India’s trade surplus with the US is relatively low compared to other Asian countries. The US accounts for 177% of India’s goods exports, but India’s share in US imports remains small at just 2.7% as of 2024.

India imposes some of the highest tariff rates, with the weighted average tariff on US imports at 8.5%, compared to 3% for US tariffs on Indian goods. Among Asian nations, South Korea faces the highest tariff burden, with an average rate of 14.4%. According to Morgan Stanley, India’s higher tariffs make it more vulnerable to potential reciprocal tariffs, especially in food products and vegetables, where it imposes higher duties on US imports.

Key Indian exports to the US include electrical machinery, gems and jewelry, pharmaceuticals, textiles, autos, iron and steel, and chemicals. The US runs its largest trade deficit with India in electrical machinery, pharmaceuticals, and precious stones, while it enjoys a surplus in minerals, fuels, aerospace, and optical parts.

Morgan Stanley warns that trade and tariff uncertainties could create business uncertainty, weighing on confidence and potentially slowing global economic growth.

Foreign Investors Pull Out Over $10 Billion, But India’s Market May Rebound

Foreign investors have sold more than $10 billion worth of Indian stocks this year, with no signs of slowing down. Despite strong local investments, stock prices continue to fall due to uncertainty in global markets. Morgan Stanley says that while investors are hoping for foreign funds to return, just having more inflows won’t be enough—confidence in economic growth needs to improve. The bank expects India’s stock market to recover in the coming months and prefers investing in private-sector financial companies and consumer-focused businesses.

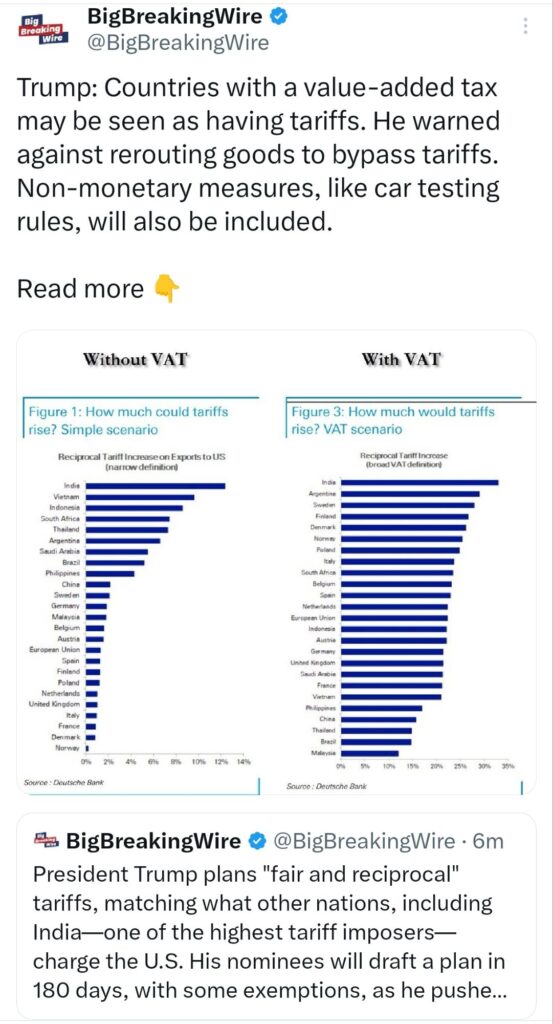

Trump Warns of Tariffs on VAT Countries and Trade Loopholes

President Donald Trump suggested that countries using a value-added tax (VAT) system might effectively be imposing tariffs on U.S. goods. He warned that such countries could face reciprocal duties. He also cautioned against attempts to bypass tariffs by rerouting goods through third countries, stating that such strategies would not be allowed.

Trump also announced that non-monetary trade barriers, such as mandatory testing for imported cars, would be considered when imposing new tariffs.

His trade adviser, Peter Navarro, indicated that India, Japan, and the European Union (EU) could be among the main targets of these tariffs. India had recently reduced tariffs on heavy motorcycles and some U.S. agricultural products, an issue Trump had previously criticized.

Trump is pushing these tariffs to help address budget shortfalls while implementing tax cuts. His nominee for the Office of Management and Budget, Russell Vought, has been assigned to assess the financial impact of the proposed tariffs.

US-India Trade and Defense Ties: Key Focus on Energy, Technology, and Supply Chains

Trump talked about plans to increase US exports of energy, including oil and gas, as well as defense technology, aiming to reduce the trade gap. He also mentioned that the US would work towards selling F-35 fighter jets to India in the future.

Modi, on the other hand, focused on increasing overall trade between the two countries, aiming to double it to $500 billion by 2030. He highlighted India’s interest in working with the US on artificial intelligence and semiconductors—two key areas for Trump’s administration. Modi also emphasized strengthening supply chains, especially in pharmaceuticals.

US Tariff Hike Could Hit Emerging Markets Hard

If the US raises tariffs to match the highest ones imposed on its goods, emerging markets like India, Argentina, Africa, and Southeast Asia would be hit hardest, says Bloomberg Economics. Many countries could feel the impact since Trump sees trade as unfair due to the US importing more than it exports. He also criticizes value-added taxes (VAT) on US goods, like the EU’s 15% VAT and Japan’s consumption tax. His administration is considering a broader approach to trade “fairness.”

India at Risk of Major Trade Impact if US Imposes Reciprocal Tariffs

India could face significant challenges in various sectors if the US goes ahead with its plan to impose reciprocal tariffs. Emkay Global warns that India might be the worst affected among major countries. Sectors like chemicals, automobiles, textiles, and footwear are expected to bear the brunt. Even industries such as defense and renewable energy equipment may not be spared, as the US pressures India to buy more from American suppliers.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

2 Comments