Japan’s current account slipped into a deficit for the first time in two years, as a weaker yen drove up import costs and seasonal demand surged, according to data from the Ministry of Finance.

In January, the country recorded a current account deficit of 257.6 billion yen (approximately $1.75 billion), exceeding market expectations of 230.5 billion yen. This downturn was mainly caused by a widening trade gap, where import growth significantly outpaced exports.

Rising Imports Worsen Trade Balance

A key factor behind the deficit was a sharp 17.7% increase in imports compared to the previous year, reaching 10.44 trillion yen. Meanwhile, exports saw only a 2.1% rise, totaling 7.5 trillion yen. This imbalance resulted in a trade deficit of 2.94 trillion yen, a 92.9% year-on-year increase.

The earlier timing of China’s Lunar New Year prompted businesses to stockpile electronic components and smartphones, further boosting imports. At the same time, Japanese exports slowed due to the temporary disruption in Chinese demand.

Services and Digital Trade Trends

While the services sector posted a deficit of 476.6 billion yen, this was 30.4% lower than the previous year, indicating some recovery. However, the digital services deficit, mainly driven by payments for online advertising and cloud services, expanded by 10% year-on-year.

On the other hand, tourism revenues surged, with the travel balance recording a surplus of 708.3 billion yen, an 80% increase from the previous year. The influx of Asian tourists, particularly around the Lunar New Year, played a crucial role in this growth.

Stronger Foreign Investment Income Offsets Losses

Japan’s primary income balance, which measures earnings from overseas investments, remained strong with a surplus of 3.6 trillion yen, reflecting a 20.5% year-on-year increase. Higher dividend payments from automobile sector subsidiaries abroad contributed significantly to this growth, helping offset some of the overall current account losses.

Understanding the Current Account

The current account is a key indicator of a country’s economic health, tracking the flow of goods, services, investment income, and financial transfers between Japan and other nations. It includes:

Trade Balance: The difference between exports and imports of goods.

Services Balance: Transactions in sectors like tourism and digital services.

Investment Income: Profits from foreign assets such as dividends and interest.

Unilateral Transfers: Payments like remittances and foreign aid.

A current account surplus means a country is exporting more than it imports, while a deficit indicates higher reliance on foreign goods and services. Japan’s latest figures suggest that a weak yen and shifting global trade patterns continue to shape its economic outlook.

Conclusion

Japan’s return to a current account deficit highlights the impact of currency fluctuations, trade imbalances, and seasonal economic shifts. While foreign investment earnings and tourism growth provided some relief, rising import costs remain a challenge. Moving forward, policymakers will need to address yen stability and trade competitiveness to ensure economic balance in the coming months.

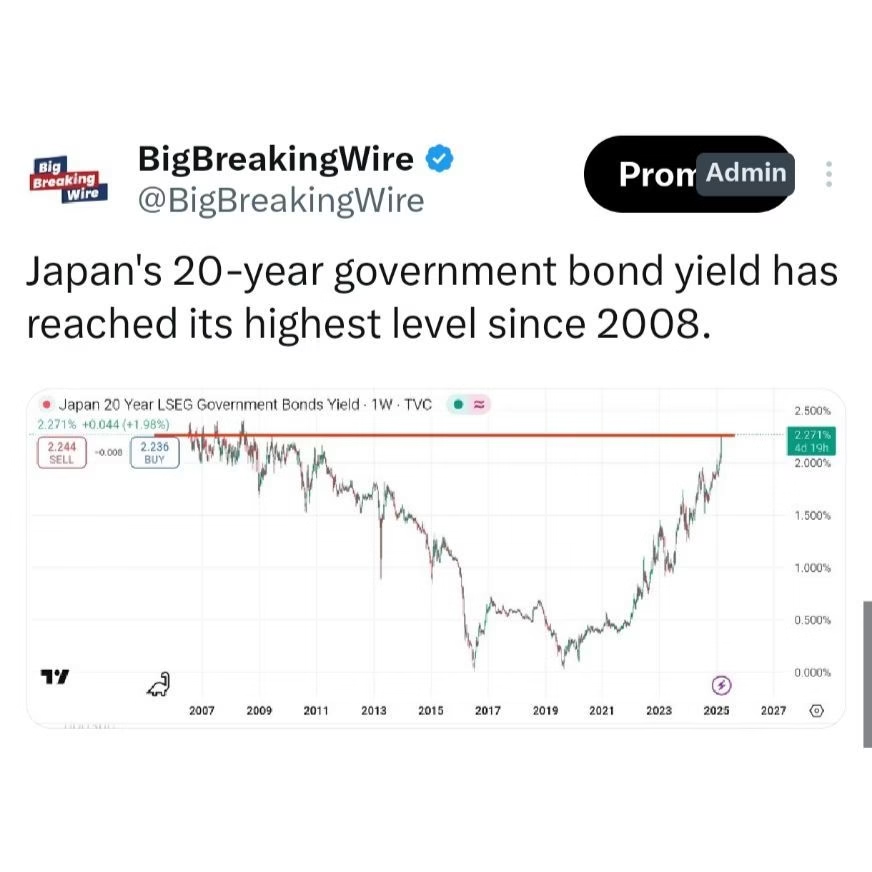

Chart of the day

Japan’s 20-year government bond yield has reached its highest level since 2008.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment