India has launched the second phase of its national chip strategy through the India Semiconductor Mission 2.0, announced in the Union Budget 2026 to 27. The government has set aside Rs 1,000 crore for this phase to strengthen chip design, equipment manufacturing, and materials production inside the country. This move matters because semiconductors power everything from mobile phones to defence systems, and supply shortages in recent years exposed India’s dependence on imports. Businesses, engineers, startups, and students across the electronics sector are directly affected.

What Happened

The Government of India announced India Semiconductor Mission 2.0 as part of the Union Budget 2026 to 27, according to PIB Delhi. This phase focuses on producing semiconductor equipment and materials within India and building full stack Indian chip intellectual property.

For the financial year 2026 to 27, Rs 1,000 crore has been allocated specifically for ISM 2.0. The focus is on industry led research, training centres, and advanced design capabilities to prepare a skilled workforce for future chip technologies.

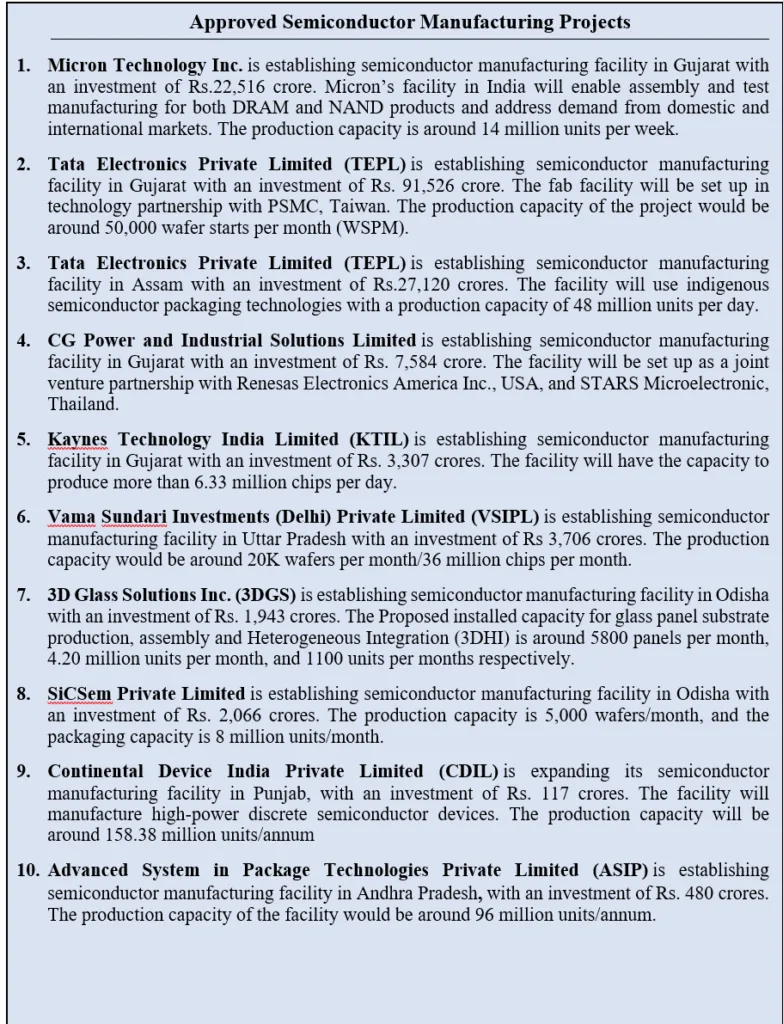

This builds on ISM 1.0, approved in December 2021 with a total incentive outlay of Rs 76,000 crore. By December 2025, 10 semiconductor projects worth about Rs 1.60 lakh crore were approved across 6 states, covering silicon fabs, compound semiconductor units, and assembly and testing facilities.

Why Did It Happen

The main reason is global supply chain risk. During the Covid pandemic, chip shortages hit more than 169 industries worldwide, slowing production and raising costs. India, which imports most of its advanced chips, felt the impact across automobiles, electronics, and telecom sectors.

Today, semiconductor manufacturing is concentrated in a few regions. Taiwan produces over 60 percent of global semiconductors and nearly 90 percent of the most advanced chips. This creates geopolitical and supply risk for countries like India that rely heavily on imports.

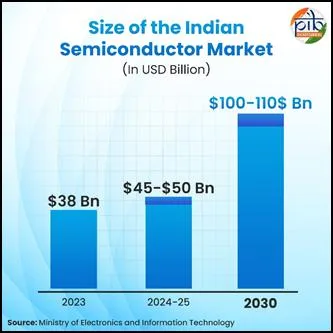

India also sees a huge growth opportunity. The domestic semiconductor market was about 38 billion dollars in 2023, rose to around 45 to 50 billion dollars in 2024 to 25, and is expected to reach 100 to 110 billion dollars by 2030. The government wants more of this value to be created locally.

What Is the Bigger Context or Concern

Semiconductors are now seen as a strategic asset, not just an industrial product. Chips power energy grids, hospitals, telecom networks, financial systems, satellites, and defence equipment. A disruption in supply can slow entire economies.

Major economies are responding. The United States, European Union, Japan, and South Korea have launched large national programmes to bring chip manufacturing closer to home. India is positioning itself as a trusted partner and an alternative manufacturing hub.

India has also set technology goals. By 2029, the country aims to design and manufacture chips needed for about 70 to 75 percent of domestic applications. The long term roadmap includes working towards 3 nanometre and 2 nanometre technology nodes by the next decade.

How Does This Affect Markets, Companies, or People

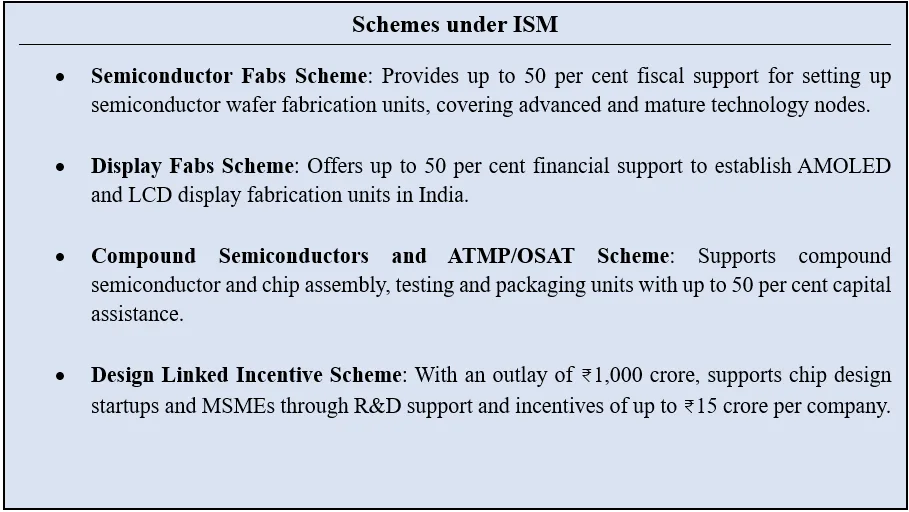

For companies, ISM 2.0 means more financial support and policy backing for fabs, packaging units, and design startups. Under the modified semiconductor programme for 2026 to 27, the total outlay is Rs 8,000 crore to drive capital investment and job creation.

One semiconductor fab is expected to see Rs 4,000 crore investment during the year, generating around 1,500 jobs. Nine units in compound semiconductors and assembly testing are projected to invest Rs 11,000 crore and create about 3,000 jobs.

The Design Linked Incentive scheme aims to support 30 design companies in 2026 to 27, with a target of developing 10 semiconductor IP cores and employing around 200 design professionals. So far, 24 startups have been supported and attracted nearly Rs 430 crore in venture capital.

For students and engineers, the talent pipeline is expanding. Under national design platforms, about 2.25 crore tool hours have been used for chip design. Around 67,000 students and more than 1,000 startup engineers are using advanced tools for chip development.

Indigenous processors like DHRUV64 developed by C-DAC are also part of the push, using open RISC V architecture. This reduces long term dependence on foreign processor designs and supports secure digital infrastructure.

What Happens Next

The immediate focus will be on executing approved projects and attracting more private investment into fabs, packaging, and materials manufacturing. Training centres and academic programmes will scale to produce industry ready engineers.

The design ecosystem is expected to expand further, with a target of enabling at least 50 fabless semiconductor companies in the next phase. This will strengthen India’s role in global chip design, where it already has a strong engineering base.

In the longer term, success will depend on technology depth, not just factories. India will need to move into advanced nodes, specialty materials, and high end equipment to truly become a major semiconductor nation by 2035.

Frequently Asked Questions

What is India Semiconductor Mission 2.0?

It is the second phase of India’s national chip programme announced in Budget 2026 to 27, focusing on local chip equipment, materials, design IP, and advanced manufacturing capabilities.

How much money is allocated for ISM 2.0?

Rs 1,000 crore has been allocated for ISM 2.0 in 2026 to 27, while the broader modified semiconductor and display programme has an outlay of Rs 8,000 crore for the year.

Why are semiconductors so important for India?

Chips power electronics, telecom, automobiles, defence, and digital infrastructure. Shortages can disrupt many industries, so local capacity improves economic and national security.

Who benefits the most from this mission?

Chip manufacturers, design startups, engineers, students, and electronics companies benefit through funding, jobs, research support, and a stronger domestic supply chain.

Conclusion

India Semiconductor Mission 2.0 signals a shift from planning to deep capability building in chips. With targeted funding, design support, and talent development, India is trying to reduce import dependence and become a reliable part of the global semiconductor network in the coming decade.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment