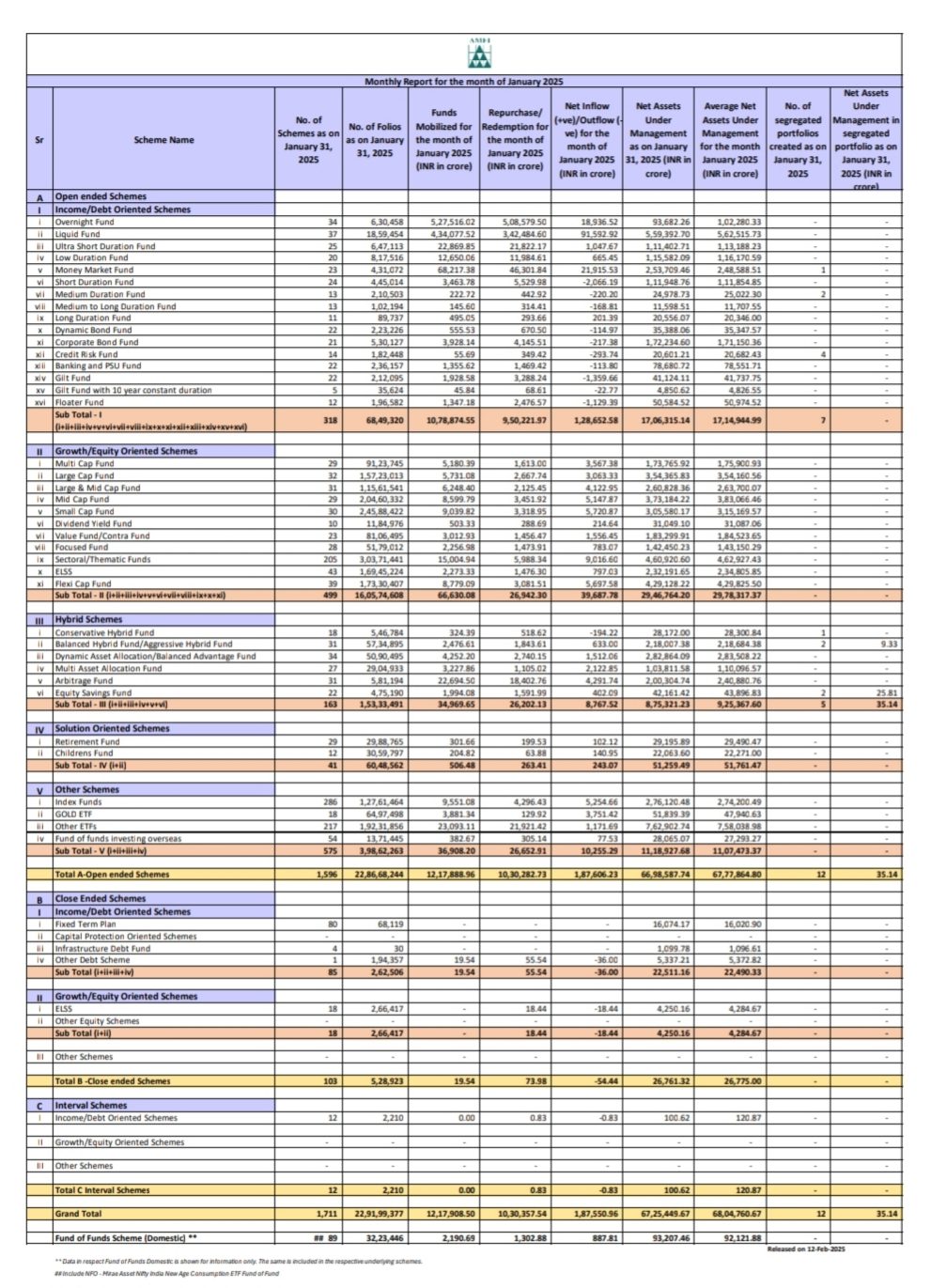

Despite strong inflows into equity mutual funds, the total assets under management (AUM) for actively managed equity schemes declined in January—the first dip since October.

AMFI January Data (Month-on-Month)

Total inflow: ₹1.87 lakh crore, compared to an outflow of ₹80,355 crore.

Equity inflow: ₹39,687 crore.

Total assets under management (AUM): ₹67.3 lakh crore, up from ₹66.9 lakh crore.

Equity AUM: ₹29.5 lakh crore, down from ₹30.6 lakh crore.

Equity Mutual Fund Inflows Remain Robust

Actively managed equity funds saw inflows of ₹39,687 crore in January, slightly lower than December’s ₹41,155.9 crore, marking a 3.6% decline. Small- and mid-cap funds continued to attract investor interest, accounting for 27% of total inflows into actively managed equity schemes.

Large-cap funds: Inflows rose to ₹3,063.3 crore from ₹2,010.9 crore in December.

Mid-cap funds: Inflows stood at ₹5,147.8 crore, marginally up from ₹5,093.2 crore in the previous month.

Small-cap funds: Inflows increased to ₹5,721 crore, compared to ₹4,667.7 crore in December.

Flexi-cap funds: Investors poured in ₹5,697.5 crore during the month.

Sectoral & thematic funds: Inflows rose to ₹9,016.5 crore, though significantly lower than December’s ₹15,331.5 crore.

Debt Funds See Strong Inflows

Debt mutual funds witnessed a sharp turnaround, recording inflows of ₹1.28 lakh crore in January, compared to an outflow of ₹1.27 lakh crore in December.

Overnight funds: Outflows stood at ₹18,936.5 crore, slightly lower than December’s ₹22,347.6 crore.

Liquid funds: Witnessed a large outflow of ₹91,592.9 crore, higher than December’s ₹66,532.1 crore.

Hybrid and Passive Funds Gain Traction

Hybrid mutual funds saw inflows rise to ₹8,767.5 crore, almost double the inflows of ₹4,369.8 crore recorded in December.

Arbitrage funds attracted the highest inflows at ₹4,291.7 crore.

Multi-asset allocation funds had led the category in the previous month.

Passive funds saw ₹10,255.2 crore in inflows in January, a sharp rise from December’s ₹784.3 crore. The index fund category led the way with inflows of ₹5,254.6 crore.

New Fund Offerings (NFOs) Remain Active

January saw 12 new fund launches, contributing ₹4,544 crore in inflows. The index fund category had the highest number of NFOs, followed by sectoral and thematic funds.

While inflows into mutual funds remain strong, the first decline in equity AUM since October suggests market movements may have impacted overall valuations. However, sustained investor interest in mid-cap, small-cap, and passive funds continues to drive the market forward.

Impact

Midcap and small-cap schemes saw strong inflows for the 6th consecutive month, while sectoral funds received ₹9,000 crore, down from ₹15,000 crore last month. Flexicap funds continued to attract investments for the 10th straight month, and all equity schemes reported inflows for the 4th consecutive month.

Key Factors

Overall fund flows turned positive due to ₹92,000 crore inflows into liquid funds. The equity segment recorded inflows for the 47th straight month, with equity inflows at ₹39,688 crore, slightly lower than ₹41,156 crore last month but still near record levels. However, equity AUM fell to a 6-month low of ₹29.5 lakh crore, while total AUM neared an all-time high at ₹67.3 lakh crore. NFO inflows remained weak at ₹4,544 crore, down 67% from ₹13,852 crore last month, with only 12 new schemes launched in January.

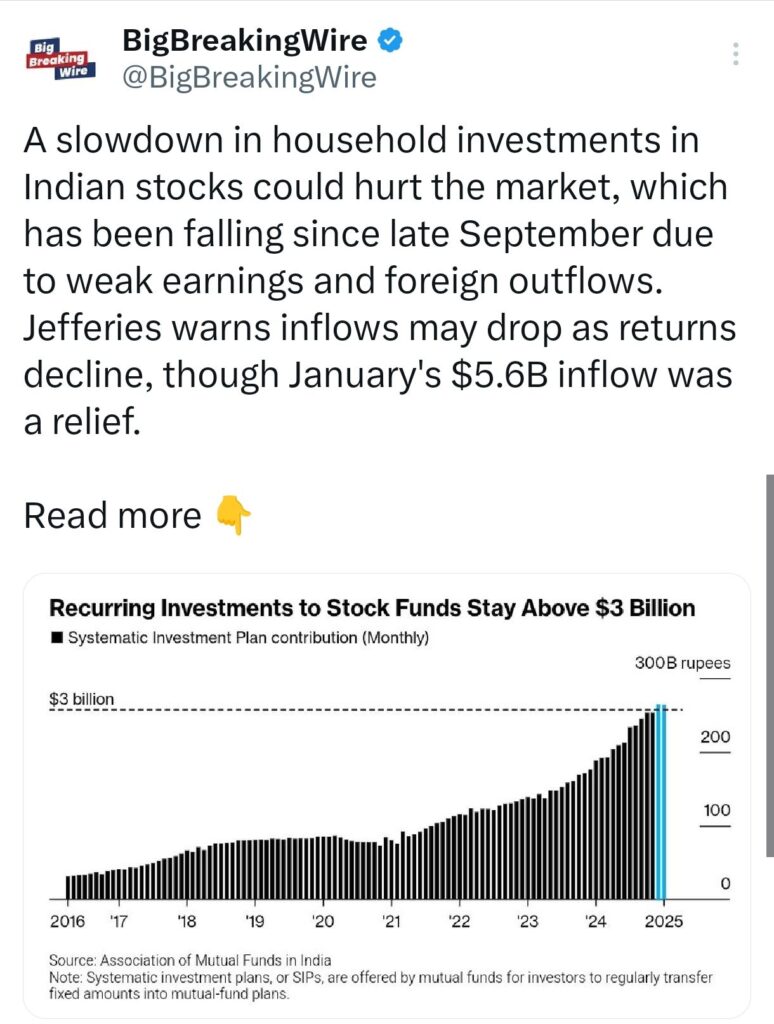

Indian Markets Slide Amid Foreign Outflows, But Domestic Investments Provide Support

Indian stock markets have been declining since late September, wiping out over $600 billion in value due to slowing corporate earnings and heavy foreign fund outflows exceeding $22 billion. However, steady household investments into equities have helped domestic institutions remain net buyers, partially cushioning the impact.

In January, equity investment plans saw a net inflow of $5.6 billion, marking the 47th consecutive month of positive contributions. A Jefferies report on Feb. 13 noted that while this strong inflow was a relief, there is a risk of lower investments ahead as trailing 12-month returns continue to drop.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

One Comment