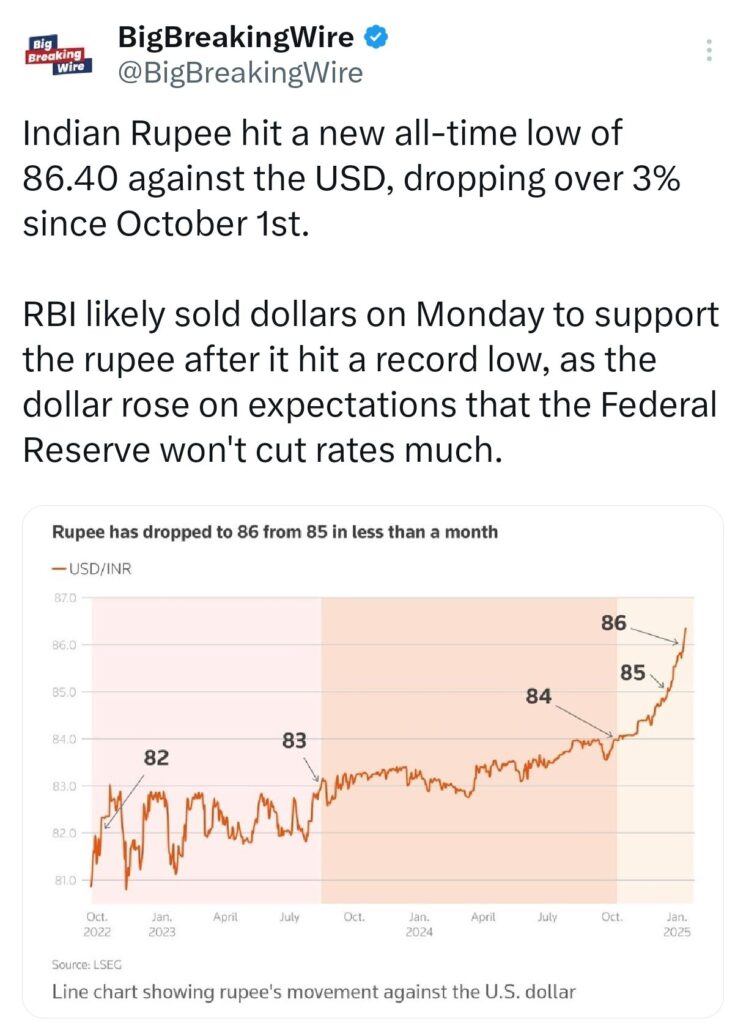

Indian Rupee dropped to an all-time low of 86.40 against the US dollar on Monday, marking a historic breach of the 86 level for the first time. This depreciation follows robust US job data, which raises expectations that the Federal Reserve may limit rate cuts in 2025, adding pressure on emerging market currencies.

From Friday’s closing value of 85.96, the INR’s decline highlights the ongoing challenges it faces amidst a strengthening dollar. Factors like substantial outflows from domestic equities, hawkish Federal Reserve statements, and rising crude oil prices are contributing to the rupee’s weakness. As the world’s third-largest oil consumer, India is particularly vulnerable to fluctuations in oil prices.

Despite these challenges, routine interventions by the Reserve Bank of India (RBI), such as the sale of US dollars, may have helped mitigate the INR’s losses.

The US labor market’s unexpected strength in December, with 256,000 jobs added compared to the forecast of 160,000, coupled with a drop in the unemployment rate to 4.1%, has provided further support to the US dollar. The dollar index climbed 0.22% to 109.72, reaching its highest level in over two years. Federal Reserve officials, however, have offered mixed signals regarding future monetary policy. While some have suggested a rate cut may be possible if inflation remains controlled, others caution against lowering rates too quickly, citing the risk of inflation being stuck between 2.5% and 3%.

Looking ahead, there is speculation that the INR may weaken further, Gavekal Research predicting it could breach the 90 mark against the US dollar in 2025. India’s potential shift away from a quasi-peg to the dollar could provide the rupee more flexibility but also expose it to increased volatility. In this scenario, a 10% depreciation, pushing the rupee to 95, is not ruled out. Market observers believe bearish sentiment on the rupee may persist due to continued strength in the US labor market and broader economic conditions.

Models suggest that stronger US nominal GDP growth, higher interest rates, and a potential decline in US Treasury yields could drive the dollar higher against both emerging market currencies and the INR. This could result in a 7-10% depreciation for the rupee, with weaker domestic growth trends contributing to a gradual decline. As the INR experiences a year-over-year depreciation of 3%, it signals potential for more pronounced weakening in the months ahead.

Additionally, the negative India-US real policy rate spread and an overvalued broad real effective exchange rate (REER) add to the pressure on the rupee. Estimates suggest that the INR could fall to levels between 90-92 within the next 6-10 months, signaling further challenges for the Indian currency.

Barclays has revised its forecast for the Federal Reserve’s interest rate cuts, now anticipating a 25 basis point reduction in June 2025, rather than the two rate cuts previously expected for March and June of that year. Additionally, Barclays expects the Fed to implement three separate 25 basis point cuts in 2026, with one occurring in each of the months of June, September, and December.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment