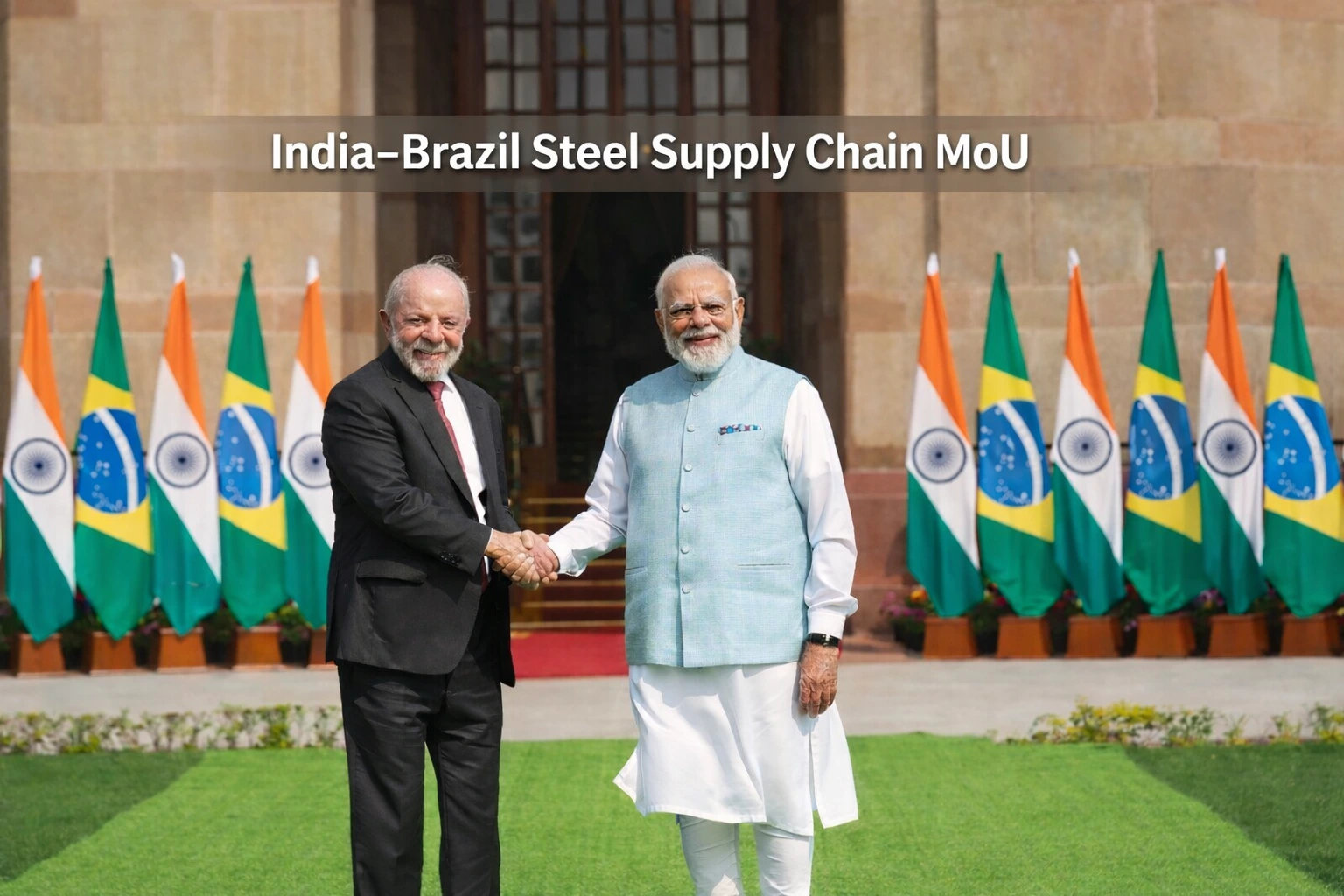

India and Brazil signed a Memorandum of Understanding (MoU) on February 21, 2026, in New Delhi to strengthen cooperation in mining and minerals critical for steel production. The agreement was exchanged in the presence of Prime Minister Narendra Modi and Brazilian President Luiz Inácio Lula da Silva. The pact focuses on iron ore, manganese, nickel, niobium, processing technologies, and AI-driven exploration. With India’s steelmaking capacity at 218 million tonnes, the move aims to secure long-term raw material supply amid rising infrastructure demand and global supply chain volatility.

What Happened in India–Brazil Steel Supply Chain Agreement

The Ministry of Steel, Government of India, and Brazil’s Ministry of Mines and Energy formalized a bilateral MoU to deepen cooperation across the steel value chain. The framework includes investment in mining, mineral processing, recycling technologies, automation, and artificial intelligence in geoscientific exploration.

The agreement places strong emphasis on sustainable development of key steel inputs such as iron ore, manganese, nickel, and niobium. Brazil is one of the world’s top iron ore producers, while India is the second-largest crude steel producer globally, creating a complementary strategic partnership.

| Key Element | Details |

| Agreement Date | 21 February 2026 |

| Countries Involved | India and Brazil |

| Core Focus | Steel raw materials, mining, technology, AI exploration |

| India Steel Capacity | 218 million tonnes |

| Strategic Minerals | Iron ore, manganese, nickel, niobium |

Why Did India and Brazil Sign This MoU

The primary driver is supply chain security. India’s steel demand is expected to grow by 7–9% annually due to infrastructure expansion, manufacturing growth, and urbanisation projects under national development plans. This requires stable access to high-grade raw materials, many of which are globally concentrated.

Brazil holds some of the largest reserves of iron ore and niobium, minerals that are essential for high-strength steel and advanced industrial applications. By diversifying sourcing beyond traditional suppliers, India reduces exposure to geopolitical disruptions, price shocks, and export restrictions.

The agreement also aligns with India’s long-term industrial policy, which prioritizes domestic steel capacity expansion to support sectors like railways, defence, construction, and renewable energy infrastructure.

Bigger Context Behind Steel Supply Chains in Economy and Geopolitics

Global steel supply chains have become increasingly strategic amid rising trade fragmentation and resource nationalism. Countries are now prioritizing bilateral mineral partnerships to secure critical industrial inputs rather than relying on spot markets.

China currently dominates global steel production and controls significant mineral processing capacity. India’s partnership with Brazil reflects a broader geopolitical shift toward building alternative resource corridors among emerging economies.

The India–Brazil cooperation also fits within the larger BRICS economic alignment, where resource-rich nations and manufacturing economies are strengthening South-South trade. Brazil’s mining expertise and India’s industrial scale create a mutually beneficial economic structure.

| Global Steel Context | Implication |

| Rising Infrastructure Spending | Higher long-term steel demand |

| Geopolitical Trade Tensions | Need for diversified mineral sourcing |

| Critical Mineral Competition | Strategic partnerships gaining importance |

| Decarbonisation Goals | Shift toward efficient and sustainable steel production |

How the India–Brazil MoU Affects Markets, Companies, Investors, and Economy

The agreement is structurally positive for Indian steel companies such as public and private sector producers that are expanding capacity to meet domestic demand. Stable access to raw materials can reduce input cost volatility and improve long-term margins.

For investors, the pact signals policy continuity in strengthening industrial supply chains, which could support capital expenditure in steel, mining, and logistics sectors. Infrastructure-linked stocks and metal producers may benefit from reduced supply risks and improved resource planning.

On the macroeconomic front, stronger mineral access supports India’s manufacturing ambitions and export competitiveness. Steel consumption in India is projected to cross 160–170 million tonnes annually by the end of the decade, driven by large-scale infrastructure projects and industrial corridors.

| Stakeholder | Impact |

| Steel Companies | Improved raw material security and cost stability |

| Investors | Positive long-term outlook for metal and infrastructure sectors |

| Government | Supports industrial growth and supply chain resilience |

| Global Trade | Strengthens South-South economic cooperation |

What Happens Next in India-Brazil Steel Cooperation

The next phase is expected to involve joint exploration projects, technology sharing in mineral processing, and potential investments in mining infrastructure. Indian firms may explore equity participation in Brazilian mining assets to secure long-term supply contracts.

Policy coordination on recycling technologies and AI-driven exploration could also accelerate efficiency in mineral extraction. This is particularly relevant as the global steel industry faces pressure to lower emissions and adopt sustainable production methods.

Over the medium term, deeper mineral integration between India and Brazil could reshape global steel trade flows, reduce dependency on concentrated supply regions, and support India’s goal of becoming a 300 million tonne steel producer.

Frequently Asked Questions

What is the India–Brazil MoU on steel supply chain?

It is a bilateral agreement signed on February 21, 2026, to enhance cooperation in mining, minerals, and technologies required for steel production.

Why is Brazil important for India’s steel sector?

Brazil is a leading global producer of iron ore and holds large reserves of manganese, nickel, and niobium, which are critical for steelmaking.

How does this agreement impact India’s economy?

It strengthens raw material security, supports infrastructure-driven steel demand, and improves long-term industrial supply chain resilience.

Will this affect global steel markets?

Yes, deeper India–Brazil cooperation may diversify supply chains and reduce reliance on traditional mineral exporters, influencing global trade dynamics.

Conclusion

The India–Brazil MoU marks a strategic shift toward securing industrial supply chains in a fragmented global trade environment. By aligning mineral resources with manufacturing demand, both countries are strengthening long-term economic resilience. As India scales steel capacity beyond 218 million tonnes, stable access to critical minerals and advanced mining technologies will play a central role in sustaining growth, attracting investment, and reinforcing geopolitical economic partnerships.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment