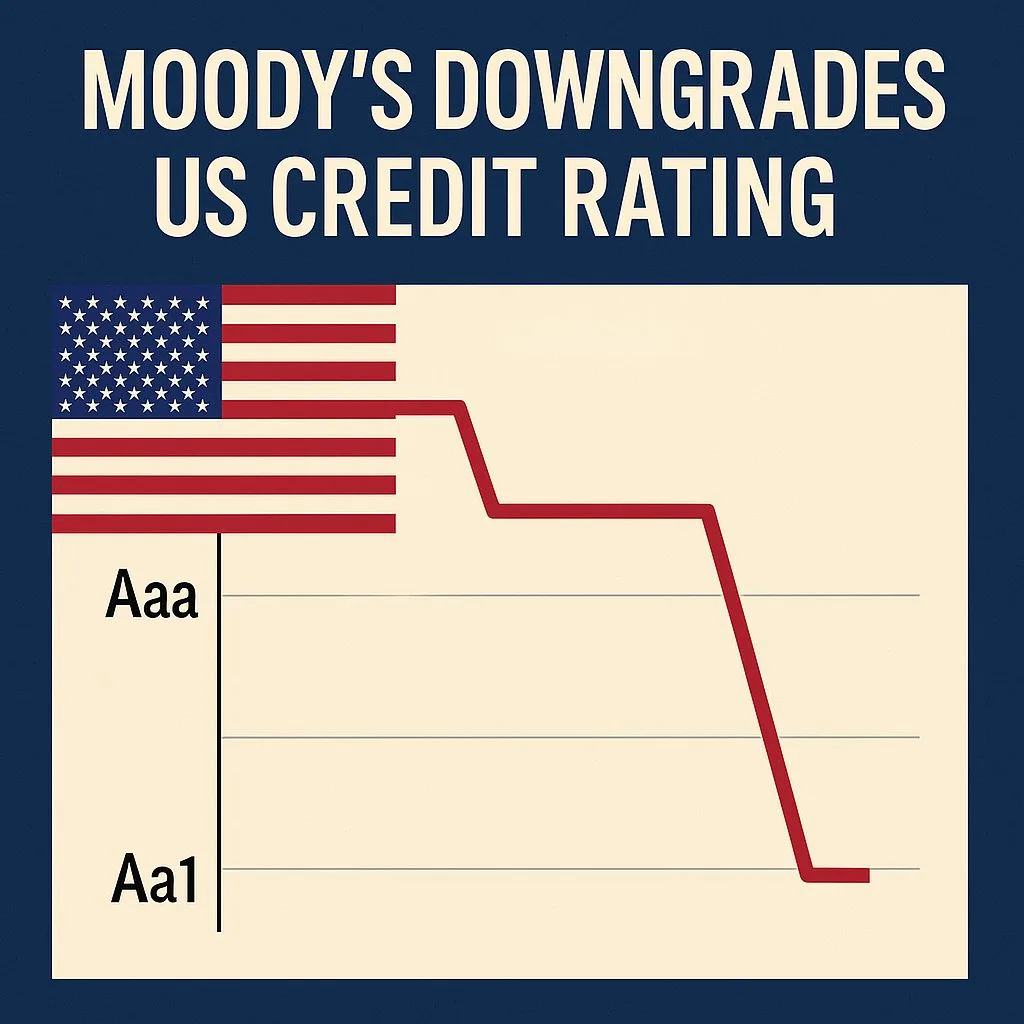

America Loses Its Final Triple-A Rating

The United States has officially lost its last top-tier credit rating. On Friday, Moody’s Investors Service downgraded the U.S. credit rating from Aaa to Aa1, raising concerns about the government’s growing debt and the long-term ability to manage public finances.

This is the first time in history that Moody’s has downgraded the U.S. from its perfect credit status, ending a streak that began in 1917.

Why Did Moody’s Lower the Rating?

The credit downgrade was driven by several worrying trends:

The federal debt has reached $36 trillion.

Budget deficits remain high, with no clear plan to reduce them.

Interest payments on debt are rising fast, making it harder for the government to manage its finances.

Moody’s said, “The downgrade reflects more than a decade of increasing debt and interest burdens. These metrics are now significantly worse than those of other highly-rated nations.”

What Does a Credit Downgrade Mean?

A lower credit rating means that investors see the U.S. government as slightly riskier to lend money to. This can lead to higher interest rates when the government borrows money in the future. Over time, this can impact taxpayers, consumers, and the broader economy.

However, Moody’s emphasized that the United States still has strong credit fundamentals, such as:

The world’s largest economy

A highly resilient financial system

The U.S. dollar’s role as the global reserve currency

Debt-to-GDP Ratio Set to Rise Sharply

Moody’s estimates that the U.S. federal debt will grow to 134% of GDP by 2035, up from about 98% in 2024. This debt-to-GDP ratio compares how much the country owes with how much it produces in goods and services annually.

In comparison, federal interest payments are expected to rise significantly—from around 9% of revenue in 2021 to 18% in 2024, and possibly 30% by 2035.

This shows that a larger portion of government income will be used just to pay interest, leaving less room for spending on services like healthcare, defense, or infrastructure.

U.S. Joins Other Downgraded Nations

Moody’s was the last major rating agency to maintain a AAA rating for the U.S. Previously:

Standard & Poor’s downgraded the U.S. in 2011

Fitch Ratings lowered its rating in August 2023

Now, all three major credit agencies have moved the U.S. below the top-tier rating.

White House Responds to the Downgrade

The White House criticized the timing of Moody’s decision. Spokesman Kush Desai said Moody’s had remained quiet during what he called “the fiscal disaster of the past four years,” and questioned the agency’s credibility.

Still, the administration defended its economic policies and said it is committed to responsible spending.

Economic Growth Takes a Hit

Adding to the negative outlook, the U.S. economy shrank by 0.3% in the first quarter of the year, according to the Commerce Department. This is a sharp reversal from the 2.4% growth in the previous quarter.

The contraction was largely due to:

A drop in government spending

A surge in imports as businesses rushed to beat upcoming tariffs

Political Challenges to Fiscal Reform

The downgrade also came amid setbacks for President Trump’s major spending plans. His much-publicized “big, beautiful bill” failed to pass the House Budget Committee, as several Republicans joined Democrats in voting against it.

This highlights the deep political divide over how to manage the nation’s finances.

Moody’s Outlook and Future Risks

While Moody’s still considers the U.S. a strong and stable economy, it warned of long-term risks:

No major cuts to mandatory government spending are expected under current policy proposals.

Fiscal performance is likely to worsen compared to both the U.S.’s own history and to other wealthy countries.

Moody’s does not believe tariffs will significantly impact growth, but views the lack of fiscal discipline as a critical long-term issue.

Conclusion: A Wake-Up Call for the US Economy

Moody’s downgrade is a major signal that America’s rising debt and political gridlock are now starting to affect its global financial credibility. While the U.S. still holds a strong position in the world economy, the current path is unsustainable unless meaningful reforms are made.

If interest payments continue to climb and deficits remain unchecked, borrowing costs could rise even more, hurting growth, investment, and public services.

This downgrade should serve as a serious warning to policymakers, investors, and citizens alike: it’s time to confront the growing debt crisis before it’s too late.

Update

President Trump disagrees with Moody’s decision to downgrade the U.S. credit rating, asserting that the world continues to have strong confidence in the American economy despite the agency’s assessment.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment