Stocks of many government-backed companies in India, particularly in the railway and defense sectors, have recently fallen after a strong rise. This drop is mainly due to foreign investors selling their shares. Currently, 14 companies in the Nifty CPSE Index have seen their prices drop over 10% from their highest levels in the past year, while seven others are down about 5%.

The decline in these public sector companies, which were very popular earlier this year, coincides with foreign investors pulling money out of Indian stocks for 12 consecutive days. Concerns about stock prices and a recovery in Chinese stocks have led to this selling trend. Over the past 11 trading days, foreign investors have sold more than ₹74,800 crore worth of Indian stocks. Meanwhile, domestic investors have purchased around ₹75,200 crore in stocks during the same period, although it’s unclear if they bought any of the PSU stocks.

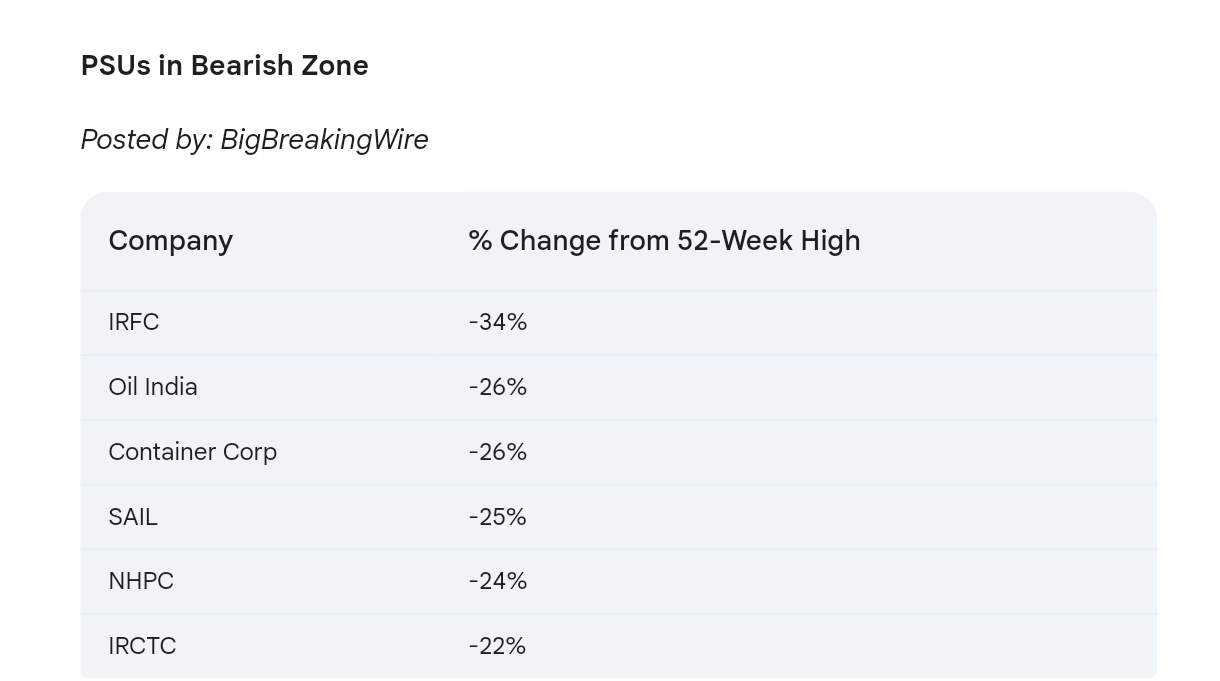

This correction follows a remarkable increase in the Nifty CPSE Index, which rose over 80% in the last year due to strong order books and India’s economic growth. Companies like Indian Railway Catering and Tourism Corp., NHPC Ltd., Steel Authority of India Ltd., Container Corp., Oil India Ltd., and Indian Railway Finance Corp. have all seen their stock prices drop by more than 20% from their one-year highs.

Nifty 50 has risen 15% compared to last year, but it has declined in the past month. Nearly 40% of the stocks in the Nifty 50 are currently in correction mode.

Although the Nifty 50 has only fallen 6% in the last nine trading days, several major stocks are already experiencing corrections. Approximately 20 stocks have dropped by 10%, and five have fallen by more than 15% from their highest prices in the past year.

Most power sector PSU stocks, including REC, PFC, SJVN, NHPC, and BHEL, have experienced corrections ranging from 25% to 30% from their peak values. The exception is Power Grid, which has seen a smaller decline of only 10%, with corrections below 19%.

Public sector companies have experienced significant growth in their valuations over the past five years, driven by strong profits and government initiatives to improve infrastructure. The share of PSUs in the Nifty 50 index has risen from 8.02% in September 2019 to 9.53% today.

As benchmark stock indices have fallen nearly 5% over the past 12 trading days, railway and defense stocks have taken the biggest hits, with all railway stocks down more than 20% from their peaks. For example, Titagarh Rail Systems Ltd. and IRCON Ltd. have dropped by 41.1% and 36.3%, respectively. Defense stocks like Ideaforge Ltd. have fallen over 50%, while Cochin Shipyard Ltd. and Garden Reach Shipbuilders & Engineers have seen drops of around 43% and 40%.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment