As international crude oil prices show a downward trend, there is growing speculation about a possible reduction in petrol and diesel prices in India. This expectation is fueled by the comments of Petroleum Secretary Pankaj Jain, who recently indicated that oil marketing companies (OMCs) might consider cutting retail prices if crude oil prices continue to remain soft.

Improved Margins for Oil Marketing Companies (OMCs)

The reduction in global crude oil prices has positively impacted the marketing margins of OMCs such as Indian Oil Corporation (IOCL), Bharat Petroleum Corporation (BPCL), and Hindustan Petroleum Corporation (HPCL). This improvement in margins can potentially lead to a price cut for consumers.

Since May 2022, petrol and diesel prices in India have remained relatively stable, with the only relief seen in March 2024 during the Holi festival when prices dropped by ₹2 per litre. However, prices have been high since then, and a reduction would offer much-needed relief to consumers.

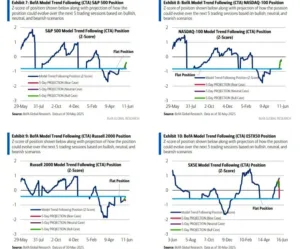

Brent Crude Oil Price Trend

The price of Brent crude oil has dropped by over 15% since the beginning of July 2024, hitting a 33-month low of $68.65 per barrel earlier this week. Currently, crude oil is trading between $70 and $72 per barrel, which benefits OMCs, allowing them to purchase crude at lower prices while selling petrol and diesel at existing market rates. This has significantly boosted their profit margins.

According to market research firm Emkay, OMCs have seen a profit of ₹13-14 per litre in September 2024 due to the drop in crude oil prices. This has helped offset losses incurred in LPG sales and has improved overall profitability.

Impact on Oil Marketing Companies

The reduction in international crude oil prices has enhanced the marketing margins of IOCL, BPCL, and HPCL. Emkay estimates that during the second quarter ending September 2024, the margin for these companies on petrol and diesel could be between ₹8-10 per litre, compared to the ₹4-5 per litre margin recorded in June.

The high margins on petrol and diesel have not only covered losses from LPG sales but are also expected to drive significant EBITDA growth in the second quarter, ranging from 21% to 138%, with HPCL expected to lead the growth.

Potential Price Cut for Petrol and Diesel

Deloitte India, stated that the government could offer relief of around ₹2-3 per litre on petrol and diesel prices. Industry experts believe that a decision on a price cut may come before key state elections in Haryana, Maharashtra, and Jharkhand, scheduled for the final quarter of this year.

Emkay predicts that petrol and diesel prices could be reduced around Diwali, ahead of the announcement of the election code of conduct in Maharashtra.

Key Highlights

Indian oil companies (IOC, BPCL, HPCL) earned ₹13-14/litre profit in September 2024, as crude prices dropped by over 15% since July.

In 2022, with Brent crude averaging $100.93/barrel, petrol and diesel were priced at ₹95 and ₹88 respectively.

As of September 2024, petrol is priced at ₹96/L and diesel at ₹89/L, with crude averaging $72/barrel.

Conclusion

If the price of petrol and diesel is reduced, it will bring much-needed relief to consumers who have been dealing with high fuel costs since May 2022. The recent fall in global crude oil prices has allowed OMCs to increase their profit margins, which may prompt a price cut soon. With state elections approaching, the timing seems right for a price reduction, possibly around the festive season of Diwali. As consumers, all eyes are now on the government and OMCs for a final decision on fuel price cuts.

This anticipated price reduction is expected to not only ease the burden on consumers but also positively impact India’s overall economy by lowering transportation and manufacturing costs.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment