India’s retail inflation slowed down sharply in June 2025, hitting a more than six-year low. This gives the Reserve Bank of India (RBI) more room to consider further interest rate cuts in the coming months.

Retail Inflation Falls to 2.10%

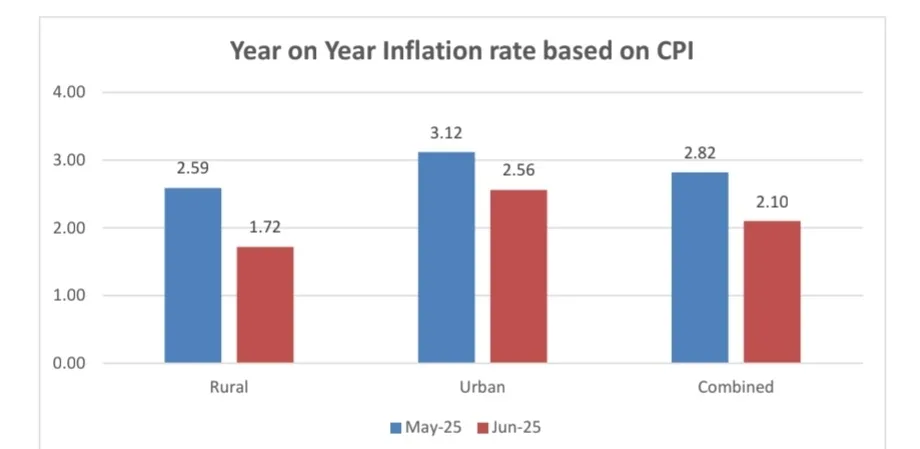

As per data released by the Ministry of Statistics and Programme Implementation, the Consumer Price Index (CPI) rose by just 2.1% in June 2025 compared to the same month last year. This is even lower than economists’ forecast of 2.25% (as per Bloomberg) and much lower than the 2.82% recorded in May 2025.

The current inflation rate is now close to the lower limit of the RBI’s 2-6% target band.

RBI May Cut Rates Again

The sharp drop in inflation could lead the RBI to continue cutting interest rates to boost economic growth. Last month, the central bank had already reduced the repo rate by 50 basis points and signaled a change to a “neutral” stance from an earlier “accommodative” one.

However, RBI Governor Sanjay Malhotra later clarified that the change in stance allows flexibility to support growth if inflation stays low. The RBI has also cut its inflation forecast for the financial year 2025–26 from 4% to 3.7%.

Most economists now expect another 25 basis point rate cut by December, though there is some uncertainty around the upcoming August 6 monetary policy meeting.

Wholesale Price Index (WPI) Data – June 2025

WPI inflation numbers, which reflect price trends at the wholesale level, also show signs of easing:

WPI Inflation (YoY): -0.13% in June vs. 0.39% in May (Expected: +0.52%)

WPI Food Inflation (YoY): -3.75% in June vs. -1.56% in May

WPI Fuel Inflation (YoY): -2.65% in June vs. -2.27% in May

WPI Manufacturing Inflation (YoY): 1.97% in June vs. 2.04% in May

These figures indicate a continued softening of food, fuel, and manufacturing prices, supporting the trend seen in the CPI data.

What This Means for You

Lower inflation means stable prices for essential goods like food and fuel.

Cheaper loans could be coming if the RBI continues to cut interest rates.

Investors and businesses may see improved growth prospects due to a more supportive monetary policy.

Key Takeaways

India’s retail inflation dropped to 2.1% in June, its lowest level in over six years.

Wholesale inflation (WPI) also fell, led by lower food and fuel prices.

The RBI may continue to cut interest rates this year to support economic growth.

Experts are divided about the next RBI decision, but most expect another rate cut by December.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment