The Indian government is managing its money well. Right now, the fiscal deficit is Rs 4.35 lakh crore, which is 27% of the total budget of Rs 16.13 lakh crore. This means the government is spending within its limits.

India’s foreign debt in USD for the second quarter is $682.3 billion, up from $663.8 billion in the previous quarter.

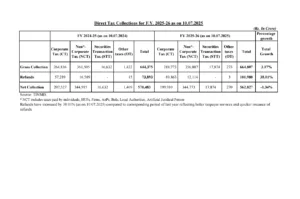

How the Government is Spending

From April to August, the fiscal deficit was Rs 4.35 trillion. This is also 27% of what they plan to spend this year. This shows they are careful with their money.

During this time, the government spent Rs 16.52 trillion. This is 34% of the total budget for the year. Last year, they spent Rs 16.72 trillion in the same months, which is a bit more. The lower spending this year is partly because there were elections earlier.

Money for Building Projects

The government is spending money to build roads, schools, and hospitals. From April to August, they spent Rs 3.01 trillion on these projects. This is 27% of what they plan to spend for the year. Last year, they spent Rs 3.74 trillion in the same time, but this year’s spending is still within the budget.

Keeping the Deficit Target

The government wants to keep the fiscal deficit at 4.9% of the country’s GDP this year. This is better than last year’s deficit of 5.6%. This shows the government is serious about managing its money.

Current Account and Trade Situation

The government also shared information about India’s money situation:

Current Account Deficit: In the second quarter, the current account deficit was -1.10% of GDP, up from -0.60% in the last quarter.

India’s current account deficit increased to 1.1% or $9.7 billion in the first quarter of the year, mainly due to a rise in the merchandise trade deficit, according to the Reserve Bank of India (RBI).

In the first quarter, merchandise imports reached $176.1 billion, while exports were only $111 billion, marking a decline compared to last year. The total trade deficit was 10%, but gains from the services sector helped offset the losses in merchandise trade.

Experts predict that the current account deficit will exceed 1% in FY25, up from 0.7% last year. However, it is expected to remain below 2% due to increased capital imports from India’s inclusion in global indices, which benefits the economy.

Balance of Payments: The balance of payments showed a surplus of $5.2 billion, down from $30.8 billion last quarter.

Trade Balance: The trade deficit grew to -$65.1 billion in the second quarter, compared to -$50.9 billion in the last quarter.

India’s Core Sector Output Declines

India’s core sector output shrank by 1.8% in August, down from 6.1% in July, as per government data released on September 30.

Growth for the first five months of the year slowed to 4.6%, compared to 8% in the same period last year. This could affect industrial production, especially since manufacturing activity has decreased recently.

India’s manufacturing PMI fell to a three-month low of 57.5 in August, compared to 58.1 in July, due to weaker demand.

The Eight Core Sector Industries Index, which makes up 40% of the Industrial Production Index, tracks key sectors like cement, coal, oil, electricity, fertilizers, gas, refinery products, and steel.

In August, the eight core industries experienced a contraction of 1.8%, marking the first decline in 42 months, following a growth of 6.1% in July. This downturn was attributed to a high comparison base and heavy rainfall in certain regions, according to the Office of the Economic Advisor.

Breakdown of August Performance (YoY): Coal output decreased by 8.1%, compared to a 6.8% increase in July. Crude oil production fell by 3.4%, slightly worse than the previous month’s decline of 2.9%. Natural gas output declined by 3.6%, following a -1.3% change last month. Petroleum refinery production dropped by 1%, down from a 6.6% increase in the prior month.

On the positive side, fertilizer production increased by 3.2%, down from a 5.3% rise. Steel output grew by 4.5%, although this was less than the 6.4% increase in July. Cement production saw a decline of 3%, following a 5.5% rise the previous month. Electricity output decreased by 5%, down from a 7.9% increase in July.

Update

A day after the release of crucial fiscal deficit data, the PMI figures for September show that India’s HSBC Manufacturing PMI has fallen to 56.5, below the expected 56.7 and down from last month’s 57.5, marking the lowest level in eight months.

Update (30th October, 2024)

The fiscal deficit for the first half of FY25 is 29.4%, down from 39.3% in the same period last year, according to data released on October 30. Capital spending was low, reaching only 37.3% of the full-year target of Rs 11.1 lakh crore, compared to 49% in the first half of FY24. Experts believe the government might achieve a lower fiscal deficit than the 4.9% target set in the Union Budget 2024-25, partly due to a higher-than-expected RBI dividend of Rs 2.1 lakh crore. Overall, the government’s spending is at 43.8% of the FY25 budget target of Rs 48.2 lakh crore, down from 47.1% in April-September 2023.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment