On Friday, the Reserve Bank of India (RBI) decided to maintain its key interest rate at 6.50%, matching both previous and market expectations. This decision comes despite weak growth in the second quarter, which led some investors to hope for a rate cut. The RBI’s Monetary Policy Committee (MPC), which includes three RBI members and three external experts, has now kept the repo rate unchanged for the 11th consecutive meeting.

RBI’s Key Priorities and Economic Outlook

RBI Chief emphasized the importance of price stability while continuing to focus on economic growth. He noted that the final phase of disinflation is taking longer than expected. He assured that India’s economy is on a stable growth path, and domestic economic activity remains balanced. Four out of the six MPC members supported the decision to keep the repo rate unchanged, and the overall policy stance remains neutral.

Regarding growth, the RBI Chief pointed out that the slowdown in growth might lead to a downward revision of the full-year growth forecast. However, the outlook for the second half of the year remains resilient, although it will need close monitoring. Inflation continues to be a concern, as it has exceeded the upper tolerance band, with food prices likely to remain high in the short term. The RBI Chief highlighted that high inflation could negatively impact GDP growth, but durable price stability is crucial for achieving long-term economic prosperity.

RBI Governor Warns Against Rate Cuts Amid High Inflation

Governor Shaktikanta Das said that the MPC believes stable prices are key to strong growth, in a live address in Mumbai. India’s inflation is above the RBI’s 4% target, reaching 6.21% in October. Das warned that cutting rates now would be risky, and he’s not in a rush to follow global trends of lowering rates. The RBI has kept rates steady for nearly two years, but there are increasing calls for rate cuts after the economy grew slower than expected at 5.4% in July-September. Both Finance Minister Nirmala Sitharaman and Commerce Minister Piyush Goyal have urged lower borrowing costs.

Interest Rates and Inflation Projections

The RBI has also maintained its Standing Deposit Facility rate at 6.25%, and the Marginal Standing Facility and Bank Rate at 6.75%. For FY25, the RBI has revised its real GDP growth forecast down to 6.6%, compared to the previous estimate of 7.2%. The third-quarter growth is projected to be at 6.8%, while growth in FY26 is expected to remain strong, with forecasts of 6.9% in Q1 and 7.3% in Q2.

Inflation is expected to stay elevated, with food prices continuing to pressure the inflation numbers. However, estimates of a record Kharif crop should help ease food prices in the later part of the year. The RBI has revised its CPI inflation forecast for FY25 to 4.8%, up from the earlier estimate of 4.5%. The near-term inflation and growth outlook is more challenging, but as food price pressures subside, inflation is expected to fall in line with the target.

CRR Cut and Liquidity Measures

In a move to provide liquidity to the economy, the RBI announced a 50 basis point (bps) cut in the Cash Reserve Ratio (CRR), bringing it down to 4.00%. The reduction will be implemented in two equal tranches, starting December 14 and December 28. This move is expected to inject liquidity of 1.16 trillion rupees into the banking system. The Indian Rupee remained stable at 84.6650 per dollar following the announcement, while forward premiums rose slightly.

RBI Officials Discuss Inflation, Growth, and Liquidity

RBI Deputy Governor Patra explained that the decline in sales growth is a sign that inflation is hitting urban consumers, contributing to the overall slowdown in the economy. He emphasized that inflation is the main factor behind this slowdown. Meanwhile, RBI Governor Das stated that inflation has made a strong attempt to rise, but their efforts are focused on keeping it under control. He also mentioned that the Reserve Bank is in regular communication with the government to address inflation and implement supply-side measures. Looking ahead, Das warned of continued tight liquidity in the coming months and acknowledged the possibility of an increase in the amount of currency in circulation.

India Raises Interest Rate Caps for Foreigners’ Deposits

India’s central bank has announced plans to permit banks to increase the interest rates they offer to non-resident Indians (NRIs) in a bid to attract more foreign inflows and address the decline of the rupee. Shaktikanta Das, the Governor of the Reserve Bank of India (RBI), revealed that the ceiling on interest rates for foreign-currency non-resident bank deposits will be raised during his monetary policy speech on Friday. As a result of this move, the rupee strengthened by up to 0.3%, reaching 84.52 per dollar. The Indian currency has been under pressure, hitting new record lows in recent weeks, due to mounting global economic challenges.

This step comes after heavy foreign exchange interventions and builds on similar actions from 2013 and 2022. However, analysts are unsure if it will help stop the rupee from losing value. The rupee hit a record low of 84.7575 against the dollar due to U.S. policy issues, money leaving the country, and weakness in other regional currencies.

Future Policy and Economic Measures

The RBI also plans to introduce several measures to support growth and stability. A new benchmark, the Secured Overnight Rupee Rate (SORR), will be introduced, and small finance banks will be allowed to offer pre-sanctioned credit lines through the Unified Payments Interface (UPI). Additionally, a committee will be formed to explore the use of artificial intelligence in the financial sector.

The RBI remains cautious, stating that any further policy support will depend on how the economic situation unfolds, particularly with regard to inflation and growth. The Chief also reassured that the depreciation of the Indian Rupee and its relative stability compared to emerging market peers reflects the strength of India’s economic fundamentals.

BRICS No Decision on Common Currency Yet

India’s central bank chief has stated that there has been no decision made by the BRICS bloc regarding the creation of a common currency to reduce reliance on the dollar. Reserve Bank of India Governor Shaktikanta Das mentioned during a post-policy briefing on Friday that while the idea was raised by one of the member countries and discussed, no conclusion has been reached. He also pointed out that the geographical distribution of BRICS countries needs to be considered, unlike the euro zone, which benefits from geographical proximity.

In conclusion, while the RBI’s decision to keep interest rates unchanged may have disappointed some market participants, its careful balancing act between inflation control and growth support shows a cautious but steady approach to managing India’s economy.

Goldman Sachs Delays India Rate Cuts

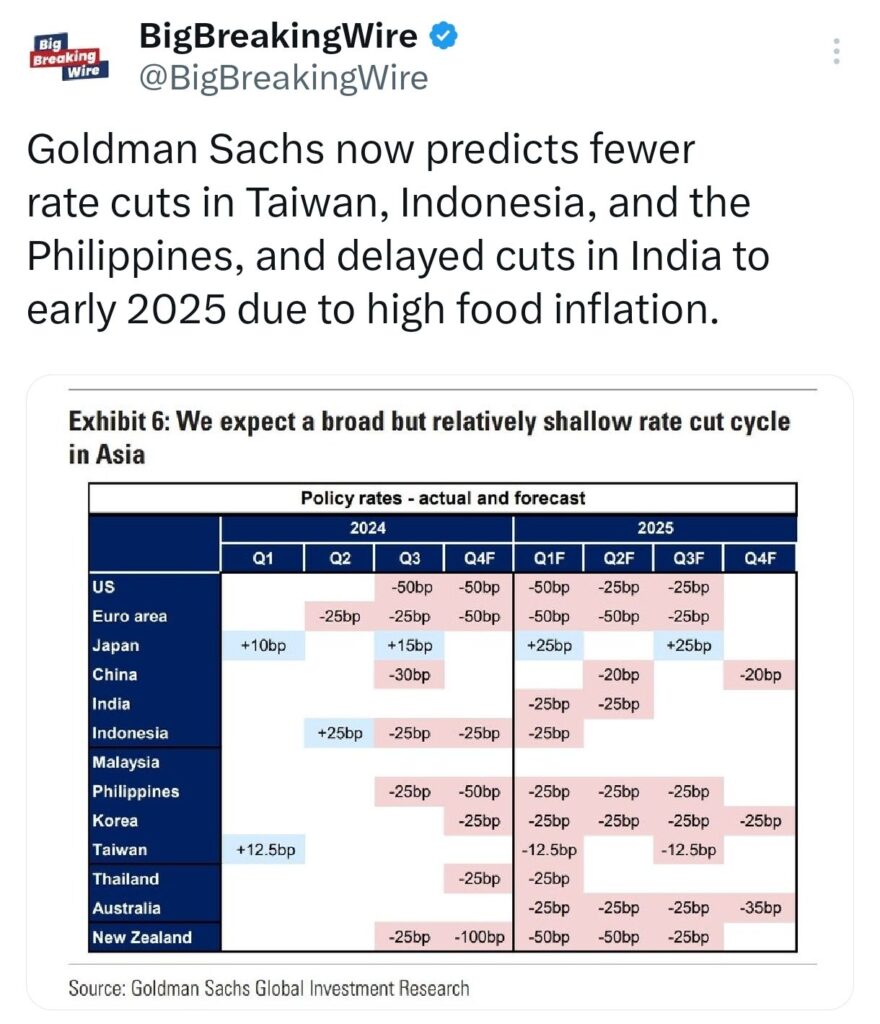

Goldman Sachs now forecasts fewer rate cuts in Taiwan, Indonesia, and the Philippines, with India’s rate cuts delayed until early 2025 due to persistently high food inflation.

Foreign Investment Returns to India’s Markets

Foreign investors are making a return to India’s stock and sovereign bond markets ahead of the crucial monetary policy meeting scheduled for Friday. Equities are showing positive movement following a record outflow in October, while debt inflows this month have already surpassed the withdrawals experienced in the previous month. This indicates a renewed confidence in India’s financial markets despite recent challenges.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment