Amid concerns about IndusInd Bank’s financial position following discrepancies in its derivatives portfolio, the Reserve Bank of India (RBI) has stepped in to reassure depositors. The central bank clarified that IndusInd Bank is financially stable, well-capitalized, and under strict regulatory supervision.

No Cause for Panic: RBI’s Assurance

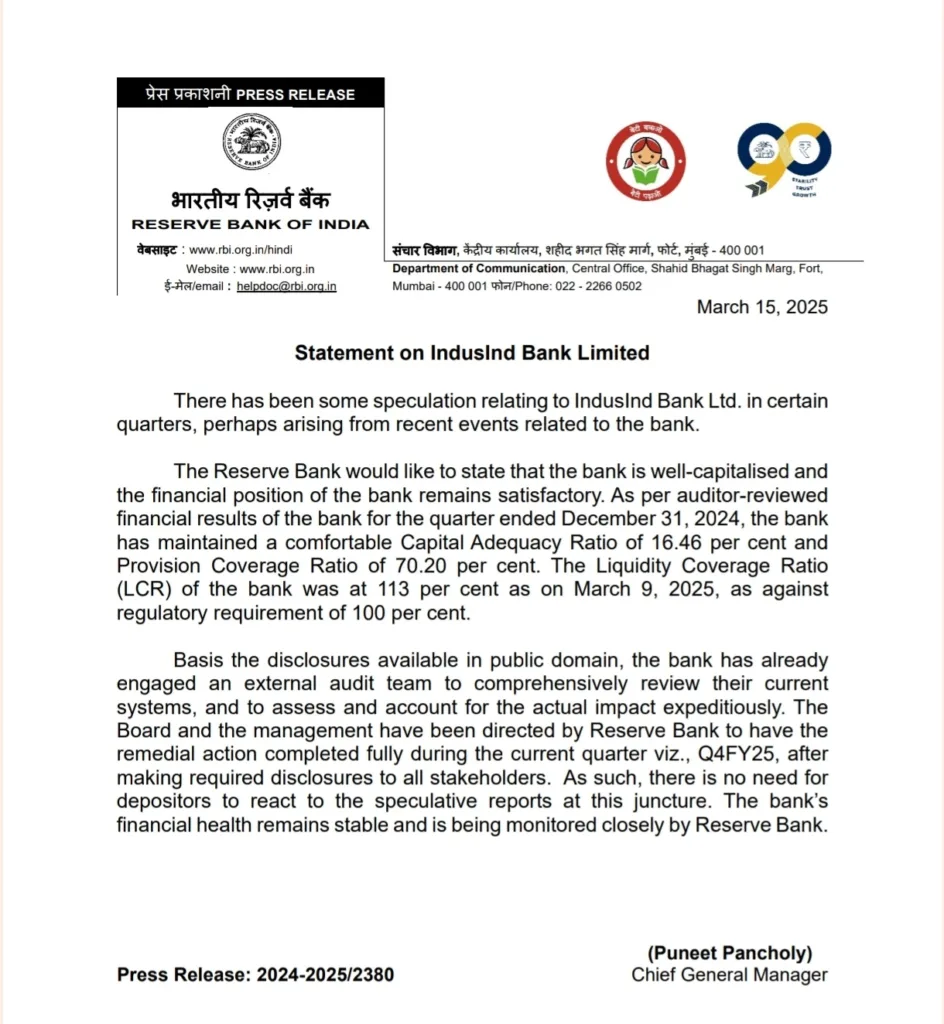

In response to recent speculation, the RBI released a statement emphasizing that IndusInd Bank’s financial health remains strong. “There is no need for depositors to react to speculative reports. The bank’s financial position is stable and is being closely monitored,” the statement read.

To reinforce confidence, RBI highlighted key financial indicators from the bank’s auditor-reviewed results for the quarter ending December 31, 2024. IndusInd Bank maintained a Capital Adequacy Ratio (CAR) of 16.46% and a Provision Coverage Ratio (PCR) of 70.20%. Additionally, as of March 9, 2025, the Liquidity Coverage Ratio (LCR) stood at 113%, comfortably above the regulatory requirement of 100%.

What Led to the Concerns?

The RBI’s clarification comes in the wake of discrepancies discovered in IndusInd Bank’s derivatives portfolio, which resulted in a financial impact equivalent to 2.35% of the bank’s net worth as of December 31, 2024. The issue surfaced when the bank reviewed its internal derivative trades, revealing accounting irregularities linked to transactions spanning the past 5-7 years.

On March 10, 2025, the bank’s MD & CEO, Sumant Kathpalia, held an emergency analyst call to address the situation. He explained that IndusInd Bank had been using foreign currency loans and swaps to hedge its balance sheet. However, from April 1, 2024, the RBI had prohibited internal derivative trades, which put past transactions under scrutiny.

RBI’s Directive to IndusInd Bank

Following the disclosure, IndusInd Bank has already engaged an external audit team to conduct a comprehensive review of its systems and quantify the actual financial impact. The RBI has instructed the board and management to complete all remedial actions within the fourth quarter of FY25 and ensure full transparency with stakeholders.

RBI’s Track Record in Banking Stability

Historically, modern India has never seen a scheduled commercial bank collapse. The RBI has robust mechanisms under the Banking Regulation Act to intervene and protect depositors in times of financial distress. In past instances, such as the Lakshmi Vilas Bank (2019) and Yes Bank (2020) crises, RBI ensured that depositors did not suffer any losses.

However, IndusInd Bank’s financial condition is far from reaching such a critical stage. Given its strong capital position and proactive regulatory oversight, the RBI sees no need for drastic intervention at this point.

The Bottom Line

Despite recent concerns over its derivatives portfolio, IndusInd Bank remains financially sound, with adequate capital and liquidity. The RBI’s reassurance and regulatory oversight further strengthen the confidence that depositors’ money is safe. For now, there is no reason for panic or speculation, as the bank works on corrective measures in line with RBI’s directives.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment