1. Key Highlights for November 2025

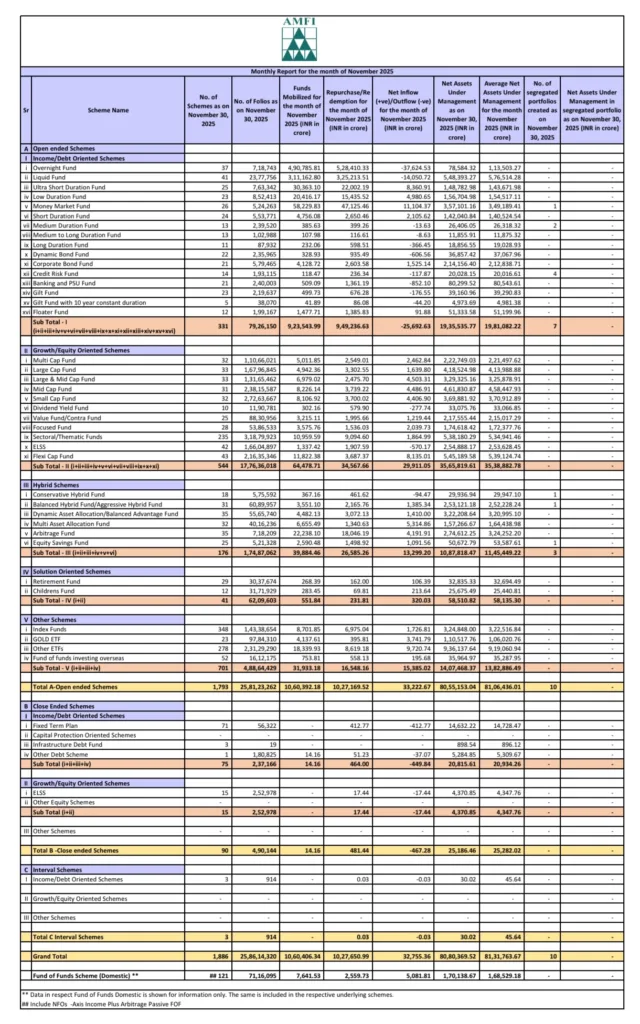

- Total AUM (All Categories): Rs 81,83,763 crore

- Total Industry Net Inflow: Rs 32,756 crore

- Total Open-Ended Schemes AUM: Rs 80,55,153 crore

- Total Mutual Fund Folios: 25.86 crore

2. Income / Debt-Oriented Schemes

Total folios: 79.26 lakh

Net outflow: –Rs 25,692 crore

Total AUM: Rs 19,35,535 crore

Debt Category Flows

| Category | Net Flow (Rs crore) |

|---|---|

| Overnight Fund | -37,624 |

| Liquid Fund | +3,214 |

| Ultra Short Duration Fund | +210 |

| Money Market Fund | -11,546 |

| Short Duration Fund | -7,097 |

| Corporate Bond Fund | -468 |

| Banking & PSU Fund | -1,127 |

| Floater Fund | +1,112 |

3. Growth / Equity-Oriented Schemes

Total folios: 1.76 crore

Net inflow: Rs 29,661 crore

Total AUM: Rs 45,48,157 crore

Equity Category Inflows

| Category | Net Flow (Rs crore) |

|---|---|

| Multi Cap Fund | +2,462 |

| Large Cap Fund | +4,060 |

| Large & Mid Cap Fund | +4,503 |

| Mid Cap Fund | +3,409 |

| Small Cap Fund | +4,409 |

| ELSS Funds | -300 |

| Flexi Cap Fund | +7,280 |

4. Hybrid Schemes

Total Net Inflow: Rs 13,299 crore

Total AUM: Rs 11,45,449 crore

| Category | Net Flow (Rs crore) |

|---|---|

| Conservative Hybrid Fund | +1,464 |

| Balanced/Aggressive Hybrid Fund | -295 |

| Dynamic Asset Allocation / BAF | +10,120 |

| Arbitrage Fund | +1,260 |

5. Solution-Oriented Schemes

Net inflow: Rs 320 crore

AUM: Rs 58,150 crore

6. Other Schemes (Index Funds, ETFs, FoFs)

Total Net Inflow: Rs 15,883 crore

Total AUM: Rs 13,07,483 crore

| Category | Net Flow (Rs crore) |

|---|---|

| Index Funds | +1,726 |

| Gold ETFs | +3,741 |

| Other ETFs | +9,702 |

| International FoFs | +1,713 |

7. Close-Ended Schemes

Net Outflow: –Rs 467 crore

Total AUM: Rs 25,186 crore

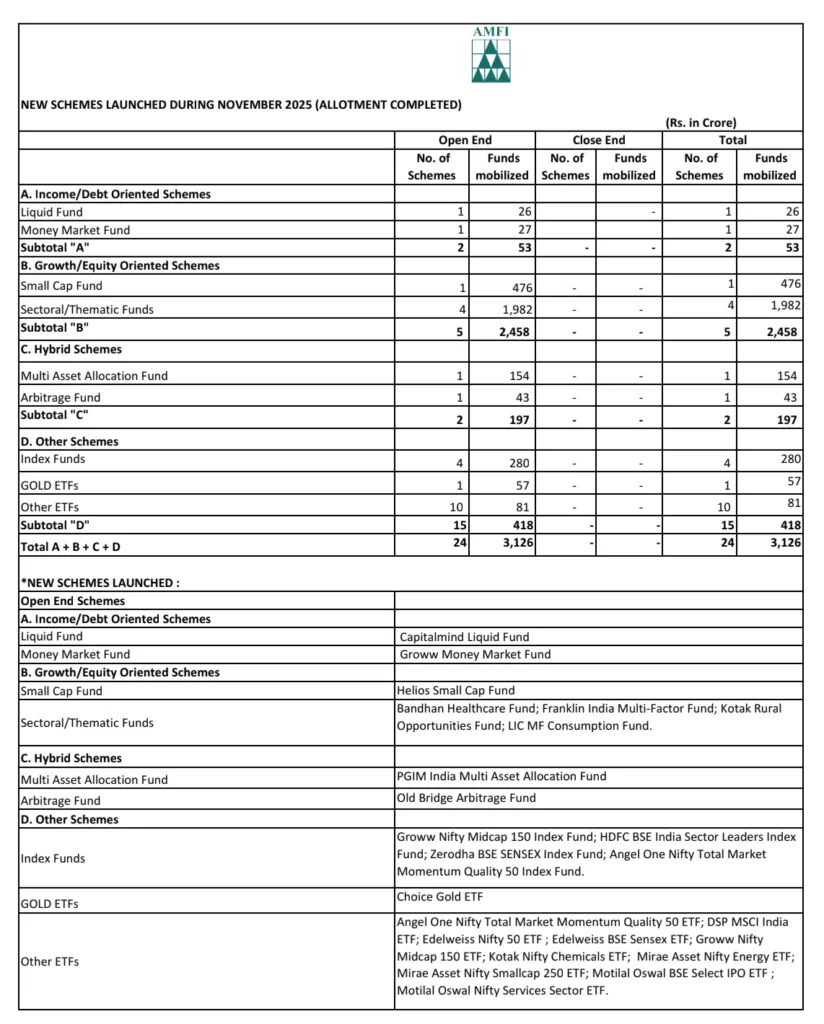

8. New Mutual Fund Schemes Launched in November 2025

Total new schemes: 24

Total funds mobilized: Rs 3,126 crore

New Launch Details

| Category | Scheme Name | Funds Mobilized (Rs crore) |

|---|---|---|

| Debt | Capitalmind Liquid Fund | 26 |

| Debt | Groww Money Market Fund | 27 |

| Equity | Helios Small Cap Fund | 476 |

| Equity – Sectoral/Thematic | Bandhan Healthcare Fund | Part of 1,982 |

| Equity – Sectoral/Thematic | Franklin India Multi-Factor Fund | Part of 1,982 |

| Equity – Sectoral/Thematic | Kotak Rural Opportunities Fund | Part of 1,982 |

| Equity – Sectoral/Thematic | LIC MF Consumption Fund | Part of 1,982 |

| Hybrid | PGIM India Multi Asset Allocation Fund | 154 |

| Hybrid | Old Bridge Arbitrage Fund | 43 |

| Index Funds | 4 Index Funds (Various AMCs) | 280 |

| Gold ETF | Choice Gold ETF | 57 |

| Other ETFs | 10 ETFs (Various AMCs) | 81 |

Conclusion

The AMFI Mutual Fund Report for November 2025 highlights strong investor confidence, with Rs 32,756 crore in net inflows and total AUM reaching Rs 81.83 lakh crore. Equity and passive categories continued to lead the growth, positioning India’s mutual fund industry for a strong 2026.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment