Japan’s Nikkei stock index plummeted over 4,400 points, marking the largest single-day drop in its history and surpassing the decline seen on Black Monday in 1987.

Japan’s Nikkei stock index plummeted over 4,400 points, marking the largest single-day drop in its history and surpassing the decline seen on Black Monday in 1987.

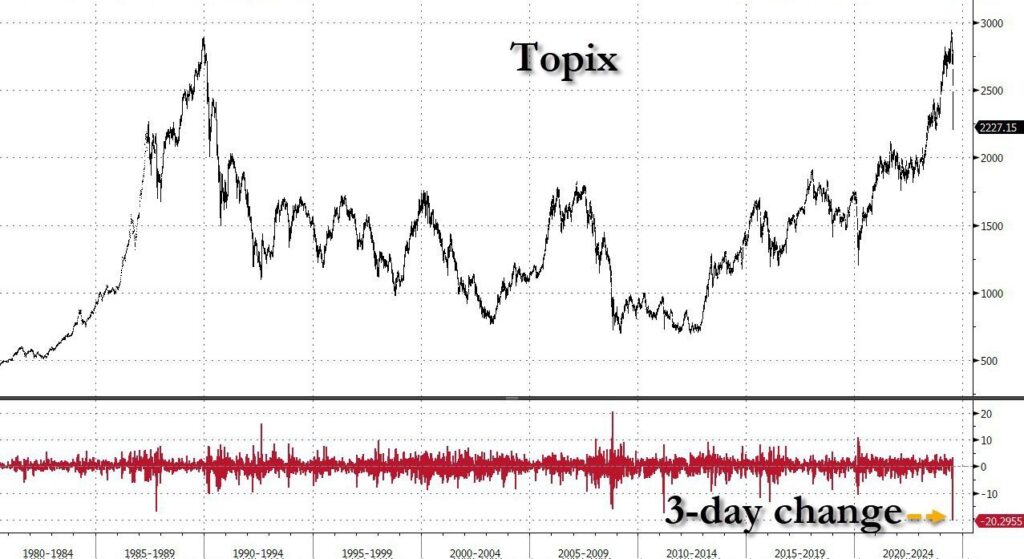

Japan’s Nikkei 225 just saw its largest two-day drop ever, plummeting 18.2%. Today alone, it fell 12.4%, nearing its 14.9% single-day record from 1987’s “Black Monday.” In three weeks, the index has lost 26% and erased all its 2024 gains.

The Nikkei 225, which had risen 27% just a few weeks ago, is now down for the year. Historically, the Nikkei 225 has fallen more than 20% in three weeks during these periods:

– 1990: A 21% drop from February 14 to March 7, following the burst of Japan’s asset price bubble.

– 2008: A 23% decline from September 26 to October 16, after the Lehman Brothers collapse.

– 2013: A 21% fall from May 22 to June 13, triggered by concerns over economic stimulus measures.

– 2020: A 23% drop from February 21 to March 13, due to panic over the COVID-19 pandemic.

Today Japan’s Nikkei 225 Volatility Index soars 132%, marking its highest one-day percentage increase on record.

Japan’s stock market has plunged dramatically, losing 25% of its value in just 17 trading days.

The Nikkei 225 index has fallen over 18% in two days, marking its largest 2-day drop ever.

Today’s 12.4% decline is the steepest since the 1987 Black Monday crash.

This rapid sell-off is driven by the unwinding of the Yen carry trade.

Investors are now speculating whether the Bank of Japan will step in to stabilize the market.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment