The Reserve Bank of India (RBI) has released its Financial Stability Report, highlighting the resilience of the Indian financial system while cautioning about potential risks to stability due to global and domestic factors. Here are the key points:

Resilience in Banking and Financial Systems

Banks have shown further improvement in asset quality, supported by robust capital buffers.

Macro stress tests indicate that even under adverse scenarios, banks’ aggregate capital levels will remain above the minimum regulatory requirements by March 2026.

Non-banking financial companies (NBFCs) are projected to maintain capital adequacy above the regulatory minimum, even in high-risk scenarios.

Risks to Financial Stability

Elevated public debt levels, stretched asset valuations, and prolonged geopolitical tensions could pose risks to financial stability.

Under a baseline stress scenario, the gross NPA ratio for 46 major banks may rise to 3% by March 2026.

In adverse scenarios, the gross NPA ratio could increase to 5% or higher.

Positive Indicators for Sustainability

The Indian financial system remains robust and vibrant, benefiting from balance sheet improvements and strong capital buffers.

Improving debt metrics and a favorable interest rate-growth differential contribute positively to fiscal sustainability.

The RBI’s report underscores the resilience of India’s financial institutions while urging caution in navigating emerging risks. This balanced outlook is a testament to the country’s evolving economic framework, ensuring stability amid uncertainties.

Microfinance Faces Rising Risks

The microfinance sector is still facing challenges, as highlighted by the Reserve Bank of India in its financial stability report. Stressed assets overdue by 31-180 days rose to 4.3% in September, up from 2.15% in March. This suggests that companies in the sector may continue to struggle with earnings. However, with stocks like CreditAccess Grameen and Fusion Finance falling 43% and 70% this year, some investors believe the worst might already be reflected in the stock prices.

India’s GDP to Recover in H2 FY25: RBI Report

India’s real GDP growth is expected to improve in the third and fourth quarters of the current financial year, driven by strong domestic demand, public spending, increased investments, and growth in service exports, according to the Reserve Bank of India’s Financial Stability Report.

The report noted that while GDP growth slowed to 6% year-on-year in the first half of 2024-25, down from 8.2% and 8.1% in the two halves of 2023-24, the fundamentals for long-term growth remain strong. GDP growth hit its lowest in seven quarters at 5.4% in the second quarter of FY25 but is projected to recover in the second half of the year.

The Finance Ministry projects economic growth of 6.5% for FY25, supported by strong rural and urban demand, higher investments, and increased government spending. Rural demand remains robust, with sales of two- and three-wheelers rising 23.2% and 9.8%, and domestic tractor sales up 9.8% in October-November 2024. Urban demand is also strengthening, with passenger vehicle sales growing 13.4% and air travel seeing significant growth in the same period.

The October-March period is expected to perform better than the first half of the financial year. Food prices are likely to ease, helped by positive prospects in the farming sector. Government capital spending is also playing a key role in boosting growth, particularly in infrastructure and capital goods. Order books in these sectors show strong momentum, indicating a revival in investment.

Sectors like cement, steel, and electricity are set to benefit from increased post-monsoon demand and government initiatives, further driving growth in the infrastructure sector.

RBI Governor Sees Stronger Growth in 2025

India’s new RBI Governor, Sanjay Malhotra, predicts economic growth to improve in 2025, supported by strong consumer and business confidence. However, the medium-term outlook is challenging due to geopolitical tensions, potential financial instability, and rising debt levels. Growth is expected to slow to 6.6% in FY2025 after surpassing 8% annually in recent years, potentially impacting corporate profits and household income.

The RBI’s Financial Stability Report highlights that gross non-performing assets in banks may rise to 3% by March 2026, up from 2.6% in September 2024. Despite this, stress tests show that banks and non-banking financial companies (NBFCs) will maintain capital adequacy levels well above regulatory requirements even under adverse scenarios. However, the slowdown in growth poses risks to asset quality and loan repayments.

The capital adequacy ratio of banks is forecasted to slightly decrease from 16.6% in September 2024 to 16.5% by March 2026 under a baseline scenario. This reflects a stable but cautious banking environment. While banks remain resilient, challenges from weaker economic growth and higher non-performing assets will demand vigilant oversight to maintain stability.

The central bank’s focus on these issues reflects its commitment to supporting the economy while managing systemic risks. Governor Malhotra’s outlook signals optimism for recovery in 2025, alongside a readiness to address emerging risks through policy adjustments, potentially including interest rate cuts next year.

Download full report from here

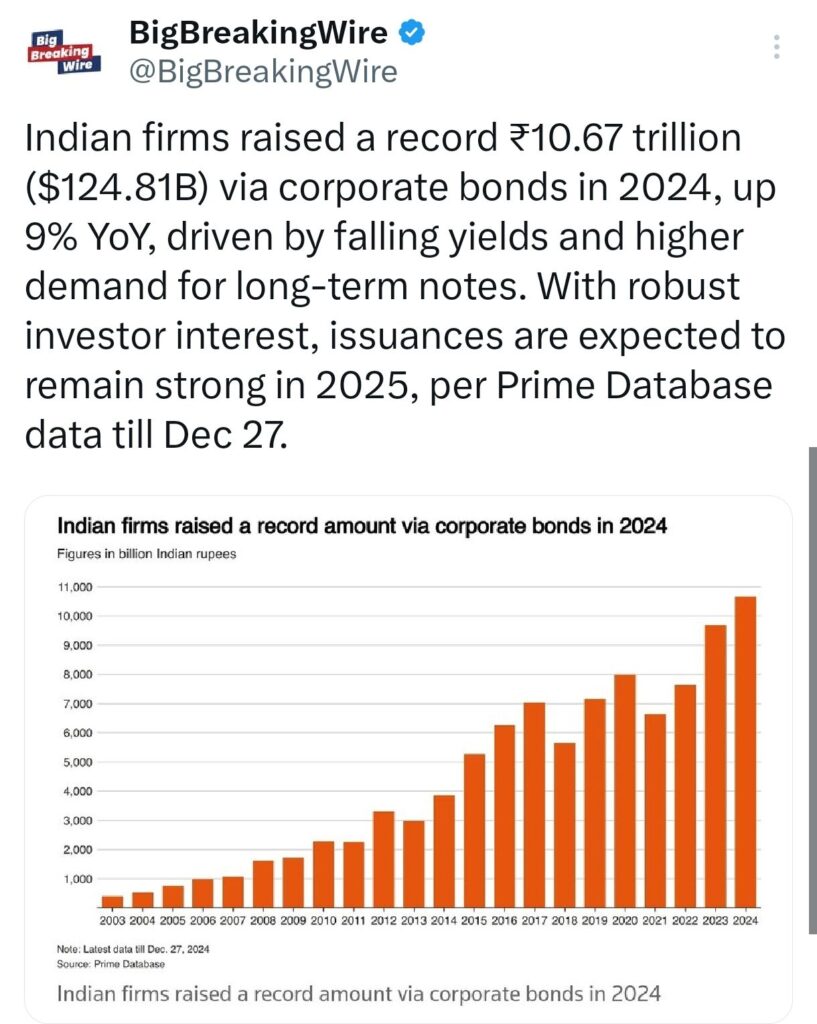

Chart of the day

Indian companies raised a record ₹10.67 trillion ($124.81 billion) through corporate bonds in 2024, marking a 9% increase from the previous year. This growth was fueled by declining yields and higher demand for long-term bonds. Robust investor interest suggests that bond issuances will likely remain strong in 2025, according to data from Prime Database as of December 27.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

One Comment