In recent times, many fund managers have stated that large-cap stocks are expected to outperform smaller market stocks because they offer better value. However, a new list from Nuvama Alternative and Quantitative Research shows a mixed picture. While fund houses have increased their holdings in some large-cap stocks, they have reduced their stake in others or even completely exited from some Nifty 50 stocks.

Here’s a closer look at some specific changes:

Axis Mutual Fund has completely sold its shares in public sector companies like ONGC, NHPC, and Petronet LNG. It has also reduced its stake in major Nifty companies such as TCS, Reliance Industries, and Tata Motors.

HDFC Mutual Fund has lowered its stake in companies like Max Healthcare, Embassy Office Parks REIT, and Zee Entertainment. It has completely exited from stocks like IDFC and Sadbhav Engineering.

Kotak Mutual Fund has cut its investment in stocks such as Samvardhana Motherson, Bharat Forge, and Reliance Industries (a major Nifty 50 company). It has fully exited from stocks like Zee Entertainment, Asian Paints, and Ami Organics.

ICICI Prudential Mutual Fund has sold all its shares in Suzlon, a top performer, as well as in Gulf Oil Lubricants and GNA Axles. It has also reduced its stake in stocks like Reliance Industries, Lupin, and Gujarat Gas.

Quant Mutual Fund, which has recently been in the news, has sold its entire holding in Nifty 50 companies like TCS and Dr. Reddy’s, as well as in smaller companies like Granules India.

Nippon India Mutual Fund has only fully sold its stake in Poonawalla Fincorp. It has also reduced its investment in Nifty companies like L&T, Bajaj Finance, and smaller companies like Aditya Birla Fashion.

Mutual Funds Report First Cash Allocation Decline Since April

In September, the cash allocation in actively managed equity schemes by mutual funds decreased for the first time since April. The cash allocation dropped by 0.14%, following a steady increase throughout the fiscal year. In August, the cash allocation had risen to 4.92% of total assets under management (AUM).

Despite the decrease in cash allocation percentage, the actual cash amount increased due to rising investments in mutual funds. By September, mutual funds held cash worth ₹1.49 lakh crore, a 0.9% rise, while the total asset base grew by 3.38% to reach ₹31 lakh crore.

Overall, excluding new fund offerings, total cash increased by 0.5%, even as the cash allocation percentage fell by 0.14%. This decline in cash allocation indicates that mutual funds are increasing their market investments and maintaining lower cash reserves than before.

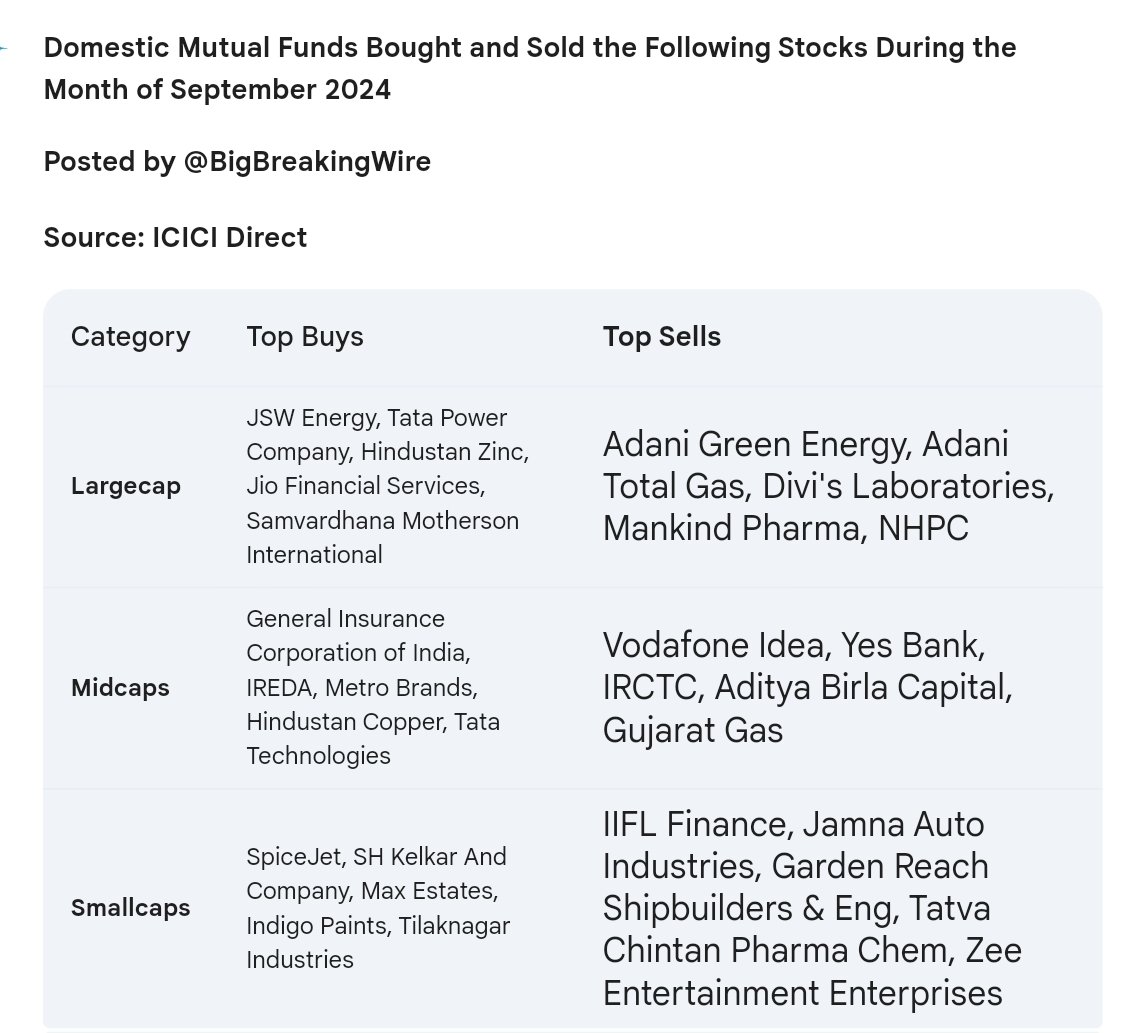

In September, mutual fund inflows into equities surpassed those from domestic institutions. Mutual funds purchased ₹32,200 crore worth of stocks, while domestic institutional investors (DIIs) had inflows just above ₹30,900 crore, indicating net outflows from non-mutual fund domestic institutions.

So far in October, mutual funds have invested ₹23,300 crore in equities, compared to DIIs’ investment of around ₹57,800 crore. In contrast, foreign portfolio investors experienced a net outflow of over ₹56,400 crore.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment