India Inc.’s operating profit margin (OPM) is expected to improve in the second half of the current financial year, driven by stronger rural demand, increased government spending, and the festive season. This boost is anticipated to improve the credit metrics of companies in Q3 FY25, with the interest coverage ratio rising to 4.5-5.0 times, up from 4.1 times in Q2 FY2025, according to a report from credit rating agency ICRA.

Despite a slow revenue growth in Q2 FY2025, India Inc. is expected to see a rebound in the coming quarters. Growth will be supported by sectors like FMCG, retail, and commodities (such as iron, steel, and cement), fueled by higher government capex spending and rising rural demand.

The Q2 performance of 590 listed companies showed a 6% year-on-year revenue growth but a dip in OPM by 102 basis points to 16.9%. Sequentially, OPM dropped by about 81 basis points in Q2 FY2025.

India Inc.’s credit metrics remained largely stable despite varying debt levels across sectors. With the RBI halting rate hikes since April 2023 and OPM set to improve, interest coverage is expected to rise soon. Key factors to watch include global economic trends, government spending, and a recovery in urban demand.

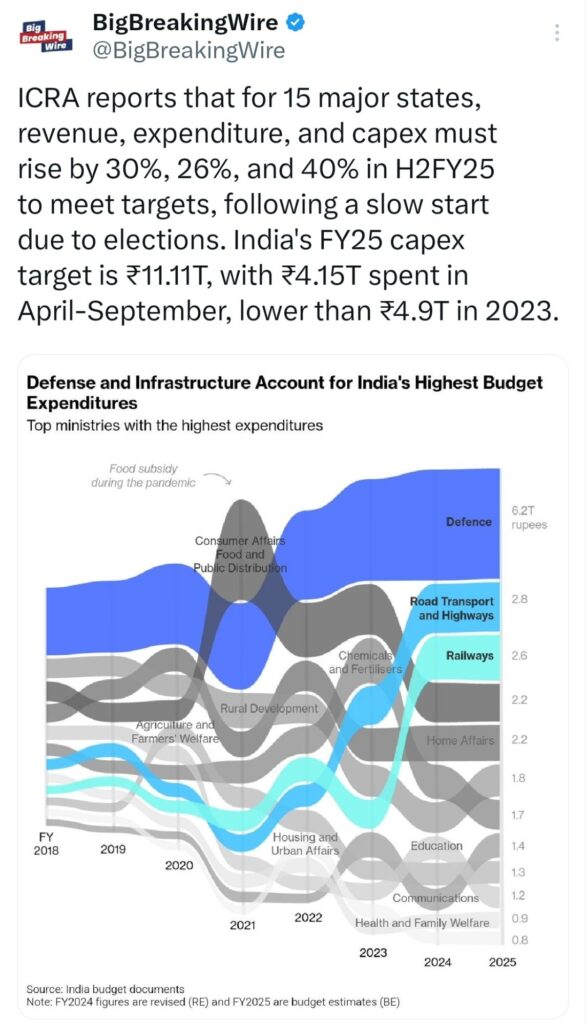

ICRA: States Need 40% Boost in Capex H2 FY25

According to a report by ICRA, for India’s 15 major states to meet their financial targets in the second half of FY25, revenue, expenditure, and capital expenditure (capex) must increase by 30%, 26%, and 40%, respectively. This comes after a sluggish start to the year, largely due to the impact of state and national elections. The total capex target for India in FY25 stands at ₹11.11 trillion, with ₹4.15 trillion spent in the first half of the year (April-September), which is lower than the ₹4.9 trillion spent during the same period in FY2023. To meet the overall capex goal, significant acceleration in spending is needed in the second half of the fiscal year.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment