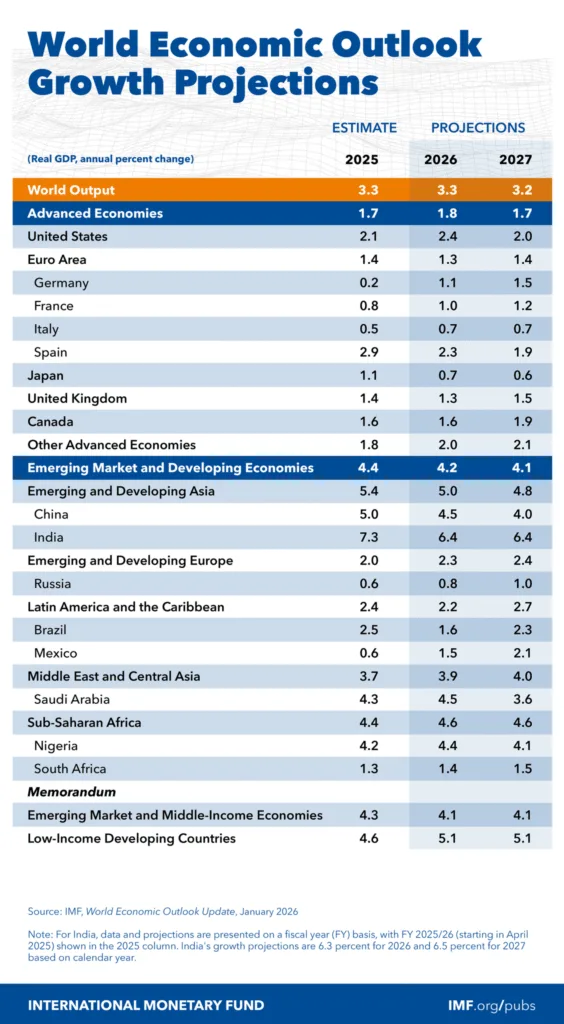

The International Monetary Fund (IMF) released its latest World Economic Outlook (WEO) on January 19, 2026. The report shows a stronger than expected global economy, led by resilient growth in India and improved momentum in the United States and China.

However, the IMF also warned that risks to global growth remain tilted to the downside due to trade tensions, geopolitics and financial market risks.

India Economic Growth Outlook: IMF Raises FY26 Forecast

India continues to be one of the fastest growing major economies in the world. The IMF has upgraded India’s growth outlook after stronger performance in recent quarters.

- India GDP growth for FY26 is now projected at 7.3%, up from 6.6% earlier

- This is a 0.7 percentage point upgrade from the IMF’s October estimate

- Growth for FY27 is revised to 6.4% from 6.2%

- GDP growth is expected to remain at 6.4% in FY28

According to the IMF, the upgrade reflects strong momentum in the second half of the year and solid economic activity going into the fourth quarter. India recorded growth of over 8% in the first half of the year, surprising on the upside.

India’s government had earlier projected 7.4% growth for FY26 in its first advance estimates released on January 6. The World Bank has also raised its FY26 growth forecast for India to 7.2%, reinforcing confidence in India’s near-term economic strength.

The IMF expects growth to moderate slightly in the coming years as temporary factors such as favourable base effects and short-term cyclical support fade.

Global Economic Growth Forecast: IMF Update

The IMF has slightly raised its global growth outlook, citing stronger activity in major economies.

- Global GDP growth for 2026 is now seen at 3.3%, up from 3.1%

- Global growth for 2025 is estimated at 3.3%

- Growth for 2027 remains unchanged at 3.2%

Despite the upgrade, the IMF cautioned that global growth remains below historical averages and vulnerable to shocks.

United States Economic Outlook

The US economy has shown stronger momentum than previously expected.

- IMF raises US GDP growth forecast for 2026 to 2.4% from 2.1%

- Growth for 2025 is estimated at 2.1%

- IMF lowers 2027 growth forecast to 2.0% from 2.1%

The IMF stated that any future US Federal Reserve rate cuts should require robust evidence that inflation is returning sustainably to target levels.

China Economic Growth Outlook

China’s outlook remains mixed, with near-term support but medium-term moderation.

- IMF raises China 2025 GDP growth forecast to 5.0%

- 2026 growth is revised up to 4.5% from 4.2%

- 2027 growth is lowered to 4.0% from 4.2%

The IMF noted that structural challenges, property sector stress and demographic trends continue to weigh on China’s medium-term growth.

Eurozone and Advanced Economies

Growth in advanced economies remains modest.

- Eurozone growth forecast for 2027 remains unchanged at 1.4%

- Advanced economies overall are expected to grow around 1.7% to 1.8% over 2025 to 2027

Germany shows a gradual recovery, while France and Italy see moderate improvement. Japan’s growth outlook remains subdued due to structural and demographic factors.

Emerging Markets and Developing Economies

Emerging markets continue to outperform advanced economies.

- Emerging market and developing economies growth at 4.2% in 2026

- Emerging and developing Asia growth at 5.0% in 2026

- Sub-Saharan Africa growth at 4.6%

Low-income developing countries are expected to grow at over 5.0% in both 2026 and 2027.

Key Risks Highlighted by the IMF

The IMF warned that global risks remain tilted to the downside.

- Possible new trade tensions and higher tariffs

- Geopolitical conflicts disrupting trade and energy markets

- Risk of an AI-driven market correction

- Rising fiscal vulnerabilities in high-debt countries

The IMF also stressed that central bank independence, especially that of the US Federal Reserve, remains paramount for global financial stability.

AI Impact on Global Growth

Artificial Intelligence could provide a meaningful upside to global growth if productivity gains materialize.

- AI productivity gains could lift global growth by up to 0.3 percentage points in 2026

- Medium-term gains could range between 0.1% to 0.8%

However, the IMF also noted that increased AI investment may raise the neutral interest rate, making future rate cuts more difficult.

Conclusion

The IMF’s January 2026 World Economic Outlook highlights a more resilient global economy than previously expected, led by strong growth in India and steady momentum in the US and China.

India remains a standout performer with growth above 7%, while global growth stabilizes around 3.3%. Despite these positives, risks from geopolitics, trade barriers and financial markets remain significant.

Overall, the outlook is cautiously optimistic, with policy discipline and productivity gains, especially from AI, playing a crucial role in sustaining growth.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment