India’s merchandise trade deficit widened sharply in December 2025, reflecting higher imports, modest export growth, and global trade pressures.

What Was India’s Trade Deficit in December 2025?

India’s merchandise trade deficit stood at US$ 25 billion in December 2025, compared with US$ 20.6 billion in December 2024. This was the largest trade gap ever recorded for the month of December.

Why Did the Trade Deficit Increase?

- Merchandise imports rose 8.8 percent year on year to US$ 63.6 billion

- The rupee remained weak during the period

- Pressure from the United States reduced flexibility in sourcing discounted Russian oil

- Energy input costs for Indian refiners increased despite lower global crude prices

- Merchandise exports grew only 1.8 percent to US$ 38.5 billion

Impact of US Tariffs on Indian Exports

Several Indian export sectors remained under pressure due to 50 percent tariffs imposed by the United States. India is currently among the few major economies that have not secured a comprehensive trade agreement with the White House.

Total Exports and Imports Overview

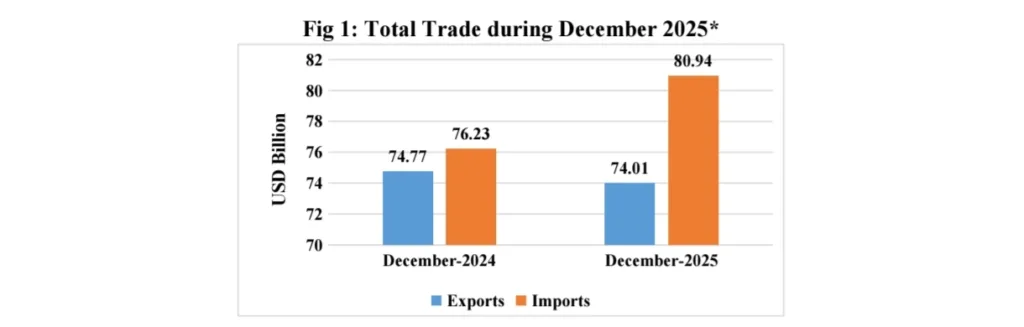

December 2025

- Total exports (merchandise and services): US$ 74.01 billion, down 1.01 percent

- Total imports (merchandise and services): US$ 80.94 billion, up 6.17 percent

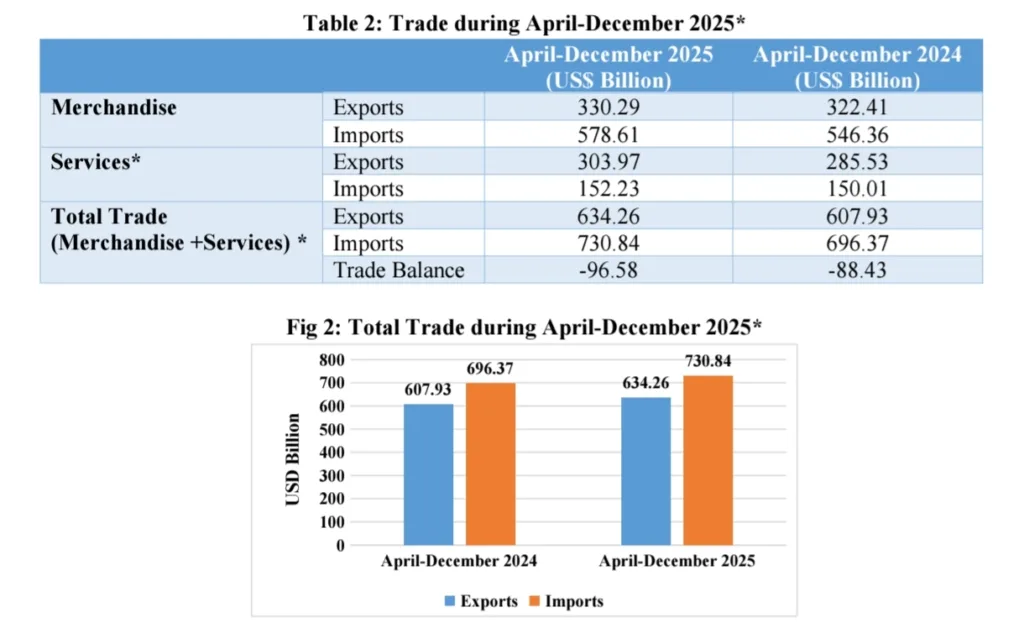

April to December 2025

- Total exports: US$ 634.26 billion, growth of 4.33 percent

- Total imports: US$ 730.84 billion, growth of 4.95 percent

Merchandise Trade Performance

December 2025

- Merchandise exports: US$ 38.51 billion

- Merchandise imports: US$ 63.55 billion

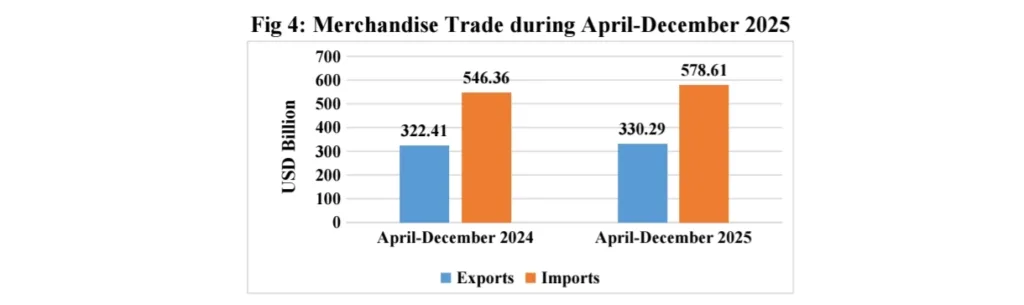

April to December 2025

- Merchandise exports: US$ 330.29 billion

- Merchandise imports: US$ 578.61 billion

- Merchandise trade deficit: US$ 248.32 billion

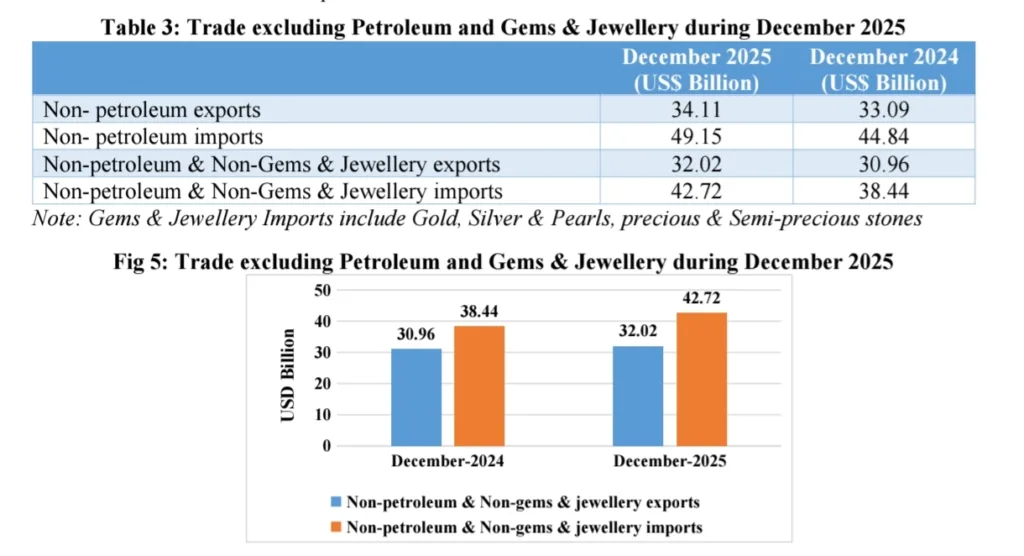

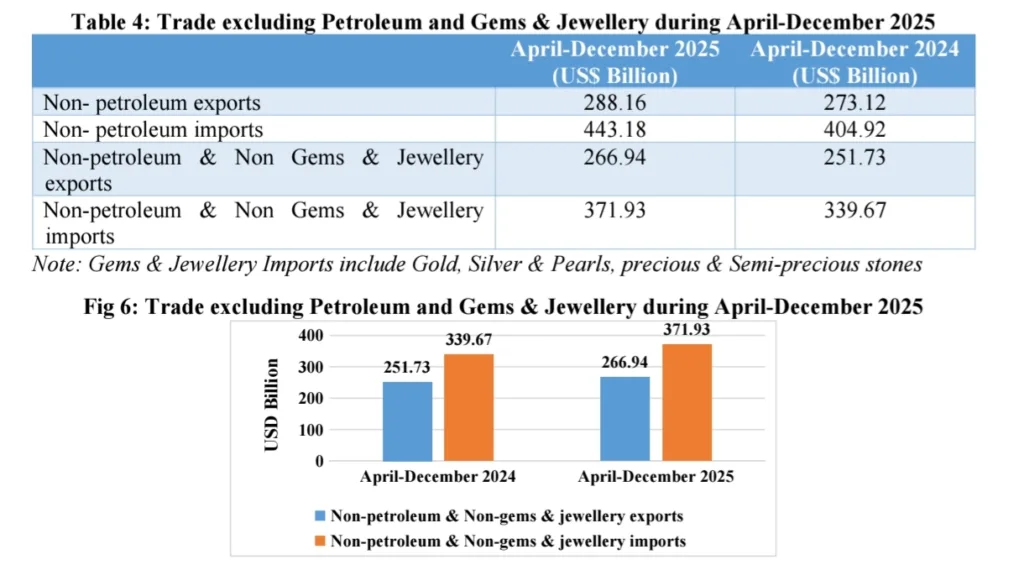

Non Petroleum and Non Gems Trade

December 2025

- Exports: US$ 32.02 billion

- Imports: US$ 42.72 billion

April to December 2025

- Exports: US$ 266.94 billion

- Imports: US$ 371.93 billion

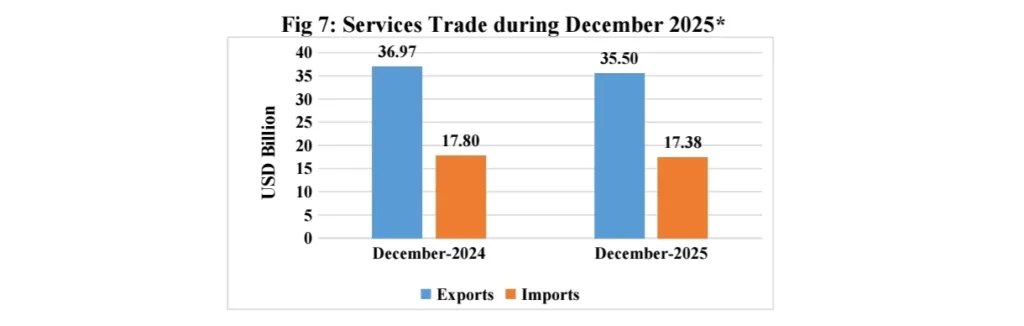

Services Trade Performance

December 2025

- Services exports: US$ 35.50 billion

- Services imports: US$ 17.38 billion

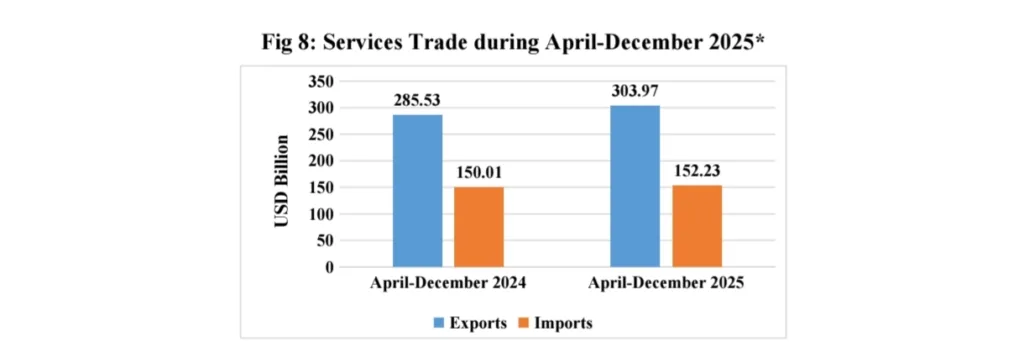

April to December 2025

- Services exports: US$ 303.97 billion

- Services imports: US$ 152.23 billion

- Services trade surplus: US$ 151.74 billion

Which Sectors Drove Export Growth in December 2025?

- Electronic goods: up 16.78 percent to US$ 4.17 billion

- Meat, dairy and poultry products: up 30.16 percent to US$ 0.66 billion

- Drugs and pharmaceuticals: up 5.65 percent to US$ 2.63 billion

- Engineering goods: up 1.28 percent to US$ 10.98 billion

- Marine products: up 11.73 percent to US$ 0.81 billion

Top Export Destinations

December 2025

- China: 67.35 percent growth

- United Arab Emirates: 14.94 percent

- Malaysia: 65.42 percent

- Hong Kong: 61.28 percent

- Spain: 48.48 percent

April to December 2025

- United States: 9.75 percent

- China: 36.68 percent

- United Arab Emirates: 7.49 percent

- Spain: 53.33 percent

- Hong Kong: 25.75 percent

Top Import Sources

December 2025

- China: 20.01 percent

- Saudi Arabia: 28.85 percent

- Brazil: 95.62 percent

- Peru: 59.08 percent

- Chile: 116.35 percent

Key Takeaway

India’s trade data for December 2025 highlights strong services exports and selective manufacturing strength, but also shows rising import dependence and geopolitical pressures impacting merchandise trade.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment