According to Nuvama Alternative & Quantitative Research, changes in the Nifty 50 index could lead to an inflow of over $1 billion, with banking shares expected to attract around $146 million.

Key Inclusions in Nifty 50

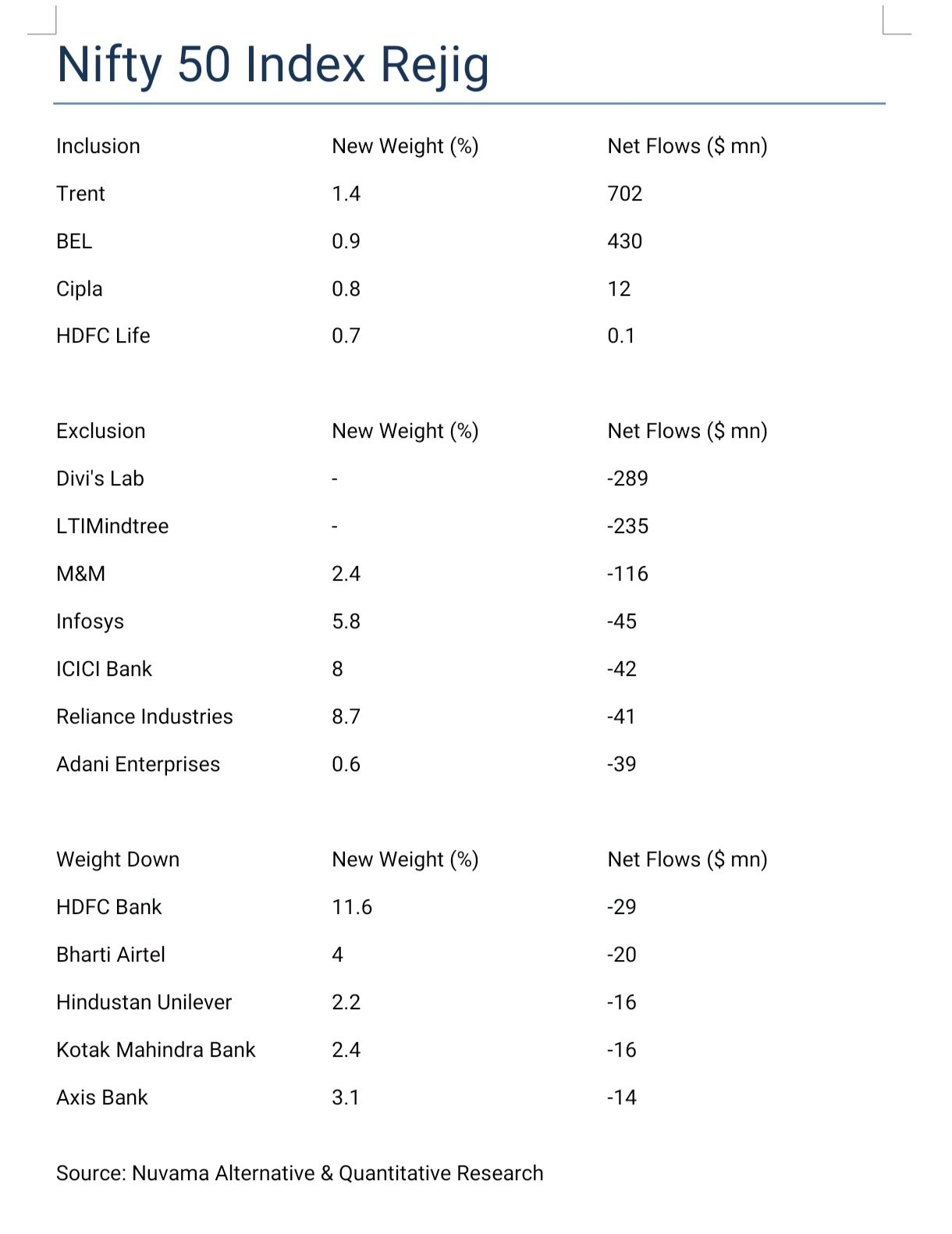

As part of the upcoming semi-annual index reshuffle, Trent, Bharat Electronics Ltd (BEL), and Canara Bank are expected to be included in the Nifty 50. These inclusions could bring in an inflow of approximately $1.2 billion. The changes are set to take place after market hours this Friday.

Key Exclusions from Nifty 50

On the other hand, stocks like LTI Mindtree, NTPC, Divi’s Labs, and Mahindra & Mahindra are set to be excluded from the Nifty 50 index. This exclusion could result in an outflow of $1.14 billion, according to Nuvama.

Changes in the CPSE Index

The Central Public Sector Enterprises (CPSE) index will also undergo some changes. Oil and Gas Corp, Coal India, and NHPC are expected to see an increase in their weightage, resulting in an inflow of $148 million. However, the weightage of NTPC and Power Grid Corp is expected to decline.

Banking Stocks Set to Gain

Nuvama’s report suggests that the main banking index, Nifty Bank, will see an increase in the weightage of stocks like IndusInd Bank, State Bank of India, Federal Bank, and Bank of Baroda. Meanwhile, Kotak Mahindra Bank, ICICI Bank, and HDFC Bank may experience a reduction in their weightage.

Nifty Next 50 Changes

The Nifty Next 50 index will also see changes, with BHEL, JSW Energy, Macrotech Developers, NHPC, and Union Bank being included. On the flip side, Berger Paints, Colgate, Marico, SBI Cards, and SRF are set to be excluded from the index.

Midcap to Large Cap Movement

Several stocks are transitioning from the midcap index to the large-cap index. These include Dixon Technologies, Jindal Stainless, Linde India, Mazagon Dock, Oil India, and Oracle Financial. Additionally, PB Fintech, Phoenix Mills, Prestige Estates, RVNL, Thermax, Torrent Power, and Uno Minda are also moving to the large-cap index.

Impact on Investors

These changes in the NSE indices are likely to drive significant inflows and outflows as institutional investors and funds adjust their portfolios. The reshuffling could provide fresh investment opportunities in the newly included stocks while causing a sell-off in the excluded ones.

By monitoring these index changes, investors can align their strategies with market trends and potentially benefit from the reallocation of capital.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment