Michael Burry has just filed a 13F for Q1 2024, updating his portfolio. He has significantly increased his Alibaba position by 66.6%, making it his second largest holding. His largest position is currently JD.com, another Chinese e-commerce company.

Michael Burry has just filed a 13F for Q1’24, revealing significant updates to his portfolio:

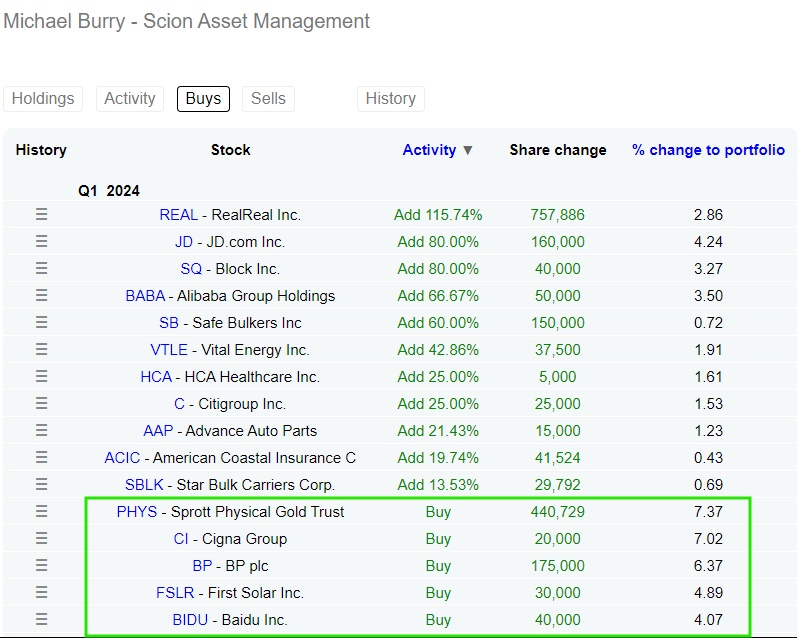

1. Top Holdings:

– JD.com ($JD): Largest position at 9.53%

– Alibaba ($BABA): Increased by 66.6%, now his second-largest position at 8.74%

– HCA Healthcare ($HCA): 8.06%

– Citigroup ($C): 7.64%

– Sprott Physical Gold Trust ($PHYS): New addition at 7.37%

– Block ($SQ): 7.36%

– Cigna Group ($CI): New addition at 7.02%

– Advance Auto Parts ($AAP): 6.99%

– BP plc ($BP): New addition at 6.37%

– Vital Energy ($VTLE): 6.35%

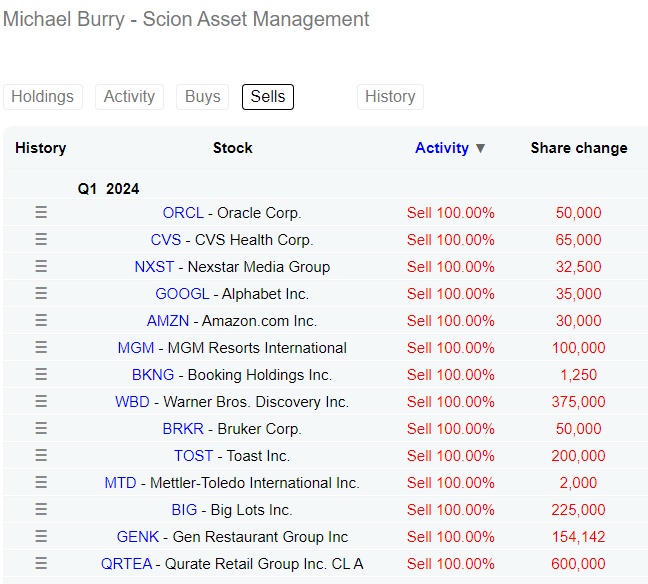

2. Closed-out Positions:

– Oracle ($ORCL)

– CVS Health ($CVS)

– Alphabet ($GOOGL)

– Amazon ($AMZN)

– Booking Holdings ($BKNG)

– And many more.

3. New Additions and Buys:

– Sprott Physical Gold Trust ($PHYS)

– Vital Energy ($VI)

– BP plc ($BP)

– First Solar ($FSLR)

– Baidu ($BIDU)

Note: Michael Burry has just filed a 13F for Q1 2024, updating his portfolio as of the end of the quarter, about 45 days ago. Notably, he increased his Alibaba position by 66.6%, making it his second largest holding. His largest position at that time was JD.com, another Chinese e-commerce company. Given Burry’s active trading style, his portfolio often changes frequently, so this reflects only his holdings as of the end of Q1.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment