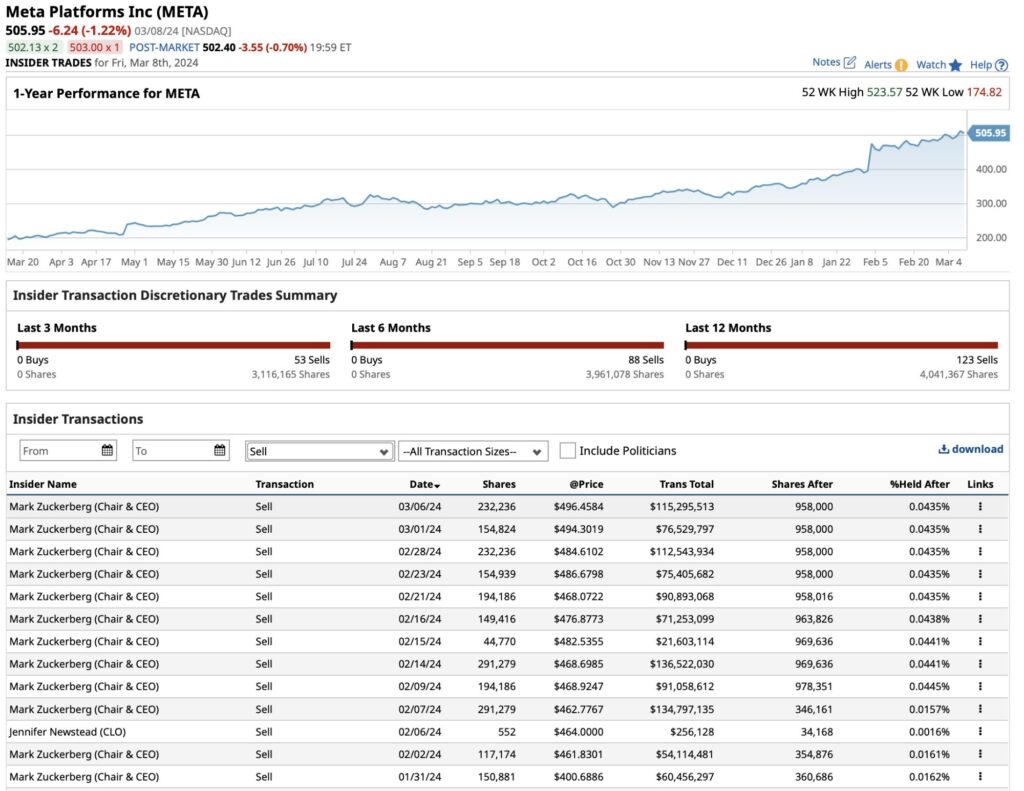

Mark Zuckerberg, the Chair & CEO, sold over $300 million in $META shares in the past week, bringing his total sales to over $1.5 billion since November.

During the latter part of February and the beginning of March 2024, Mark Zuckerberg, the Director, major shareholder, Chairman, and CEO of Meta Platforms, Inc. (META), orchestrated a series of substantial stock transactions, revealing a strategic divestment from the company. The disclosed details provide a comprehensive overview of the extent and dynamics of these stock sales.

Starting on February 26, Zuckerberg initiated the sales by divesting various amounts of Meta shares. The sales on this day encompassed a total of 75,468 shares, with quantities ranging from 1,857 to 9,908 shares per transaction. The prices per share fluctuated between $480.25 and $486.03, reflecting a diverse range within a single day.

This trend persisted over the following two days. On February 27, Zuckerberg continued the divestment, selling a total of 31,263 shares in transactions varying from 200 to 8,127 shares. The share prices during these transactions ranged from $480.25 to $486.6. The final leg of this series of transactions occurred on February 28, concluding with sales of 38,200 shares in transactions involving quantities from 400 to 8,436 shares. Prices per share in these transactions ranged from $483.44 to $490.50.

Further, on February 29, 2024, Zuckerberg executed significant sales, disposing of 30,000 shares at an average price of $484.74 per share. Additionally, on the same date, he sold 26,680 shares at $489.73 per share and 16,660 shares at $501.64 per share. The strategic divestment extended into March 1, 2024, with Zuckerberg selling 20,000 shares at $498.49 each and 6,469 shares at $498.96 each. Moreover, on March 1, he continued the divestment with transactions involving varying quantities, from 1,500 to 6,704 shares, at prices ranging between $495.27 and $503.75 per share.

In total, these transactions amounted to $106 million worth of shares sold by Zuckerberg in Meta Platforms, Inc. The meticulous detailing of these stock sales provides a comprehensive understanding of the scale, timing, and pricing strategies employed during this divestment period, offering valuable insights for investors and analysts closely monitoring Meta’s trajectory in the market.

In a recent development, Mark Zuckerberg, CEO of $META, offloaded an additional $100 million worth of $META stock yesterday (March 14), following the passage of the bill to ban TikTok in the House. This latest sale brings his total sales of $META stock to $1,775,351,428.026.

Update

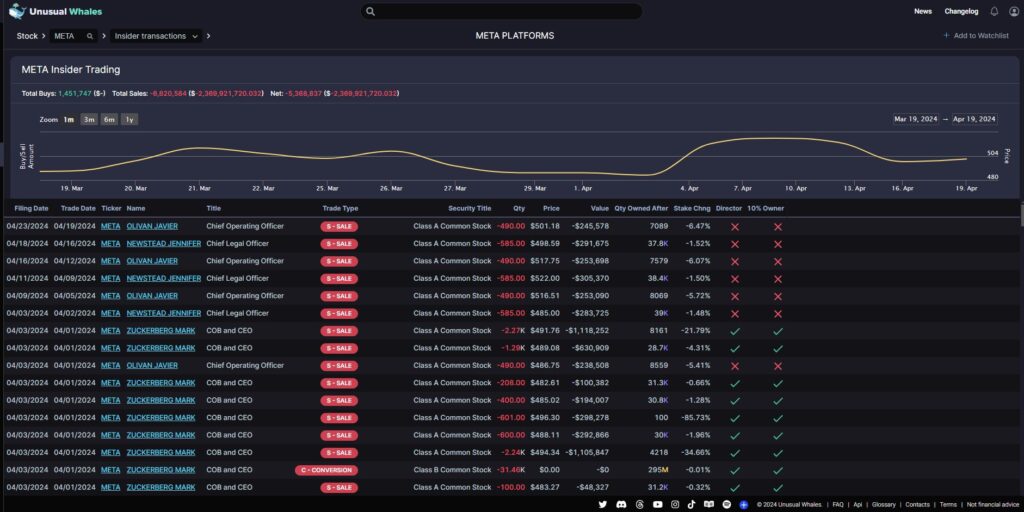

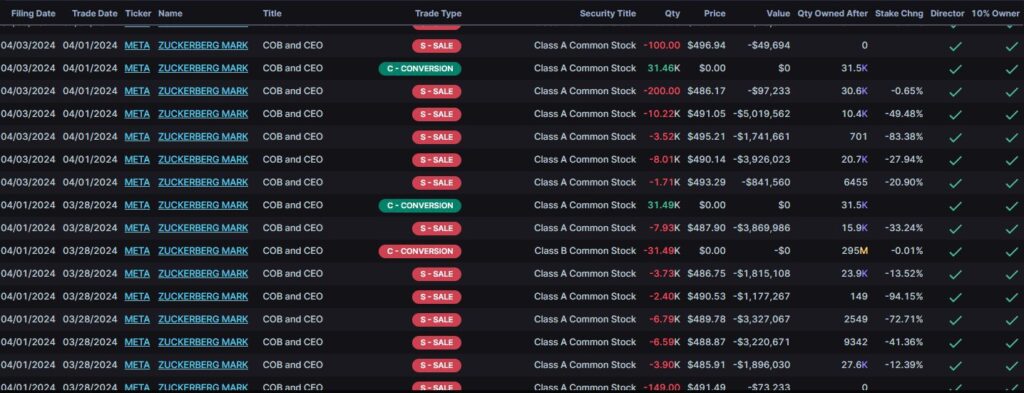

In the past month, notable figures like Zuckerberg, Javier Olivan (COO), and Jennifer Newstead (CLO) have been selling shares of $META.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment