The Economic Survey 2025-26 shows India continuing as the fastest growing major economy. Growth is driven by strong consumption, rising investment, stable inflation, and improving banking health.

GDP Growth and Economic Outlook

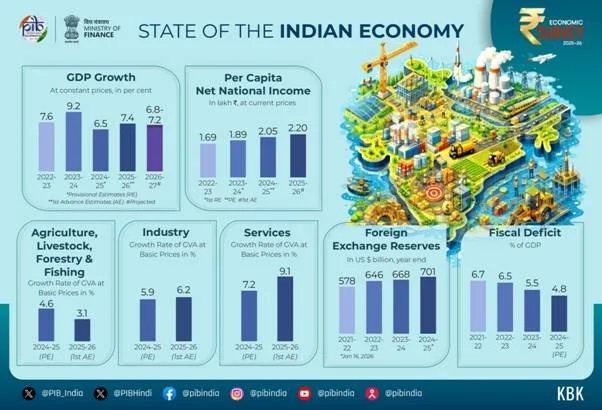

India’s real GDP growth for FY26 is estimated at 7.4%. Real GVA growth is estimated at 7.3%.

For FY27, real GDP growth is projected between 6.8% and 7.2%. India’s long term potential growth rate is around 7%.

Consumption Driving Growth

Private Final Consumption Expenditure has risen to 61.5% of GDP in FY26. Rural demand improved due to good agriculture and urban demand is gradually rising.

Low inflation, stable employment, and tax rationalisation have supported real purchasing power.

Investment and Capital Formation

Gross Fixed Capital Formation stands at 30% of GDP. Investment grew 7.6% in the first half of FY26, above the pre pandemic average of 7.1%.

Capital expenditure by the government reached nearly 60% of the budgeted allocation by November 2025.

Agriculture and Rural Economy

Agriculture and allied sectors are estimated to grow by 3.1% in FY26. Agricultural GVA grew 3.6% in the first half.

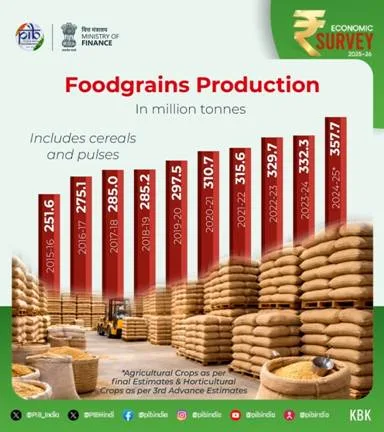

Foodgrain production reached 3577.3 lakh metric tonnes in AY 2024-25, up by 254.3 lakh metric tonnes.

Over Rs 4.09 lakh crore has been released under PM Kisan.

Manufacturing and Industry

Manufacturing grew 8.4% in the first half of FY26. Manufacturing GVA grew 7.72% in Q1 and 9.13% in Q2.

Industrial growth for FY26 is expected at 6.2%, up from 5.9% in FY25.

PLI schemes attracted over Rs 2.0 lakh crore investment, generating incremental production of Rs 18.7 lakh crore and over 12.6 lakh jobs.

India Semiconductor Mission includes 10 projects worth about Rs 1.60 lakh crore.

Services Sector

Services GVA increased 9.3% in the first half and is expected to grow 9.1% in FY26.

Inflation and Monetary Support

Average CPI inflation during April to December 2025 fell to 1.7%.

The policy repo rate has been reduced by 125 basis points. Durable liquidity injections include Rs 2.5 lakh crore via CRR cuts and Rs 6.95 lakh crore via open market operations.

Banking Sector Strength

Gross NPA ratio declined to a multi decade low of 2.2%. Half yearly slippage ratio remains at 0.7%.

Weighted average lending rates fell by 59 to 69 basis points.

Exports and External Sector

Total exports reached a record 825.3 billion dollars in FY25.

Services exports hit 387.6 billion dollars with 13.6% growth. Remittances reached 135.4 billion dollars.

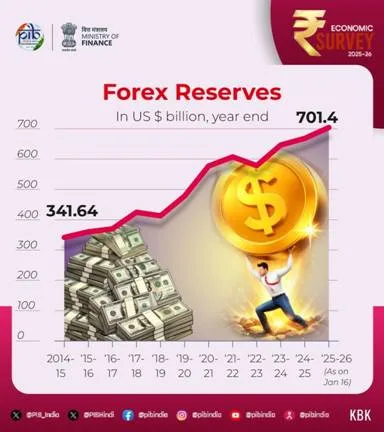

Forex reserves rose to 701.4 billion dollars, covering 11 months of imports and 94% of external debt.

Current account deficit stands at 0.8% of GDP in H1 FY26.

Infrastructure Expansion

High speed corridors increased from 550 km in FY14 to 5364 km in FY26.

Airports increased from 74 in 2014 to 164 in 2025.

Over 3500 km of railway lines added in FY26.

Financial Inclusion and Social Indicators

55.02 crore bank accounts opened under PMJDY. Unique investors crossed 12 crore.

E Shram portal registered over 31 crore workers, with 54% women.

MPI poverty declined from 55.3% to 11.28%.

India Equity Markets Show Strength Despite Global Uncertainty

India equity markets stayed steady and resilient even as global trade policies kept shifting and uncertainty remained high. According to the Economic Survey 2025 to 26, benchmark indices performed well. Nifty 50 gained about 11.1% and Sensex rose around 10.1% between April and December 2025, showing investor confidence in domestic growth.

Investor participation expanded sharply. Around 235 lakh demat accounts were added in FY26 till December, taking the total beyond 21.6 crore. Unique demat investors crossed the 12 crore mark in September 2025, and nearly one fourth of them are women. Mutual funds also saw strong participation with 5.9 crore unique investors, out of which 3.5 crore came from smaller cities. The SIP investor base surged from about 3.1 crore in FY20 to over 11 crore by FY25.

Regulatory and structural developments also supported markets. The Securities Markets Code 2025 is seen as a major step to strengthen regulation. India corporate bond market continued expanding at an annual growth rate of around 12% between FY15 and FY25. GIFT City improved its global standing, climbing nine places to rank 43 among 120 financial centres.

India Corporate Bond Market Sees Strong Expansion

India corporate bond market has grown rapidly over the years. Outstanding bonds rose from Rs 17.5 trillion in FY15 to Rs 53.6 trillion in FY25, marking annual growth of around 12%. FY25 also saw record fresh issuances of Rs 9.9 trillion, showing rising demand for bond based funding.

By March 2025, the corporate bond market made up about 15 to 16% of GDP and has become an important alternative to bank loans. In FY26, debt accounted for over 63% of total funds raised in the primary market during April to December. Regulators have supported this growth through reforms such as SEBI RFQ platform for retail investors, stronger rules for credit rating agencies, and easier bond issuance norms.

Domestic Investors Offset Foreign Flow Volatility

Foreign Portfolio Investment trends remained volatile in FY26. FPIs were buyers in early months but turned sellers in equities during later quarters, even as they bought debt. Overall, they were net sellers from April to December 2025. Still, their assets under custody rose to Rs 81.4 lakh crore by December end, up 10.4% from March 2025, helped by policy relaxations and improving India US trade outlook.

Domestic Institutional Investors played a key stabilising role. Mutual funds and insurers continued buying equities and cushioned the impact of foreign outflows. By September 2025, DIIs held 18.7% of NSE listed equities. Their share has now surpassed foreign investors and reached record highs, with mutual funds alone holding 10.9% in Q2 FY26. Along with retail and high net worth investors, domestic money has become a strong backbone for Indian markets.

Conclusion

India’s economy shows strong domestic demand, low inflation, healthier banks, record exports, rising infrastructure, and structural reforms. Despite global uncertainty, growth momentum remains stable with medium term potential close to 7%.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment