In a move to address the surge in borrowing by low-income consumers, the Reserve Bank of India (RBI) has tightened regulations on consumer loans, urging lenders to enhance oversight on small personal loans. The central bank is considering stricter measures to mitigate the rising risk of loan defaults.

As part of the regulatory measures, RBI has increased risk weights on consumer credit exposure for commercial banks by 25 percentage points to 125%. This adjustment also extends to credit card receivables, with scheduled commercial banks (SCBs) facing a risk weight of 150%, and non-banking financial companies (NBFCs) at 125%.

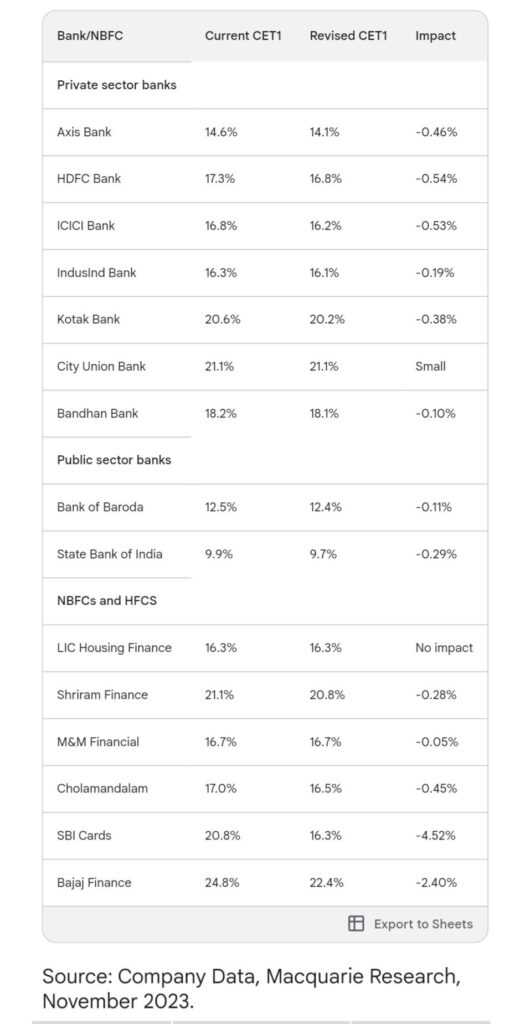

The elevated risk weights specifically target unsecured personal loans, excluding those tied to housing, education, vehicles, or secured by gold or gold jewelry. Macquarie’s analysis suggests that this move will negatively impact the Common Equity Tier 1 (CET1) ratio for both Banks and Non-Banking Financial Companies (NBFCs).

The CET1 impact is expected to vary across institutions, influenced by their risk profiles and asset compositions. Private sector banks may bear a greater brunt due to their higher concentration of risky assets, while public sector banks could see a comparatively lower impact.

Notably, the increase in risk weights is anticipated to make capital-raising and lending more expensive for banks and NBFCs, potentially hindering economic growth in India. The overall impact on individual institutions will depend on their risk management practices and the nature of their loan portfolios. As these regulatory measures take effect, the financial landscape in India may witness shifts in lending strategies and a recalibration of risk management frameworks.

The most impacted is SBI Cards with an impact of -4.52%. The least impacted are City Union Bank and LIC Housing Finance with an impact of 0.0% according to Macquarie Research.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

One Comment