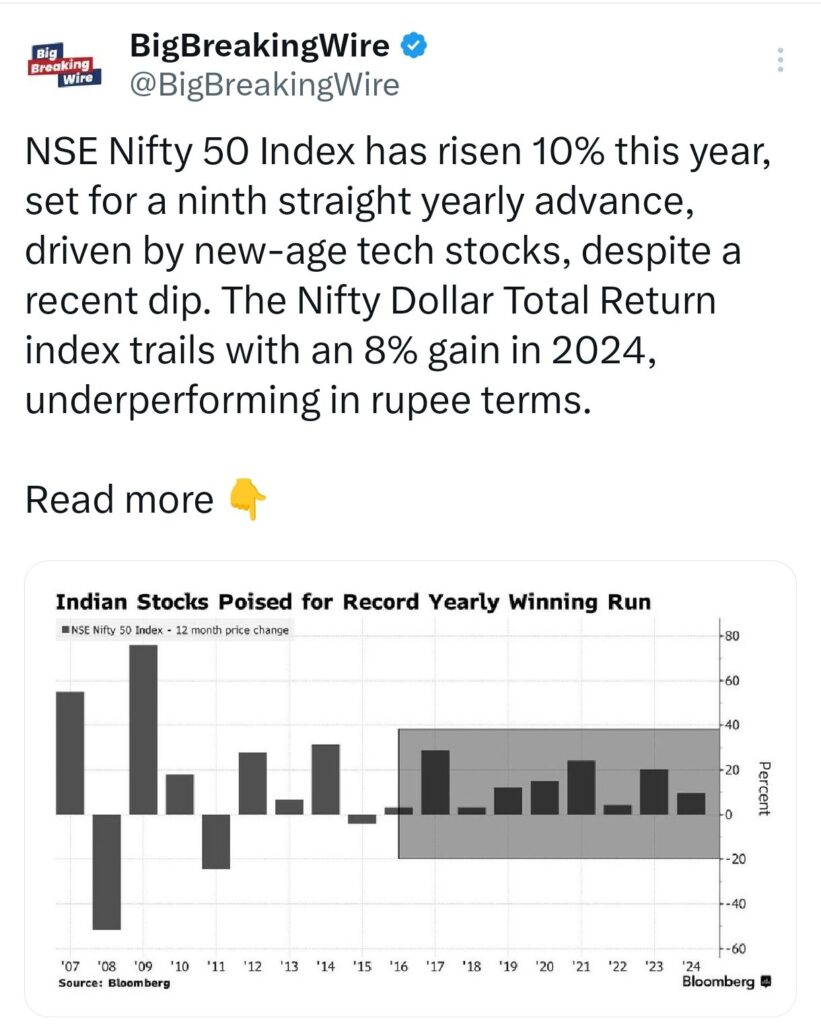

The Indian rupee’s sharp decline to record lows is dampening the appeal of Indian shares for foreign investors. After breaching the 85 Vs USD, the rupee is now nearing 86, raising concerns among overseas investors calculating returns in dollar terms. This challenge is worsened by mediocre stock market performance, with the Nifty Dollar Total Return Index up just 8% this year, lagging the Nifty’s 10% gain in rupee terms.

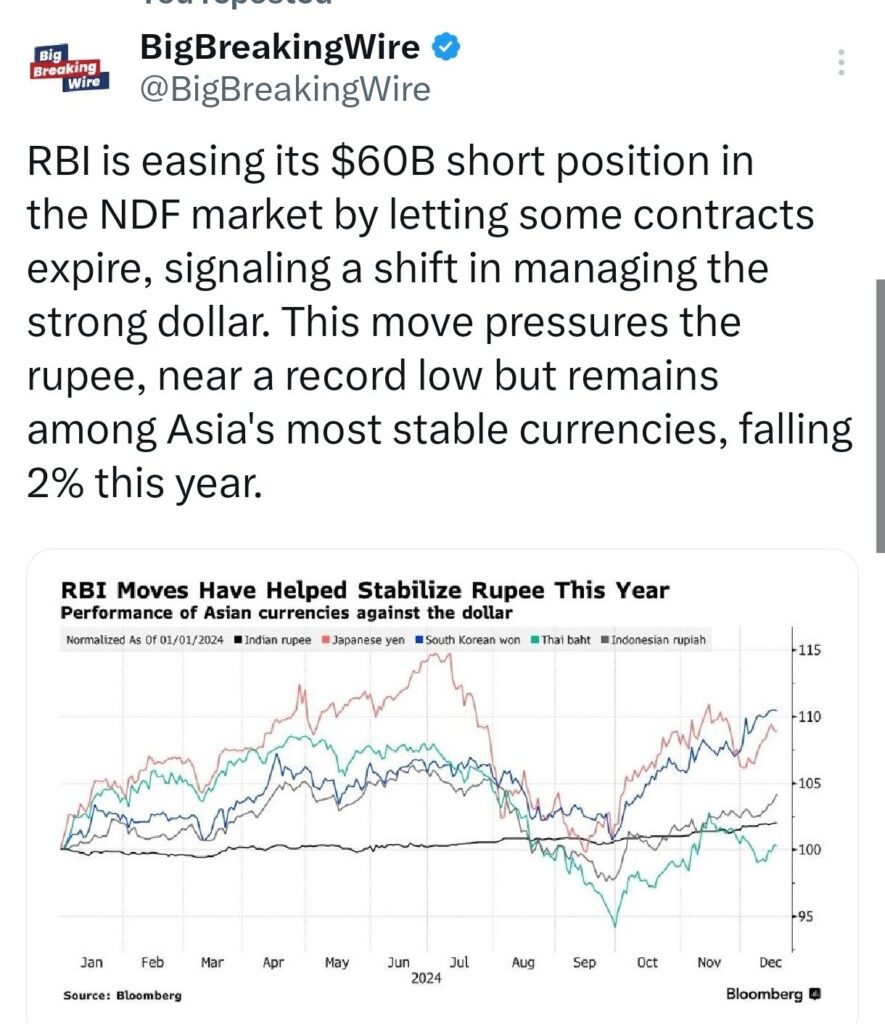

RBI is gradually reducing its $60 billion short position in the NDF market by allowing some contracts to expire, marking a shift in its approach to managing the strong dollar. This strategy has added pressure on the rupee, which is near a record low but remains one of Asia’s most stable currencies, with only a 2% decline this year.

High U.S. Yields to Keep Pressure on Rupee

Last week, the 10-year U.S. Treasury yield reached its highest point since late April, driven by expectations that Trump’s trade and immigration policies could increase inflation, while his proposed tax cuts would contribute to a rise in U.S. debt. This surge in yields is providing strong support to the dollar index.

“As long as U.S. yields continue their upward trajectory, the rupee will face significant challenges,” a currency dealer stated.

Key Indicators:

– One-month non-deliverable rupee forward at 85.70; onshore one-month forward premium at 28 paisa

– Dollar index at 108

– Brent crude futures up 0.2 at $74.4 per barrel

– Ten-year U.S. Treasury yield at 4.63%

– According to NSDL data, foreign investors sold a net $186.7 million worth of Indian equities on Dec. 26

– NSDL data also shows foreign investors purchased a net $4 million worth of Indian bonds on Dec. 26

Rupee Hits 85.81 as Liquidity Deficit Soars

Over the past month, the rupee has weakened 1.2%, a sharp fall compared to its 1.3% depreciation over the previous six months. The currency’s decline mirrors broader weakness among emerging market peers, driven by the dollar’s strength and uncertainty around potential US tariffs. Volatility has surged, with the rupee sliding from 84 to 85 per dollar in just six weeks.

Traders report the Central Bank selling dollars to limit rupee losses. Interventions and revaluation effects have cut India’s forex reserves by $50 billion this quarter.

The new RBI governor, Sanjay Malhotra, has yet to address the central bank’s stance on managing exchange rate volatility. This has left traders speculating whether there’s a shift away from the previous approach of curbing sharp currency fluctuations.

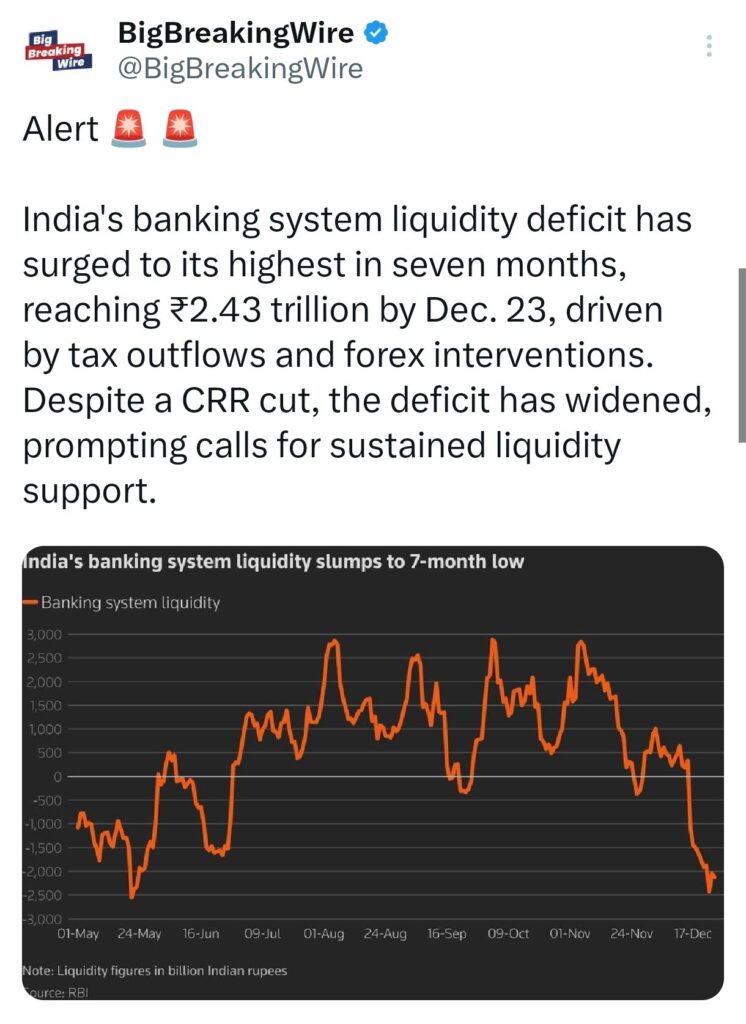

India’s banking system is facing its steepest liquidity deficit in seven months, with a shortfall of ₹2.43 trillion as of December 23. This is mainly due to significant tax outflows and the Reserve Bank of India’s (RBI) interventions in the foreign exchange market. Even though the central bank recently reduced the Cash Reserve Ratio (CRR) to ease liquidity, the deficit has continued to grow, raising concerns and calls for more sustained liquidity support from the RBI.

Meanwhile, the Indian rupee has weakened to a record low of 85.81 against the US dollar on Friday. This drop was driven by strong demand in the offshore Non-Deliverable Forward (NDF) market and increased dollar purchases by oil companies at the end of the month.

Rupee Hits Most Overvalued Since 2004

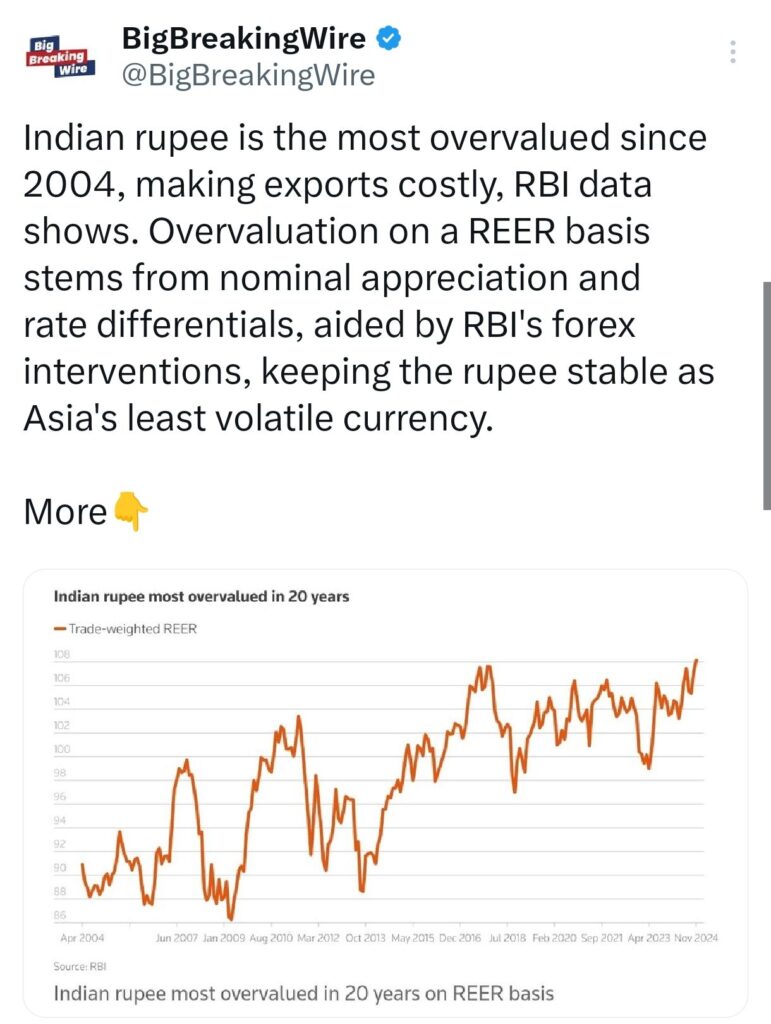

The rupee is at its most overvalued since 2004, making Indian exports pricier, RBI data shows. Its overvaluation on a REER basis reflects nominal appreciation against peers and widening interest rate gaps. Economists credit the RBI’s frequent forex interventions for slowing the rupee’s decline and stabilizing volatility. As a result, the rupee is Asia’s second-least volatile currency after the pegged Hong Kong dollar. Data before 2004 is unavailable.

Nifty 50 Hits 10% Growth Despite Slump

NSE Nifty 50 Index has risen by about 10% this year, despite a recent drop caused by slower economic growth. It is set for its ninth straight yearly gain, driven by a rise in tech stocks, while blue-chip stocks have lagged behind. On the other hand, the Nifty Dollar Total Return index has increased by just 8% in 2024, falling short of the Nifty’s 10% gain when measured in rupees.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment