Morgan Stanley India Strategy

India is currently experiencing a $10 trillion positive wealth shock, with Indian households accumulating $9.7 trillion in wealth over the past decade. This surge in wealth is expected to support the bull market, driven by growing domestic equity savings. Fears of slow economic growth are unlikely to persist, and this shift has significant implications for India’s macroeconomy and markets. We can anticipate an increase in domestic equity flows, along with more global investments in both bonds and equities. However, capacity constraints within the bureaucracy could still pose a risk to this momentum.

The growing savings from domestic equity investors are supporting the bullish market trend.

Over the last 10 years, Indian households have accumulated $9.7 trillion in wealth.

India is experiencing a major positive wealth boost.

This shift has significant implications for both the economy and the market outlook.

Short-Term Market Outlook

In the short term, the market is under pressure due to concerns about near-term economic growth.

Portfolio Strategy: Favor cyclicals over defensives, and large-cap stocks over small and mid-cap stocks.

Sector Allocation

Morgan Stanley recommends focusing on sectors like Financials, Technology, Consumer Discretionary, and Industrials, while reducing exposure to other sectors.

Goldman Sachs on Consumption Trends

Urban areas are facing a slowdown across different sectors, but rural areas are showing resilience.

The slowdown in urban consumption is caused by a mix of high food inflation, a decline in unsecured consumer lending, and general macroeconomic challenges.

A quick recovery in urban consumption is unlikely.

In this environment, certain stocks are positioned well for growth.

Key Stocks in the Current Environment

HPC Companies (Home and Personal Care): Companies like Godrej Consumer, Marico, and Emami are expected to perform better than food companies in the second half of FY25.

Pidilite: The company is benefiting from a strong housing cycle.

Titan: High-end consumption is driving growth for this company.

Trent: The company is gaining market share in its sector.

United Spirits: Growth is fueled by premiumization in the Indian spirits market.

ITC: The cigarette business is seeing steady volume growth of 3-4% along with 6-7% price growth.

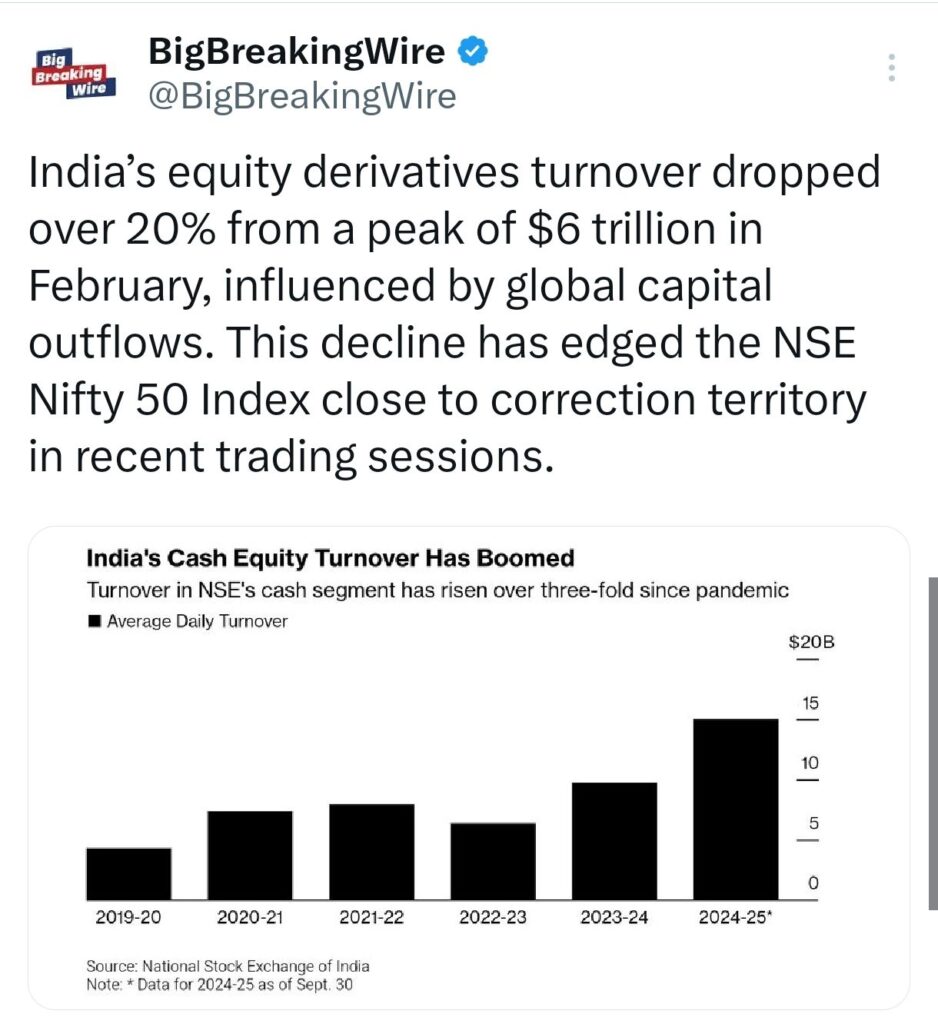

India’s equity derivatives turnover has fallen by more than 20% from its peak of $6 trillion in February. This drop has been largely driven by global capital outflows. As a result, the NSE Nifty 50 Index has come close to entering correction territory in recent trading sessions.

India’s central bank may allow the rupee to weaken alongside the Chinese yuan following Trump’s election victory, as the depreciation of the yuan poses a risk of widening India’s trade deficit with China. The Reserve Bank of India (RBI) is expected to manage the rupee’s decline by utilizing its $680 billion foreign exchange reserves. Analysts now predict the rupee could reach 85 to the US dollar within the next 12 months.

The Indian rupee has recently hit an all-time low of 84.38 against the US dollar, with experts forecasting it could reach 85/USD over the next year. Despite the RBI’s intervention, India’s foreign exchange reserves have decreased from $700 billion to $680 billion as of November 8.

Jefferies India has lowered its earnings forecasts for two-thirds of Indian companies for FY25, citing concerns over the ongoing economic slowdown. Despite this, they expect a 10% growth for the Nifty 50 index. On the other hand, Goldman Sachs has downgraded India, expressing concerns about both growth prospects and valuations. However, Jefferies remains cautiously optimistic about the market outlook, maintaining a more positive stance despite the broader challenges.

India’s bond sales are expected to rise in the next fiscal year due to higher debt repayments, especially from bonds issued during the Covid years. The government is likely to keep borrowing the same for the rest of this fiscal year as spending increases. The government plans to borrow 14.01 trillion rupees ($168 billion) in the fiscal year ending March 2025. While higher bond sales could affect the performance of sovereign bonds, which have done well this year, the government doesn’t foresee a shortfall in spending. Efforts have been made to manage debt maturities, including buying back 800 billion rupees and extending 1.35 trillion rupees of debt.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

3 Comments