AI stocks continue their meteoric rise, contributing trillions in value, while regional bank stocks face a stark contrast, experiencing a casual collapse. New York Community Bank (NYCB), which acquired the beleaguered Signature Bank, suffered a staggering 23% drop today, marking its lowest point since 1996. Despite boasting over $100 billion in assets and an extensive branch network across the US, the bank’s fortunes tumbled following an unexpected $260 million Q4 loss. To compound the crisis, NYCB slashed its dividend by a substantial 70%, exacerbating concerns among investors.

Further intensifying the turmoil, the bank recently disclosed the identification of “material weakness” in its controls, casting shadows on its operational stability. This revelation translated into a massive $2.4 billion loss for shareholders in the last quarter alone. Adding to the precarious situation, the imminent expiration of the Bank Term Funding Program in a week looms large. This emergency loan initiative, established by the Federal Reserve during the regional bank crisis, provided a financial lifeline. With the program’s end in sight, NYCB faces heightened uncertainty and potential challenges in navigating the turbulent financial landscape.

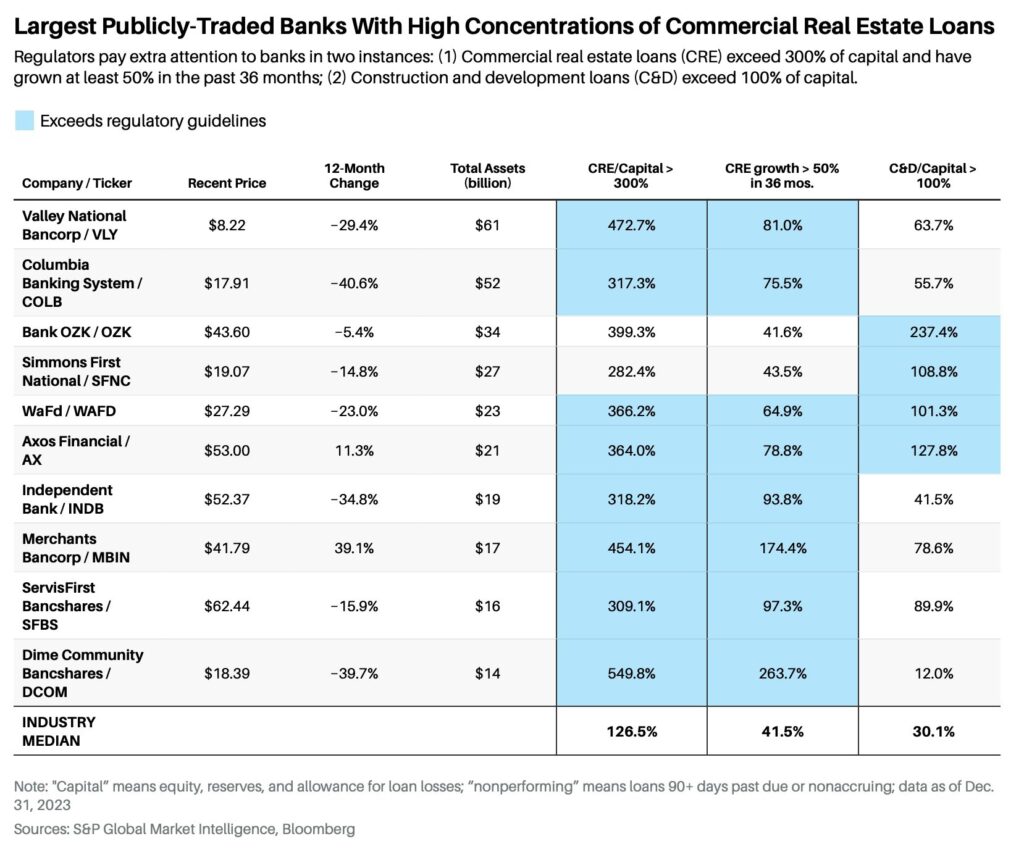

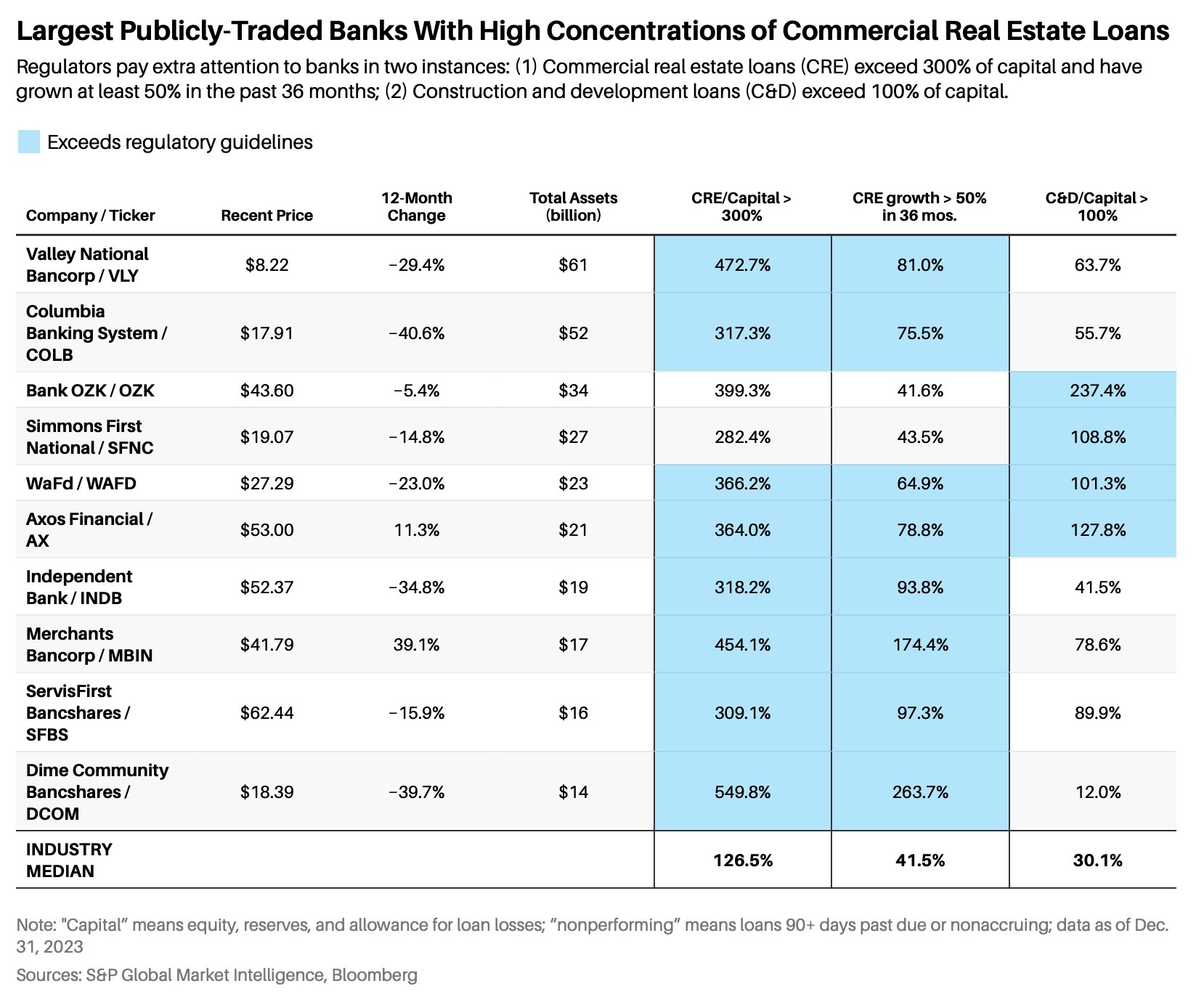

Barrons and Bloomberg underscore potential vulnerabilities in the face of a Commercial Real Estate (CRE) market downturn, pointing to 10 banks with exposure: $VLY, $COLB, $OZK, $SFNC, $WAFD, $AX, $INDB, $MBIN, $SFBS, $DCOM. JPMorgan Chase’s Jamie Dimon issues a cautionary note, highlighting the adverse impact of rising rates during a recession on real estate.

The Mortgage Bankers Association reveals that $929 billion of the $4.7 trillion outstanding commercial mortgages will mature this year, intensifying concerns. Commercial real estate, already grappling with a substantial 40% decline, adds another layer of uncertainty.

Notably, major banks, including JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, Goldman Sachs, and Morgan Stanley, see their average reserves diminish from $1.60 to 90 cents for every dollar of commercial real estate debt for borrowers at least 30 days late, as reported by FT. This underscores a heightened risk scenario and the need for strategic responses in the financial sector to navigate the challenges posed by the evolving CRE landscape.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment