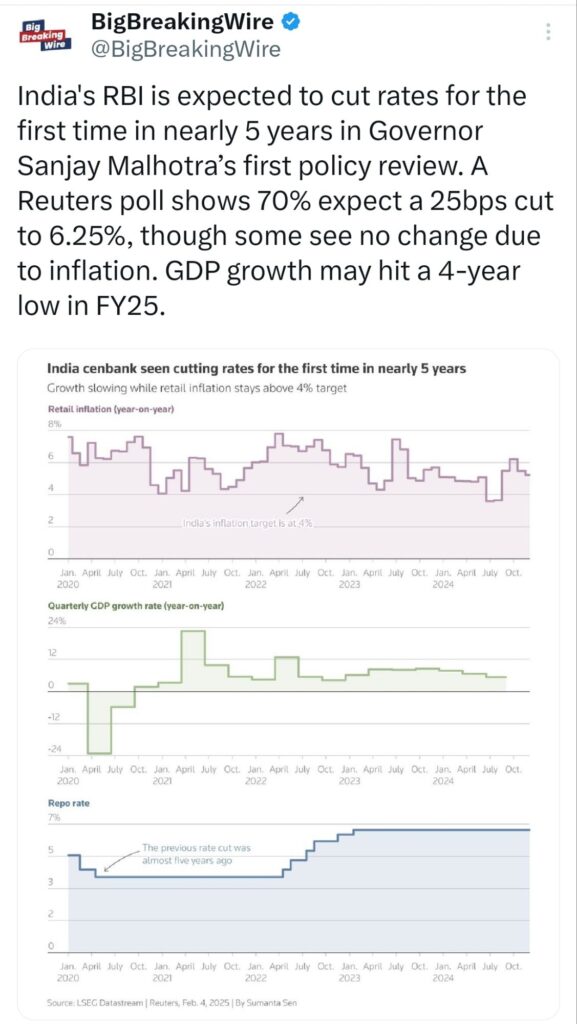

The Reserve Bank of India (RBI) cut its key repo rate by 25 basis points to 6.25% on Friday, marking its first rate reduction since May 2020. The decision, in line with expectations, comes as the economy faces its slowest growth in four years. The Monetary Policy Committee (MPC), comprising three RBI members and three external members, had kept rates unchanged for eleven consecutive meetings before this move to provide economic stimulus.

RBI Chief highlighted that CPI has largely stayed within the target range, except for a few instances, and credited the flexible inflation targeting framework for helping maintain lower average inflation since its introduction. He emphasized that improving economic efficiency is essential and that the RBI will ensure a smooth implementation of regulations, allowing adequate time for transition.

He assured that the central bank will carefully consider trade-offs when framing regulations and will continue its consultative approach. Additionally, the RBI aims to refine the inflation targeting framework further and develop more robust models for projecting inflation to enhance policy effectiveness.

RBI Chief stated that global disinflation progress is slowing, and emerging markets are experiencing significant capital outflows. India’s economy has also felt the impact of global challenges, and the uncertain global environment makes policy decisions difficult for emerging economies. However, he assured that the RBI has used all available tools to tackle these challenges, as the global economic situation remains tough.

RBI Chief stated that the Monetary Policy Committee (MPC) unanimously voted to keep the policy stance ‘neutral.’ The Marginal Standing Facility (MSF) rate and the bank rate have been set at 6.5%, while the Standing Deposit Facility (SDF) rate is adjusted to 6.0%. The RBI will focus on ensuring inflation remains aligned with the target, with further moderation expected in FY26. Growth is also projected to recover.

RBI has revised its FY25 real GDP growth estimate to 6.4% from the previous 6.6%. Agricultural activity remains strong, and the services sector is resilient. Rural demand is improving, while urban consumption remains weak. Growth will be supported by strong service exports and favorable growth-inflation dynamics. However, risks include global financial market volatility and uncertain trade policies. The MPC will remain flexible in responding to economic changes. Improving employment, tax relief, lower inflation, and strong agricultural performance are expected to boost overall consumption.

RBI expects real GDP growth of 6.7% in Q1 FY26, 7% in Q2, and 6.5% in both Q3 and Q4, with overall FY26 growth projected at 6.7%. Following the RBI’s 25 bps rate cut while keeping its policy stance unchanged, India’s 10-year government bond yield rose by 4 basis points to 6.6855%. Meanwhile, USD/INR forward premiums remained mostly unchanged.

RBI expects food inflation to ease unless supply issues arise, while core inflation may rise but stay moderate. Energy price swings remain a risk. Strong service exports will support growth. CPI inflation is projected at 4.8% for FY25 and 4.2% for FY26. Quarterly estimates for FY26 are 4.5% in Q1, 4% in Q2, 3.8% in Q3, and 4.2% in Q4.

India’s external sector remains strong, with the current account deficit (CAD) expected to stay within sustainable levels. The exchange rate policy has remained consistent, aiming to maintain market order without targeting specific levels. The Reserve Bank of India (RBI) intervenes in the foreign exchange market only to smooth excessive volatility, not to fix the exchange rate. India’s forex reserves stand at over $630 billion, providing an import cover of 10 months, reinforcing economic stability.

Liquidity in the banking system has been impacted by advance tax outflows, but the RBI is committed to ensuring sufficient liquidity. The credit-deposit ratio of banks stood at 80.8% as of January-end, and system-level indicators for non-banking financial institutions remain healthy. However, some banks are hesitant to lend in the unsecured call money market, and the RBI urges active interbank trading. The central bank will continue to monitor liquidity and financial conditions, taking necessary steps to address both short-term and long-term liquidity needs.

RBI chief highlighted the growing concern over digital frauds and announced plans to introduce forward contracts in government securities. This move aims to improve the pricing efficiency of securities that use government bonds as their underlying asset.

He also stated that a less restrictive monetary policy would be more appropriate in the current scenario. Additionally, the RBI will set up a working group to conduct a comprehensive review of trading and settlement timings in markets regulated by the central bank.

RBI Chief Malhotra said the Reserve Bank is committed to providing as much liquidity as needed and will remain vigilant, proactive, and responsive to liquidity measures. He emphasized that the primary goal remains controlling inflation, while also supporting growth. With inflation decreasing, the RBI is in a position to be more growth-friendly. He expressed optimism for projected growth numbers based on current indicators and assured that the RBI will continue to improve its macroeconomic models.

RBI Delays Implementation of Key Banking Regulations to Allow More Preparation Time

The Reserve Bank of India (RBI) will delay the implementation of three important banking regulations, allowing banks more time to adjust, according to the central bank governor. These include stricter rules for lending to infrastructure projects, a requirement for banks to reserve more funds for digital deposits, and a plan for a framework on ‘expected credit loss.’

RBI Chief Malhotra stated that the current timeline for implementing LCR (Liquidity Coverage Ratio) norms by the end of March is not sufficient. While the impact analysis of these norms has been done, they are being reviewed based on feedback. He emphasized the need to avoid any disruptions during implementation. He also mentioned that India can achieve a growth rate of 7% or higher and should aim for that. The earliest implementation of the draft norms will be by March 2026, and more time will be needed for project financing norms.

RBI Chief Malhotra stated that the recent rupee exchange rate has been incorporated into their inflation projections. He also mentioned that they are reviewing the overlap between the expected credit loss rules and the project finance rules.

RBI Chief Malhotra emphasized that the focus should be on the long-term exchange rate and other assets, rather than daily rupee fluctuations. He highlighted that global uncertainties are a bigger concern, and the current less restrictive policy will only apply to this MPC meeting due to ongoing risks.

Malhotra also strongly opposed any form of mis-selling, stating that necessary actions will be taken against regulated entities involved in such practices. RBI Deputy Swaminathan mentioned that they are continuing to engage with entities on a bilateral basis when there is non-adherence to guidelines.

Reserve Bank of India has decided to allow trading in bond forwards, which will help long-term investors, such as insurance companies, manage interest rate risks. These contracts will let investors agree to buy government bonds at a future price, offering more flexibility in managing their investments. This move follows more than a year of feedback from investors.

Currently, while the official rules for bond forwards are still pending, insurers have been using a similar instrument called bond forward rate agreements (FRAs) to hedge their long-term liabilities. These agreements help insurers secure fixed returns from bonds to meet growing obligations, as more people in India are choosing savings products. The total notional value of bond FRA trades reported between March and January was 1.1 trillion rupees ($12.2 billion).

RBI’s Cautious Rate Cut Amid Rupee Weakness and Limited Policy Space

Economists say that even though the central bank cut interest rates by 25 basis points, its overall approach remained cautious. The monetary policy committee kept a “neutral” stance instead of switching to “accommodative,” which would have suggested more rate cuts ahead.

Despite tax cuts, the budget was restrictive, and the central bank has limited room for further rate cuts, especially since the US Federal Reserve has paused its own. Economist Indranil Sen Gupta from Shiv Nadar University pointed out that with the rupee hitting record lows, the RBI must be careful. Cutting rates too much could weaken the currency further and increase inflation.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

One Comment