Investors are adjusting their expectations for a U.S. rate cut amid a robust economy and resistance from central bank officials. This reconsideration is influencing Treasury and forex markets, despite stocks hovering around record levels.

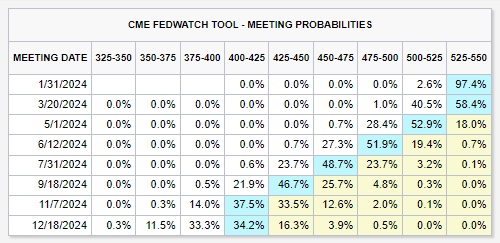

Markets no longer expect a rate cut in March 2024 officially.

Probability of March rate cuts has shifted to ~42%, a notable change from the previous 90% two weeks ago.

Odds of rate cuts at the upcoming Fed meeting are now only ~2%.

Approximately ~150 basis points of interest rate cuts are still factored into futures.

Despite fluctuations, there’s a consistent trend of markets turning dovish prematurely.

BigBreakingWire maintains the stance that the Fed is unlikely to implement 6+ rate cuts in 2024.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment