In October 2024, mutual funds in India were holding large amounts of cash, with active equity funds maintaining cash reserves of Rs 1,46,957 crore, slightly down from Rs 1,47,588 crore the previous month. Despite this small decrease, cash still made up 4.91% of total assets, the highest since May 2023. This shows that funds are selectively buying stocks at lower prices but are also saving some funds for future investment opportunities.

The total cash holdings across all mutual fund categories, including equity, debt, hybrid, and passive funds, rose to Rs 3.77 lakh crore, which is 5.64% of the industry’s total assets under management (AUM). This marks the highest cash level since February 2022 when it stood at Rs 4.19 lakh crore. This rise in cash reserves comes amid ongoing weakness in the equity market, with Indian indices continuing to fall in November.

In October 2024, Indian mutual funds saw net inflows of ₹2.39 lakh crore, reversing a ₹71,114 crore outflow in September. Equity funds recorded ₹41,887 crore in inflows, up 21.69% from the previous month. AUM rose to ₹68.5 lakh crore, but equity AUM dropped to ₹29.9 lakh crore. Open-ended equity funds saw inflows for the 44th consecutive month, despite a weak market performance, with strong demand across small, mid, and large-cap funds.

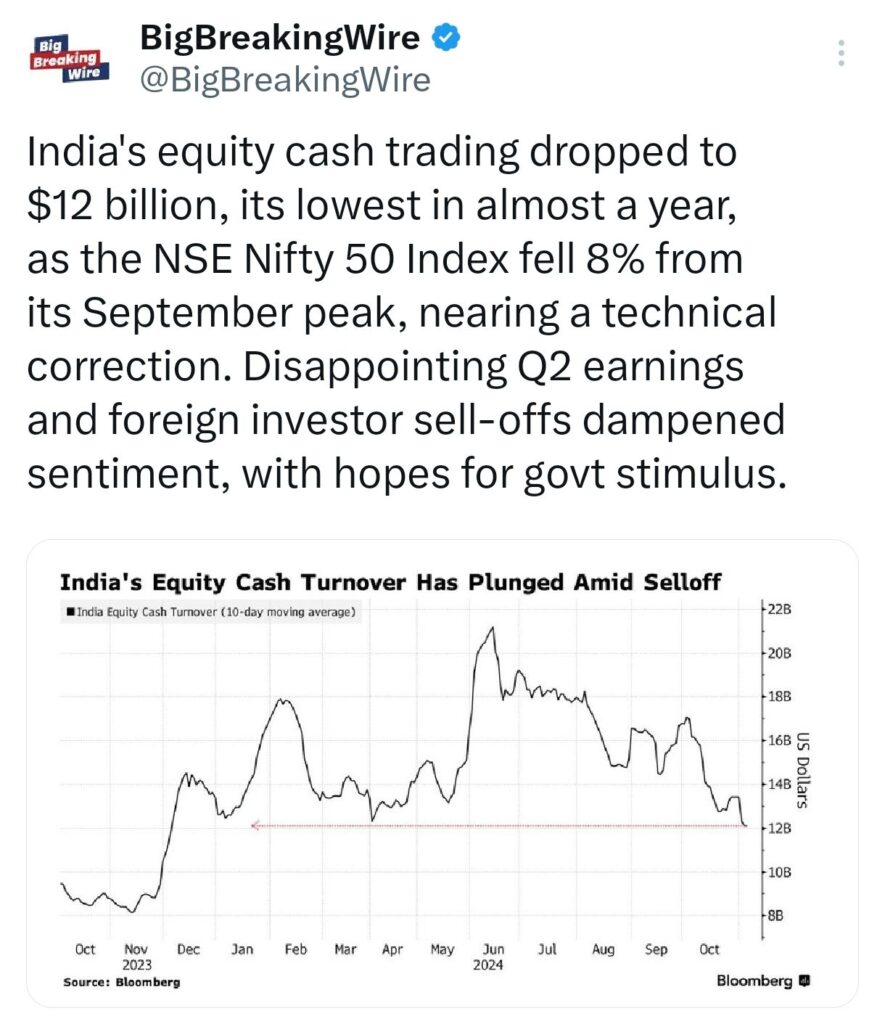

India’s equity cash trading volumes have fallen to $12 billion, the lowest in nearly a year, as the NSE Nifty 50 Index dropped 8% from its September peak, approaching a technical correction. The decline in trading activity was driven by disappointing Q2 earnings reports and ongoing sell-offs by foreign investors, which have weighed down market sentiment.

The market’s downturn in the last month and a half was largely driven by foreign institutional investors (FIIs) pulling back, while domestic institutional investors (DIIs), including mutual funds, have continued to invest.

India’s Nifty 50 has entered correction territory. This marks a significant decline of 10.34% (or 2,718 points) since September 27, driven by ongoing foreign selling. Additionally, October’s inflation surged to a 14-month high, exceeding the Reserve Bank of India’s (RBI) tolerance level, which could influence future monetary policy decisions.

Retail investors played a significant role in the market, with equity fund inflows surging by 22% month-on-month to Rs 41,887 crore in October. Meanwhile, investments via systematic investment plans (SIPs) topped Rs 25,000 crore, a milestone in the midst of the bearish market trend. This shows that retail investors are confident, even in a weaker market.

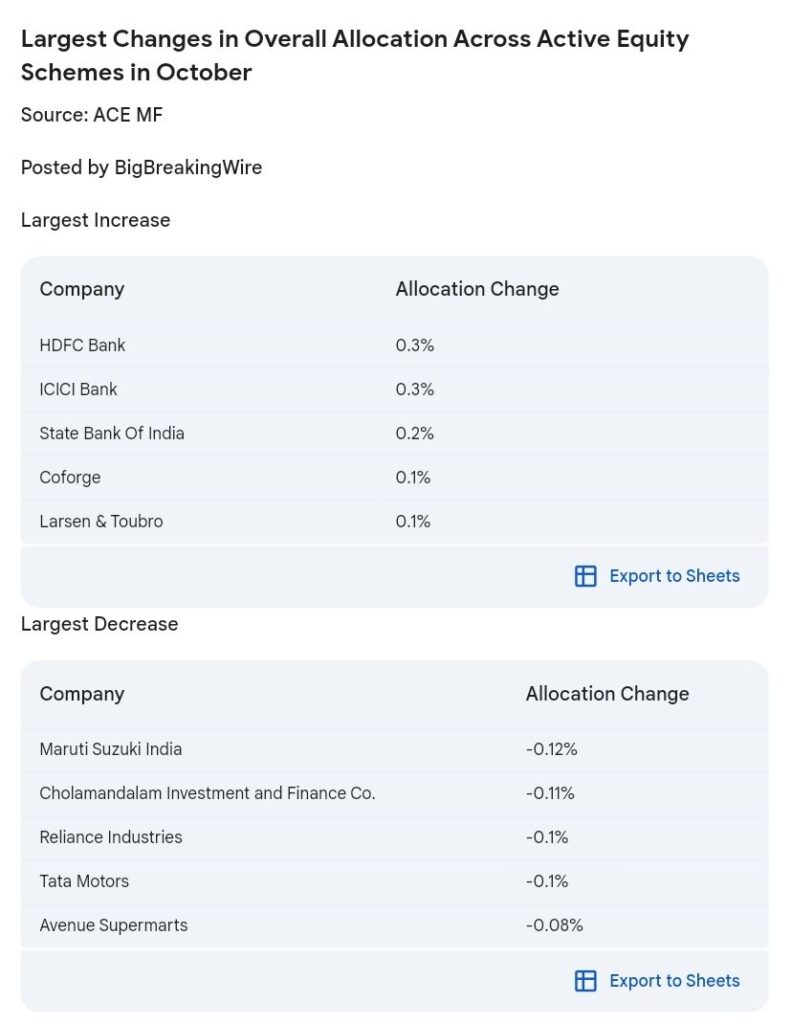

Sector-wise, mutual funds increased their holdings in banks (both private and public sector), capital goods, healthcare, technology, and cement. Conversely, they reduced exposure to sectors like oil & gas, consumer durables, automobiles, NBFCs, utilities, telecom, and metals.

Shares in the banking and financial sector outperformed the broader market decline, with three out of the top five stocks showing the highest allocation growth coming from this sector. HDFC Bank and ICICI Bank both saw a 0.31% increase in allocation, while State Bank of India experienced a 0.19% growth. These figures highlight the sector’s resilience during a challenging market period.

In contrast, the stocks with the largest allocation declines included Maruti Suzuki, which saw a 0.12% drop, followed by Cholamandalam Finance with a 0.11% decrease. Reliance Industries was also part of the list, marking its worst performance in October over the past two years. This reflects the significant challenges faced by these companies in the market during the period.

SBI Mutual Fund, with the largest active equity fund book, held the most cash—Rs 23,146 crore by the end of October. It was followed by ICICI Prudential MF with Rs 20,469 crore, and HDFC MF with Rs 18,956 crore. Funds like PPFAS and Quant had higher cash allocations relative to their AUM, with PPFAS holding 15.46% and Quant holding 7%.

SIP investments in mutual funds reached a record Rs 25,322 crore in October 2024, up from Rs 24,509 crore in September, with 10.12 crore SIP accounts. Despite market declines, retail investors remained confident, adding 24.19 lakh new SIP accounts. However, the growth in new accounts slowed, and the SIP stoppage ratio stayed above 60% for the second month.

Meanwhile, In October 2024, the share of foreign investors in NSE-listed companies fell to 15.98%, marking the lowest level in twelve years. The total value of foreign investors’ holdings in Indian equities dropped to Rs 71 lakh crore, reflecting an 8.8% decline from Rs 78 lakh crore in September. This sharp decline represents the largest drop since March 2020.

On the other hand, domestic mutual funds saw their holdings reach a record high, increasing to 9.58% from 9.32% the previous month. By the end of the September quarter, mutual funds collectively held stocks worth Rs 42.36 lakh crore. Meanwhile, domestic institutional investors (DIIs) held a total of Rs 76.80 lakh crore in stocks, further highlighting the growing influence of domestic investors in the market.

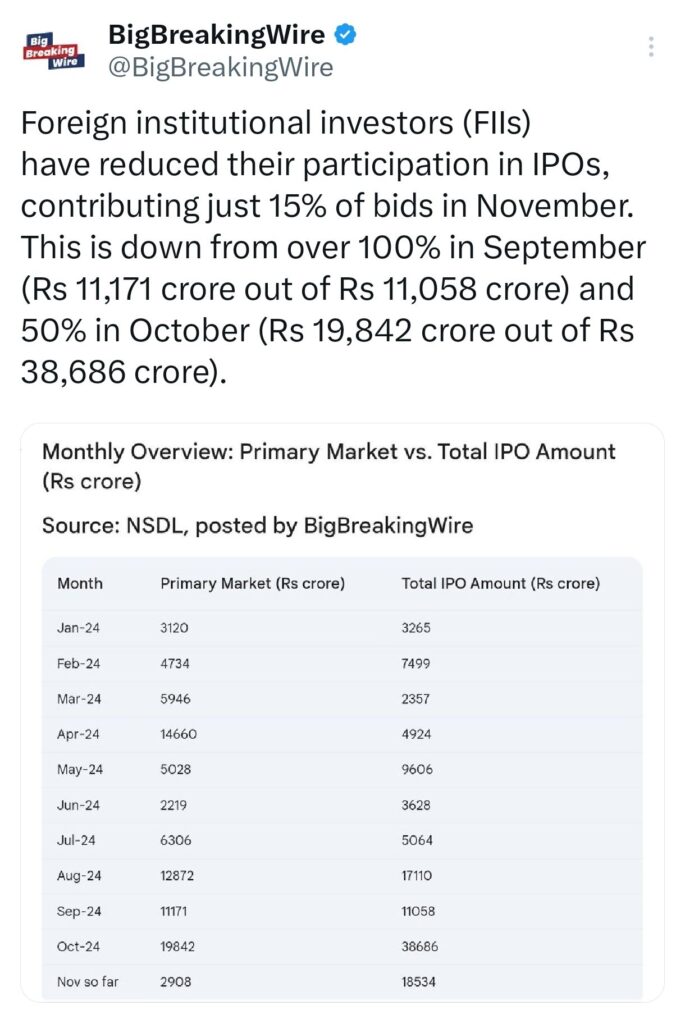

Foreign institutional investors (FIIs) have cut back on their involvement in IPOs this month, making up just 15% of the total bids in November. This is a big drop from September, when they bid Rs 11,171 crore, more than the total IPO size of Rs 11,058 crore. In October, they were more active, making up 50% of the bids with Rs 19,842 crore out of a total of Rs 38,686 crore.

A rate cut by the Reserve Bank of India (RBI) in December seems unlikely. With inflation still above 6% and global uncertainties, such as US policies and the rising value of the dollar, any easing of rates may not happen until April. High living costs and low incomes are putting pressure on demand, while there is also a continued outflow of capital from India’s stock market.

Despite global challenges like geopolitical tensions and climate change, India’s economy remains strong, thanks to solid fundamentals, a stable financial system, and a resilient external sector, says RBI Governor Shaktikanta Das. While risks like inflation and slower growth exist, the RBI holds its growth forecast at 7.2%, and Das warns against rate cuts due to inflation concerns.

Fund managers in Asia are growing increasingly bearish on Indian stocks, with many now holding an underweight position on India, according to a Bank of America (BofA) survey. Instead, they are shifting their focus to China and Japan. Since October 1, foreign investors have pulled out over $13 billion from India. The Nifty has fallen more than 10% from its September peak and briefly dipped below its 200-day moving average. Risks remain high for India’s stock market, driven by weak fundamentals.

Following Trump’s election win, India’s central bank may allow the rupee to weaken alongside the Chinese yuan, as concerns grow that a depreciating yuan could worsen India’s trade deficit with China. The Reserve Bank of India (RBI) plans to manage this currency decline by utilizing its $680 billion in foreign exchange reserves. Analysts now predict that the rupee could reach 85 against the US dollar within the next 12 months.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment