Nomura anticipates that the Indian government will strike a balance between fiscal consolidation and growth-supportive initiatives in the upcoming Union Budget for FY 2025-26. The firm expects changes in personal income tax slabs to boost consumer spending and stimulate economic activity.

The fiscal deficit for FY 2025 is projected at 4.8% of GDP, slightly below the earlier estimate of 4.9%. This improvement is attributed to reduced capital expenditure (capex) spending. Looking ahead to FY 2026, Nomura predicts capex will stabilize at 4.4% of GDP, aligning with India’s medium-term fiscal goals. Public capital expenditure is expected to grow by 12.5% year-on-year during the same period.

To foster growth, the budget could include incentives like reduced corporate tax rates for manufacturing hubs, lower customs duties on intermediate goods, and increased investment in agriculture. Additionally, Nomura anticipates higher import duties on gold, expanded foreign direct investment (FDI) limits in the insurance sector, and measures to attract more capital inflows to support the Indian rupee.

On the borrowing front, gross market borrowing for FY 2026 is estimated at ₹14.4 lakh crore, slightly higher than ₹14 lakh crore in FY 2025. However, net market borrowing is expected to fall by ₹60,000 crore to ₹11.03 lakh crore, potentially improving further if the government undertakes more buybacks in the weeks ahead.

Indian government bonds remain attractive, as the risks associated with the budget announcement appear limited. Nomura expects the government’s balanced approach to keep fiscal risk premiums low, providing the Reserve Bank of India (RBI) with greater room to lower policy rates during its February Monetary Policy Committee (MPC) meeting.

Overall, Nomura sees India’s fiscal strategy as a positive development, reinforcing long-term growth and stability.

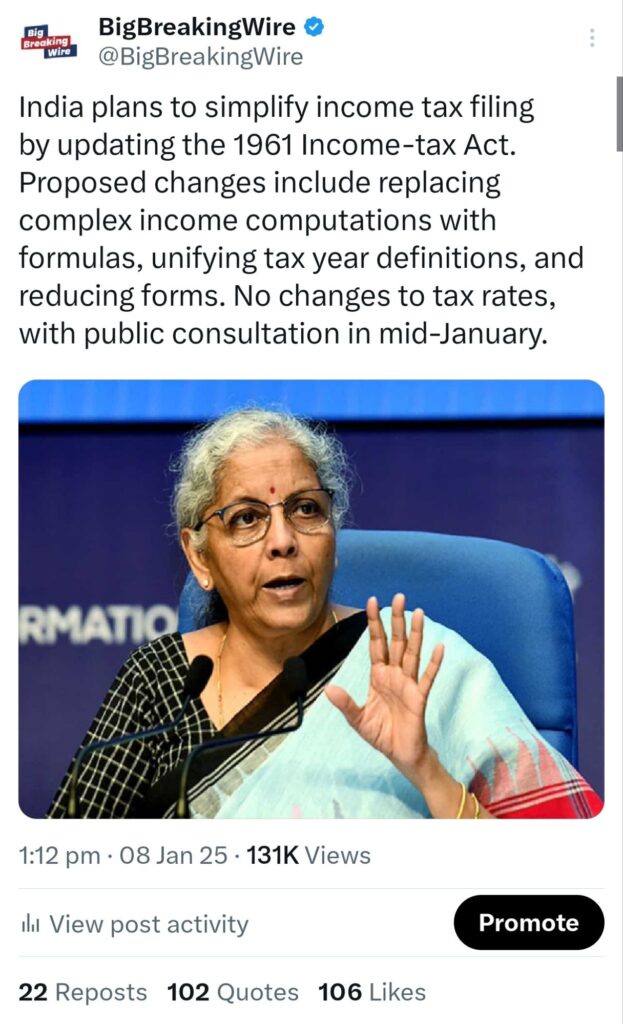

India to Overhaul Income Tax Laws in 2025

India is planning to overhaul its income tax filing system by updating the 1961 Income Tax Act, according to earlier reports from Bloomberg. The proposed changes aim to simplify the tax process by replacing the complex methods of income computation with streamlined formulas, standardizing tax year definitions, and reducing the number of forms required for filing. However, there will be no changes to the current tax rates, and the government is expected to conduct public consultations on these proposals, which began in mid-January.

The government’s goal is to introduce a new Income Tax Bill during the Budget session, which will replace the 1961 Act. The proposed bill will significantly reduce the size of the tax code, cutting it by approximately 60%. Finance Minister Nirmala Sitharaman announced the intention to revamp the tax system back in July. Currently, the draft of the bill is under review by the law ministry and is expected to be introduced in the latter half of the Budget session. The goal is to create a simpler, more efficient tax law.

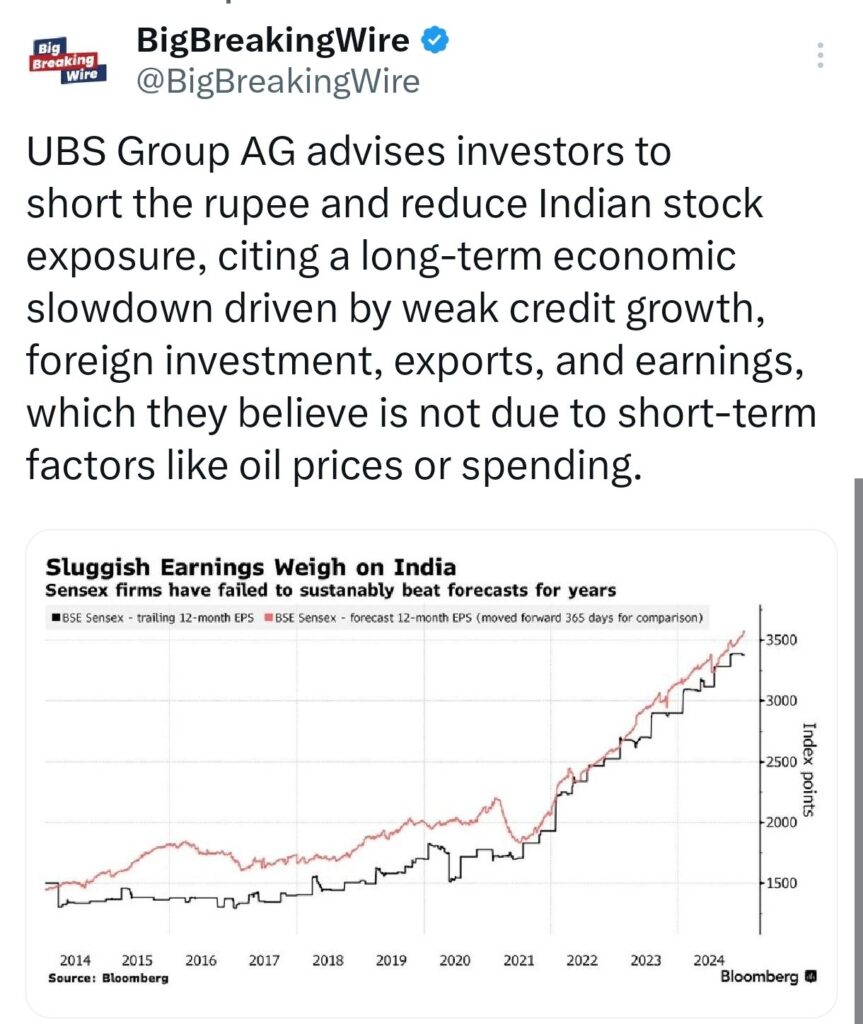

UBS Advises Shorting India’s Rupee, Stocks

UBS Group AG is advising investors to bet against India’s rupee and reduce their exposure to the country’s stocks. According to UBS’s investment research, India’s $4 trillion economy is experiencing a long-term slowdown, which cannot be attributed to temporary factors like rising oil prices or slow government spending. This decline is being driven by a consistent drop in credit growth, foreign investment, export competitiveness, and corporate earnings — trends that are expected to worsen once Donald Trump becomes president of the United States.

In the last month, Indian stocks have lost nearly $500 billion in value, with the MSCI India index having its worst start to a year since 2016. The rupee has fallen to new record lows against the US dollar, making it the worst-performing currency in Asia. Meanwhile, Indian bonds are seeing the fastest capital outflows since 2020, as the excitement over their inclusion in global bond indices fades.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment