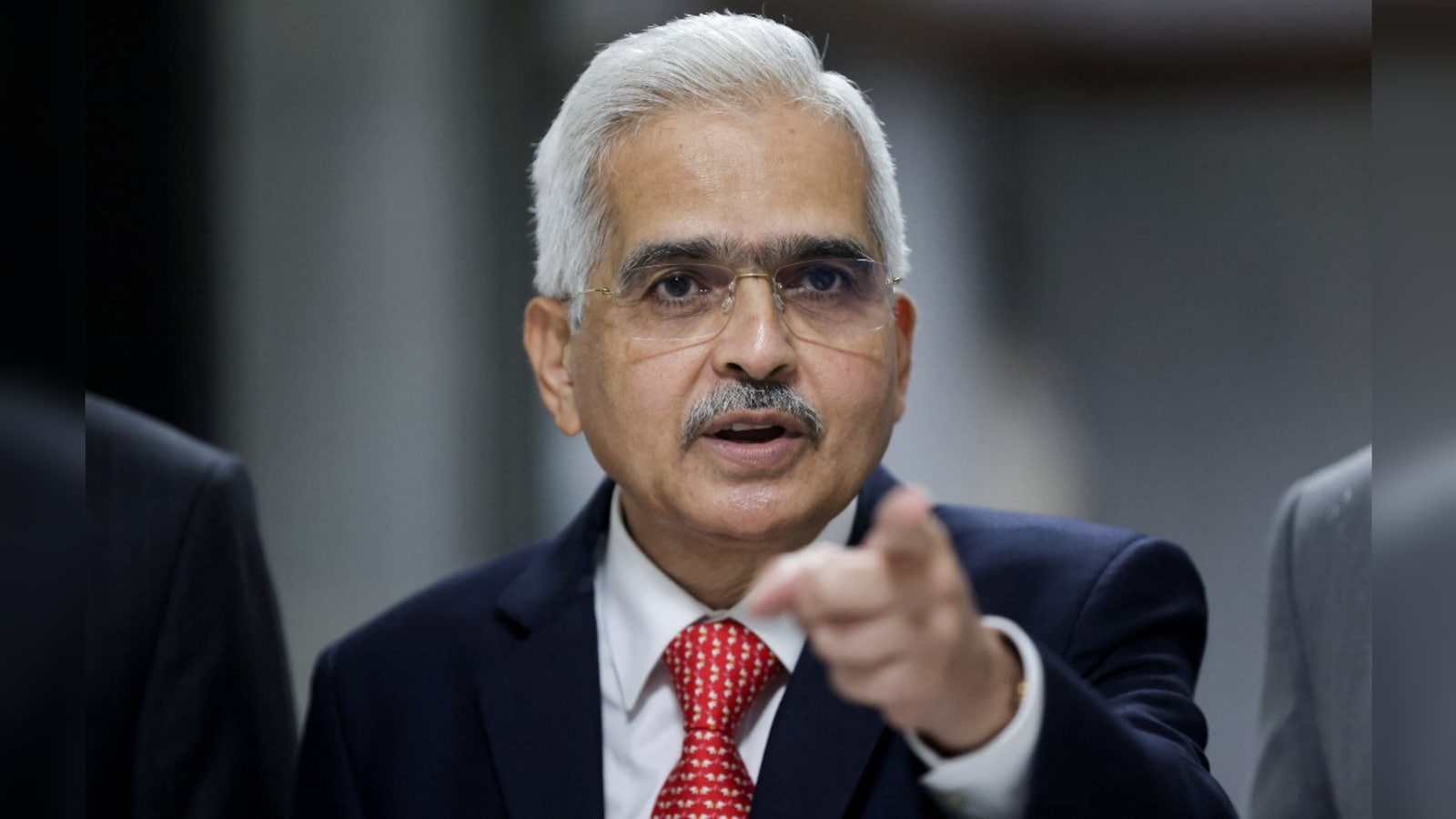

RBI Maintains Interest Rate at 6.50%, Focuses on Inflation, Economic Growth, and Financial Stability

The Reserve Bank of India (RBI) has decided to keep the key interest rate unchanged at 6.50%, aligning with both expectations and the previous rate. This decision follows a recent meeting of the Monetary Policy Committee (MPC), where 4 out of 6 members supported the rate decision.

Economic Growth and Inflation Trends

RBI Governor highlighted that India’s economic growth remains robust, with inflation generally on a declining path. The central bank aims to bring inflation gradually in line with its target, although food inflation remains persistent.

In addition to maintaining the repo rate, the RBI has kept the standing deposit facility rate at 6.25%, and both the marginal standing facility rate and the bank rate at 6.75%.

Food Price Impact

Ongoing food price shocks have slowed disinflation in Q1 2024/25. There is a significant gap between headline and core inflation, with the focus on headline inflation. Persistent food inflation could impact household inflation expectations and potentially spill over into core inflation. While temporary high food inflation may be overlooked, persistent high levels cannot be ignored.

The overall inflation trajectory is moderating, though unevenly and slowly. Vigilance is necessary to approach the 4% target.

Credit Market and Liquidity

Credit market transmission continues, with liquidity management remaining flexible. Recent financial market developments could impact emerging economies, and the RBI is committed to ensuring orderly financial market evolution.

Investment Trends

Alternative investment options are increasingly attractive to retail customers. Credit growth has moderated in sectors where preemptive measures were applied.

Banking Sector Recommendations and Compliance

- Personal Loans: Some segments of personal loans are experiencing significant growth. Banks need to carefully assess underwriting standards and monitor loan growth.

- External Financing: The RBI is confident that external financing needs will be comfortably met.

- Foreign Exchange Reserves: As of August 2, India’s foreign exchange reserves stand at $675 billion.

- Credit Reporting: Lenders are required to report credit information to credit bureaus on a fortnightly basis.

- Tax Payments: The transaction limit for tax payments via UPI will be increased to 500,000 rupees.

Banking Sector Compliance

Banks should enhance IT and cybersecurity checks. The current account deficit is expected to remain within sustainable levels in Q1 2024/25 and manageable throughout the current year.

Monetary Policy Committee (MPC) Focus

The MPC will continue to focus on withdrawing accommodation to ensure inflation aligns with its target. Key points from the RBI Chief’s statement include:

- On Inflation: Persistent food inflation remains a concern, with a focus on moderating overall inflation. Consistent monetary policy is crucial, and price stability is essential for long-term growth.

- On Monetary Policy: The policy approach must be disinflationary to control inflation effectively.

Global Economic Outlook

Globally, the economic outlook shows steady but uneven expansion. Inflation is receding slowly in various regions, with global financial markets experiencing volatility. The near-term global growth outlook remains positive, though medium-term challenges persist. La Niña conditions could impact agricultural production, while the services sector remains buoyant.

Domestic Economic Activity

The RBI Chief highlighted positive trends in the domestic economy:

- Economic activity remains resilient.

- Manufacturing shows signs of improvement.

- Fixed investment continues to be strong.

- Private corporate activity is gaining momentum.

- Enhanced agricultural activity is expected to boost rural consumption.

- Global trade prospects are likely to support external demand.

- Volatility in international financial markets presents downside risks.

GDP and Inflation Forecasts

For FY25, real GDP growth is projected at 7.1% for Q1 and 7.2% for Q2, with a forecast of 7.2% for Q1 of FY26. CPI inflation for FY25 is forecasted at 4.5%, with anticipated rates of 4.4% in Q2, 4.7% in Q3, and 4.3% in Q4.

Market Reactions

Following the RBI’s decision to pause rate changes, the U.S. dollar/Indian rupee forward premiums have risen slightly. India’s Nifty 50 Index has extended its losses, currently down by 0.6%.

As the RBI navigates these economic challenges, its policies will continue to play a critical role in shaping India’s economic landscape.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment