The government is set to introduce the New Income Tax Bill 2025 in the Lok Sabha on February 13, aiming to establish a modern tax framework. If passed, the new law will take effect from April 1, 2026, replacing the six-decade-old Income Tax Act of 1961. The bill spans 622 pages and includes 23 chapters, 16 schedules, and 536 clauses.

Note: Clauses will change to sections once the bill is passed.

Key Changes Proposed

One of the major changes in the bill is the simplification of tax-related terminology. The term “Tax Year” will replace “Assessment Year,” while “Financial Year” will take the place of “Previous Year.” The Tax Year will refer to a 12-month period starting from April 1 each year.

The bill also aims to expand definitions concerning digital transactions and crypto assets. Additionally, it includes specific references to finance companies and financial units in the context of dividends.

Compliance & Foreign Companies

As part of new compliance measures, the bill proposes introducing a Taxpayer’s Charter to enhance transparency and taxpayer rights. A detailed section suggests that foreign companies could be deemed as residents under certain conditions, impacting their tax obligations in India.

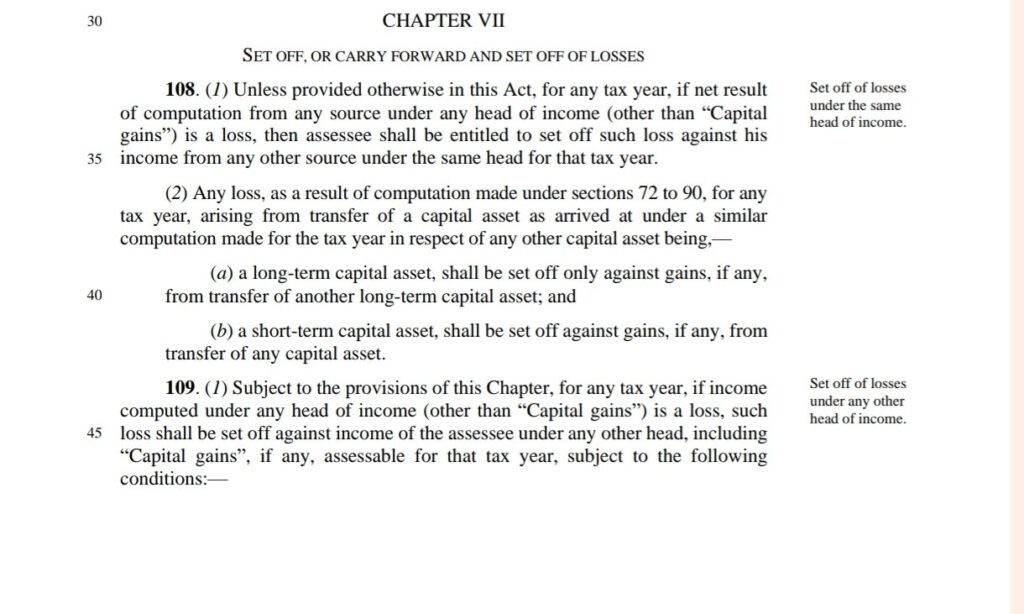

Capital Gains Tax Unchanged

Despite various updates, the bill does not propose any changes to the existing Short-Term or Long-Term Capital Gains Tax structure.

The bill is expected to be tabled in Parliament soon, setting the stage for discussions on the future of India’s income tax system.

Budget Revises Capital Gains Tax; CBDT Moves to Simplify Income Tax Act

In the July budget, Finance Minister Nirmala Sitharaman announced changes to capital gains tax. Short-term capital gains (STCG) from stocks, equity funds, and units of business trusts (InvITs and REITs) will now be taxed at 20%, up from 15%. Long-term capital gains (LTCG) will have a uniform tax rate of 12.5% for all asset classes.

Meanwhile, the Central Board of Direct Taxes (CBDT) has set up an internal committee to simplify the Income Tax Act, making it clearer and easier to understand. The aim is to reduce legal disputes and provide greater tax certainty. Additionally, 22 specialized sub-committees have been formed to review different aspects of the Act.

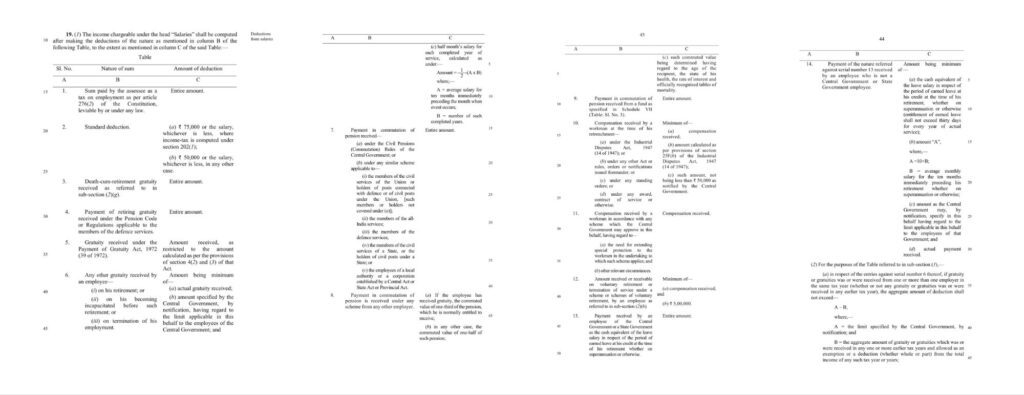

Proposed salary deductions under the New Income Tax Bill.

New Income Tax Bill Expands Definition of Undisclosed Income to Include Cryptocurrencies

The new Income Tax Bill has expanded the definition of “undisclosed income” to include virtual digital assets (VDAs) like cryptocurrencies. Previously, undisclosed income covered money, bullion, and jewelry found during searches, but now it also includes digital assets. According to the bill, undisclosed income refers to money, bullion, jewelry, VDAs, or any other valuable asset or transaction that represents income not disclosed to tax authorities. The bill defines VDAs as any digital information, code, number, or token—excluding traditional currencies—that is created through cryptographic methods and can be transferred, stored, or traded electronically. This definition explicitly includes non-fungible tokens (NFTs) and similar digital tokens, though the government has the authority to exclude specific digital assets from this category under certain conditions.

Despite this new classification, the bill does not introduce any changes to the existing tax regime for cryptocurrencies and VDAs. Income from the transfer of digital assets will still be taxed at 30% without any deductions or exemptions. Additionally, the 1% Tax Deducted at Source (TDS) on payments for transferring digital assets remains unchanged. These measures continue the government’s strict approach to cryptocurrency taxation while formally recognizing digital assets as part of undisclosed income during tax investigations.

India to Impose Heavy Tax Penalties on Undisclosed Crypto Gains

Indian crypto traders could face heavy tax penalties if they don’t report their profits, following new changes in tax laws. In the Union Budget 2025, Finance Minister Nirmala Sitharaman announced that cryptocurrency earnings will now be treated as unreported income under Section 158B of the Income Tax Act. This means crypto gains will be assessed like cash, jewelry, and bullion, making it mandatory to disclose them. The government will also require certain entities to report crypto transactions under section 285BAA. These rules will be enforced retroactively from February 1, 2025.

The government is also cracking down on unpaid taxes from crypto exchanges, with authorities already identifying $97 million in unpaid GST. Additionally, undisclosed crypto profits could face penalties of up to 70%, even if declared within 48 months of the tax year. This stricter approach follows increased regulatory actions, including Bybit halting its services in India on January 10, 2025, due to compliance issues.

Key Changes in the New Tax Bill

The new tax bill brings several changes to simplify rules and improve transparency. It introduces a Taxpayer’s Charter to protect taxpayer rights and makes tax terminology clearer. “Tax Year” will replace “Assessment Year,” and “Financial Year” will replace “Previous Year.”

Foreign companies may now be considered residents under certain conditions. There are no major changes in tax rates, and business deductions under Section 37 remain the same. Depreciation will now be treated as a deduction instead of an allowance.

The bill removes complex legal terms like explanations and provisos and introduces clearer rules for revenue recognition, MTM losses, and inventory valuation. It also moves non-taxable income to separate schedules for better organization.

Salary-related deductions, like standard deduction, gratuity, and leave encashment, have been combined into one section instead of being spread across different provisions. These updates aim to make tax laws easier to understand and follow.

Stay tuned for more updates.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

One Comment