Overview

In June 2025, the Indian mutual fund industry saw net inflows of Rs 49,094.61 crore, showing strong investor confidence. The total Assets Under Management (AUM) reached a record high of Rs 74,40,670.84 crore, continuing its upward trend across most categories.

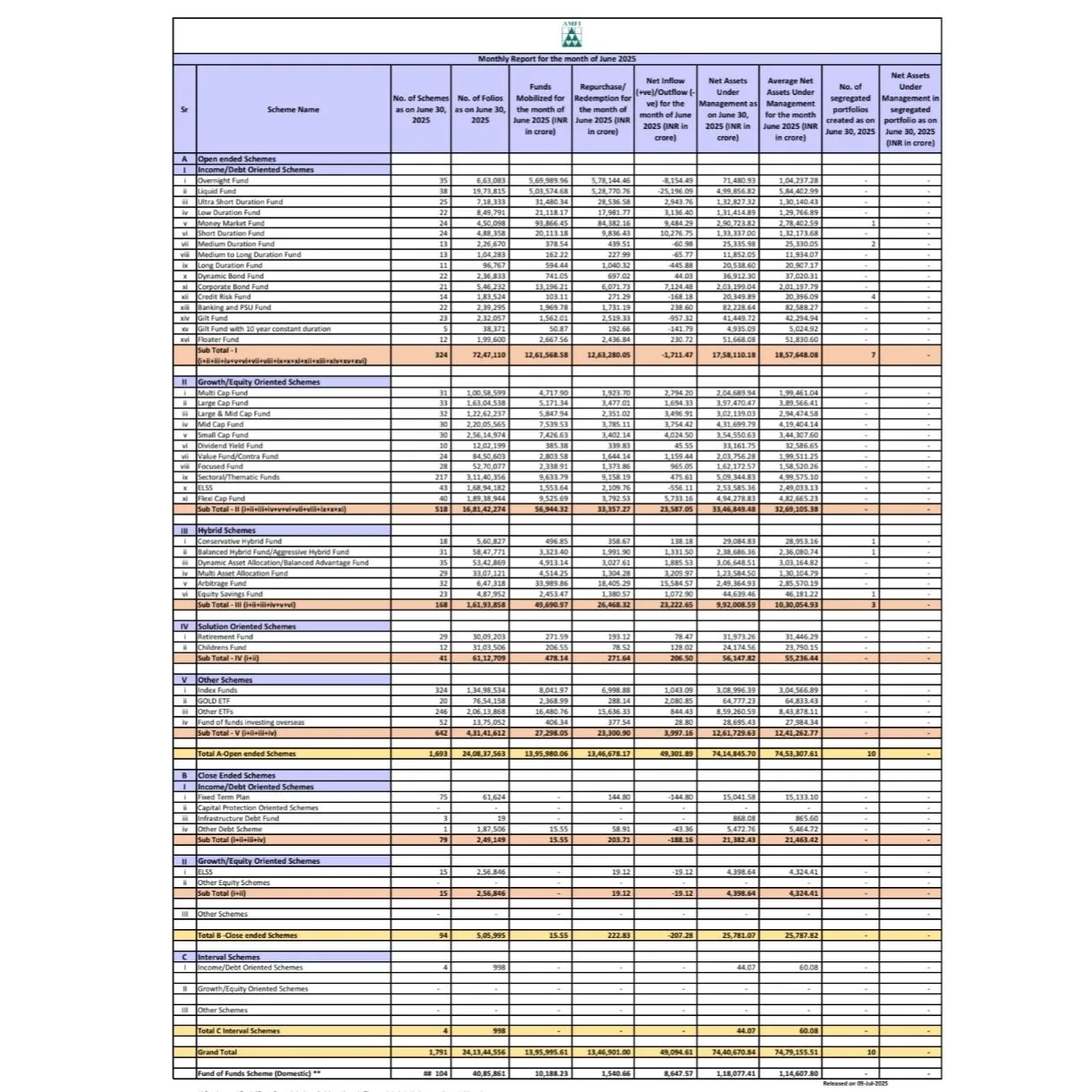

Total Market Snapshot (as of June 30, 2025)

Total Schemes: 1,791

Total Folios (Investor Accounts): 24.13 crore

Funds Mobilized in June: Rs 13,95,995.61 crore

Redemptions in June: Rs 13,46,901.00 crore

Net Inflow in June: Rs 49,094.61 crore

Total AUM (End of June): Rs 74,40,670.84 crore

Average AUM (June): Rs 74,79,155.51 crore

Category-Wise Highlights

1. Open-Ended Schemes

These are the most popular mutual fund types due to their flexibility.

A. Income/Debt-Oriented Funds

Schemes: 324

Total Folios: 7.25 crore

Net Outflow in June: Rs -1,711.47 crore

Total AUM: Rs 17,58,110.18 crore

Top Sub-categories:

Liquid Funds: Rs 4,99,856.82 crore AUM

Money Market Funds: Rs 2,90,723.82 crore AUM

Corporate Bond Funds: Rs 2,03,199.04 crore AUM

B. Equity-Oriented Funds

Schemes: 518

Total Folios: 16.81 crore

Net Inflow in June: Rs 23,587.05 crore

Total AUM: Rs 33,46,849.48 crore

Top Performers:

Small Cap Funds: Rs 3,54,550.63 crore AUM

Flexi Cap Funds: Rs 4,94,278.83 crore AUM

Sectoral/Thematic Funds: Rs 5,09,344.83 crore AUM

C. Hybrid Funds

Schemes: 168

Total Folios: 1.61 crore

Net Inflow in June: Rs 23,222.65 crore

Total AUM: Rs 9,92,008.59 crore

Popular Types:

Arbitrage Funds: Rs 2,49,364.93 crore AUM

Balanced Advantage Funds: Rs 3,06,648.51 crore AUM

D. Solution-Oriented Funds

Schemes: 41

Total Folios: 61.12 lakh

Net Inflow: Rs 206.50 crore

Total AUM: Rs 56,147.82 crore

E. Other Schemes (ETFs, Index Funds, etc.)

Schemes: 642

Total Folios: 4.31 crore

Net Inflow in June: Rs 3,997.16 crore

Total AUM: Rs 12,61,729.63 crore

2. Close-Ended Schemes

Schemes: 94

Folios: 5.05 lakh

Net Outflow: Rs -207.28 crore

Total AUM: Rs 25,781.07 crore

3. Interval Schemes

Schemes: 4

Folios: 998

Total AUM: Rs 44.07 crore

New Fund Offers (NFOs) – June 2025

In June 2025, 20 new schemes were launched and mobilized Rs 1,986 crore.

Breakdown:

Income/Debt Funds: Rs 335 crore (1 scheme)

Equity Funds: Rs 928 crore (4 schemes)

Index & ETFs: Rs 723 crore (15 schemes)

Notable NFOs:

Groww Nifty 500 Low Volatility 50 ETF

ICICI Prudential Nifty Top 15 Equal Weight ETF

Motilal Oswal Nifty India Tourism ETF

SAMCO Large and Mid Cap Fund

DSP Nifty Healthcare Index Fund

Gold ETF Inflows Jump to Rs 2,080 Crore in June 2025

Gold Exchange Traded Funds (ETFs) in India saw a strong surge in investor interest in June 2025, with net inflows rising to Rs 2,080.85 crore—the highest monthly inflow since January. This marks a sharp increase from Rs 291.91 crore in May. The inflows were boosted by the launch of two new Gold ETFs, which together contributed Rs 41 crore. So far in 2025, total net inflows into Gold ETFs have crossed Rs 8,000 crore.

Summary

The mutual fund industry in June 2025 maintained its growth momentum, especially in equity and hybrid categories. With Rs 49,094.61 crore net inflow and Rs 74.40 lakh crore AUM, investors are showing strong confidence in India’s market stability and long-term economic outlook.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment