In October, Asian markets (excluding China) saw large foreign outflows as investors became worried about the U.S. presidential election and other factors. Investors pulled out a total of $15.38 billion from countries like India, South Korea, Thailand, Taiwan, Indonesia, Vietnam, and the Philippines. This was the biggest monthly outflow since June 2022.

Indian stocks saw the largest withdrawal, with $11.2 billion leaving the market. Investors were concerned about weak corporate earnings in India and started focusing more on Chinese stocks after Beijing announced a stimulus plan. According to Prerna Garg from HSBC, India’s stock market had grown quickly in recent years, but that growth seemed to be slowing down.

India’s equity cash trading volume fell to $12 billion, its lowest level in nearly a year, as the NSE Nifty 50 Index dropped by 8% from its peak in September, approaching a technical correction. This decline was driven by weaker-than-expected Q2 earnings and continued foreign investor sell-offs, which dampened market sentiment. Investors were also hoping for government stimulus measures to revive the market, but these expectations have yet to materialize.

The disappointing earnings reports for the third quarter also made investors nervous, with more than half of large companies in the Asia-Pacific region missing their expected profits. South Korea faced its third straight month of foreign outflows, with $3.4 billion withdrawn. Stocks in Thailand, Indonesia, and Vietnam saw $2.1 billion in outflows combined, while Taiwan and the Philippines attracted foreign investments of $1.22 billion and $106 million, respectively.

India’s Economic Advisor has stated that the country’s economic policies will remain consistent with the U.S., regardless of the election result. The advisor also believes that the ongoing diplomatic tensions with Canada won’t lead to a reduction in Canadian pension fund investments. Additionally, there are no major concerns about potential outflows from Indian equity markets.

Looking ahead, the Economic Advisor is optimistic about improving economic activity in the coming months. In October, government capital spending rose, and the government remains confident in its growth forecast of 6.5%-7% for FY25.

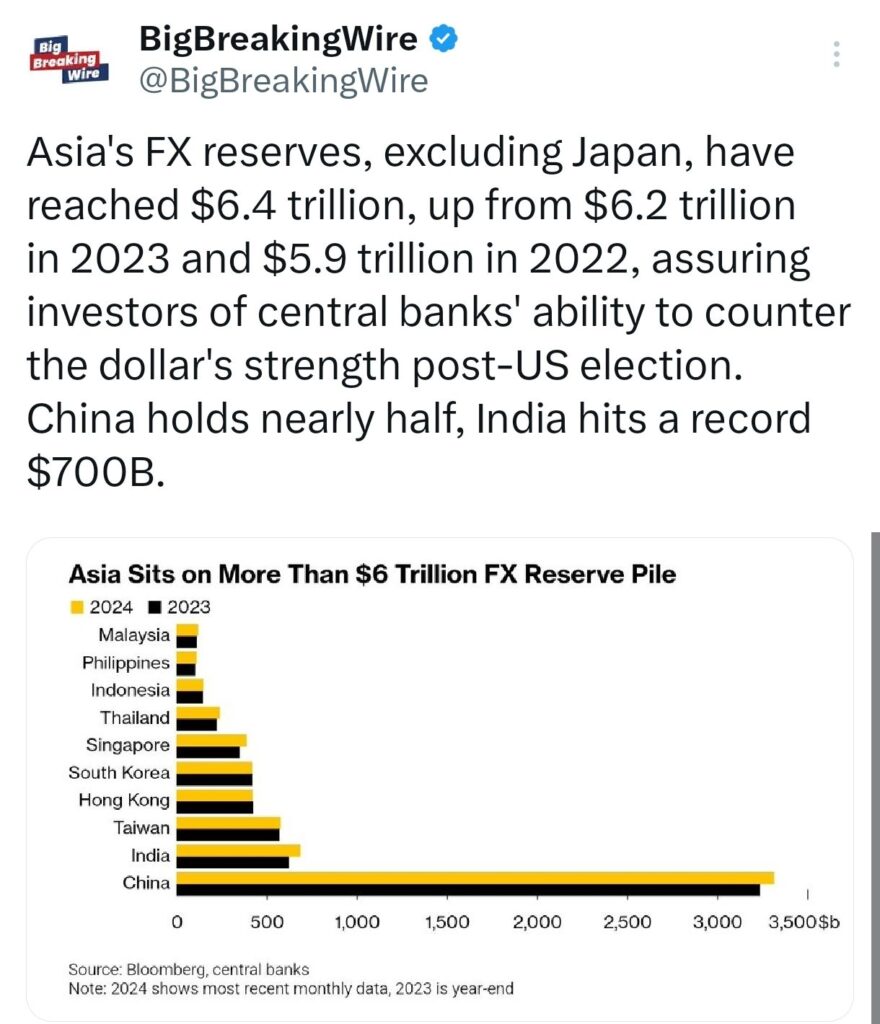

Asia’s foreign exchange reserves, excluding Japan, have grown to $6.4 trillion, rising from $6.2 trillion in 2023 and $5.9 trillion in 2022. This increase assures investors that central banks in the region have the resources to manage the strength of the U.S. dollar following the U.S. election. China holds nearly half of the total reserves, while India has reached a record high of $700 billion in foreign exchange reserves.

Jefferies has revised down its earnings forecasts for India, while Nomura anticipates a slowdown in the country’s growth for the third quarter of FY25, challenging the Reserve Bank of India’s optimistic outlook. On top of this, India’s Goods and Services Tax (GST) collections have shown a modest 6.5% increase, marking the slowest growth in the last 40 months.

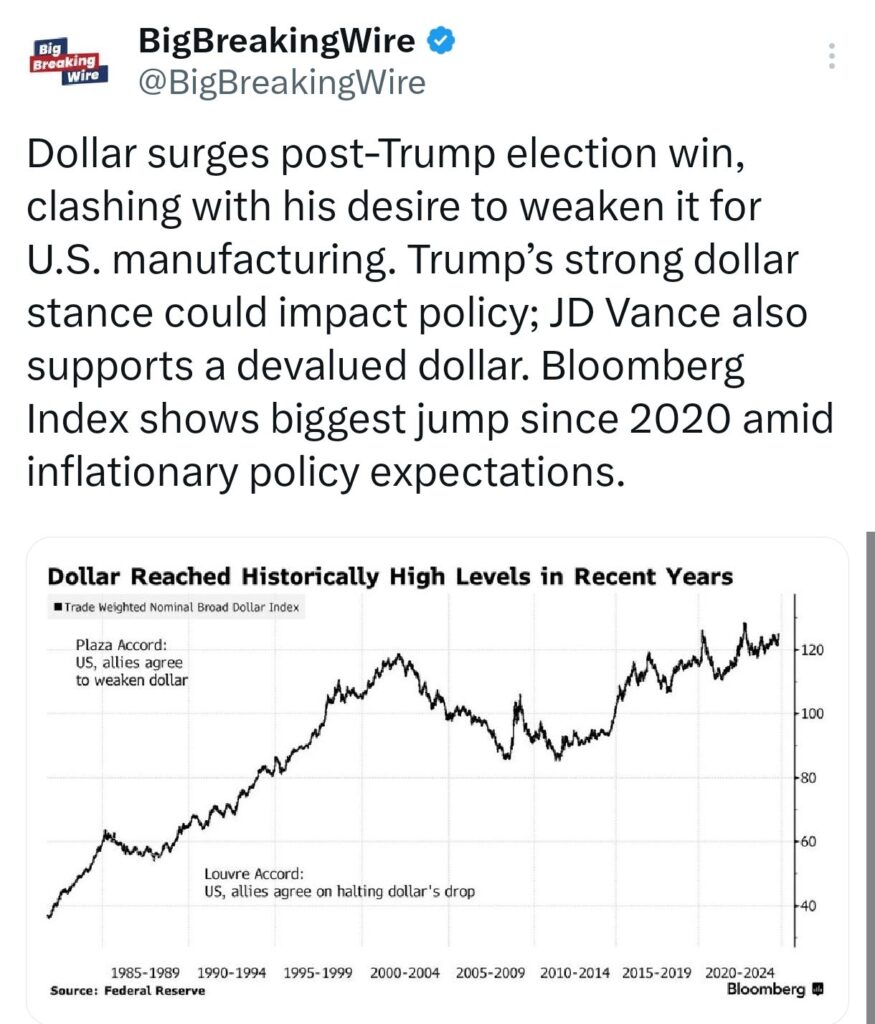

U.S. dollar has surged following Donald Trump’s victory in the election, which contrasts with his previous stance of wanting to weaken the dollar to support U.S. manufacturing. Trump’s position on the dollar could influence future policy decisions, as he has historically advocated for a weaker currency. JD Vance, a key ally, also supports the idea of a devalued dollar. Meanwhile, the Bloomberg Dollar Index has experienced its biggest jump since 2020, driven by expectations of inflationary policies under the new leadership.

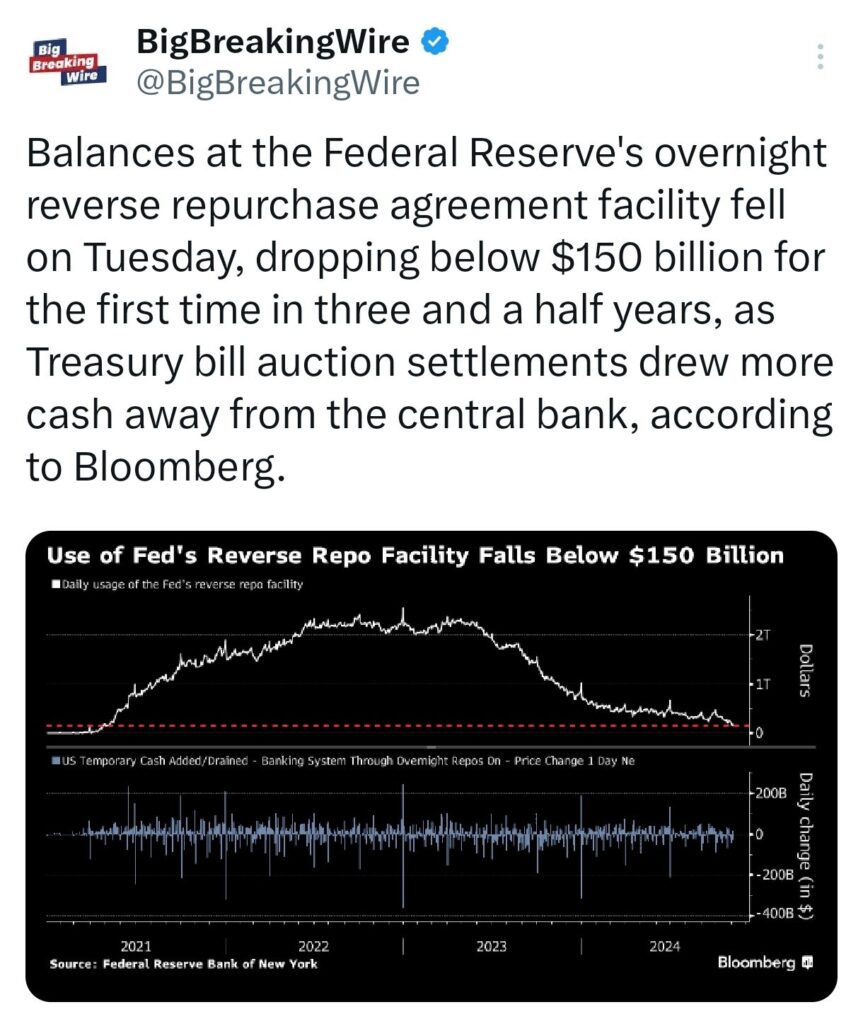

On Tuesday, balances at the Federal Reserve’s overnight reverse repurchase agreement (reverse repo) facility dropped below $150 billion for the first time in over three and a half years. This decline occurred as Treasury bill auction settlements pulled more cash away from the central bank, according to Bloomberg. The reverse repo facility, where financial institutions park excess cash overnight, saw a decrease in activity due to the increased demand for Treasury bills, which absorbed more liquidity from the market.

Asian markets were mixed on Thursday as investors considered the possible impact of a Donald Trump win on policies like tariffs. They were also waiting for decisions from the U.S. Federal Reserve and other central banks.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment