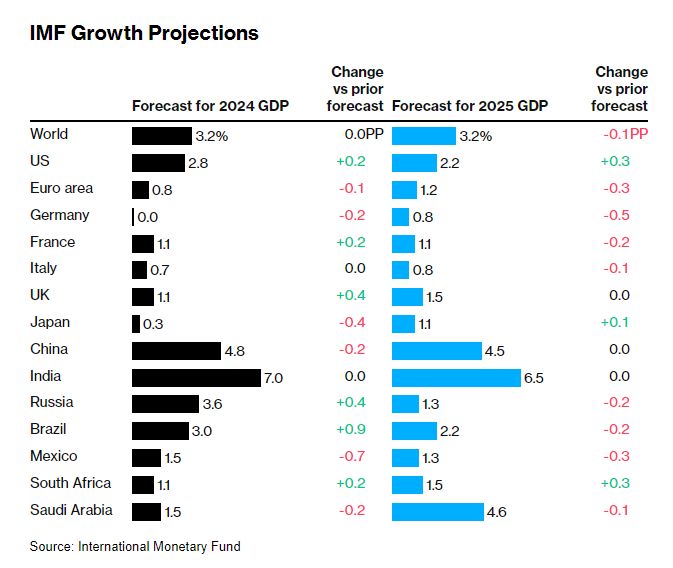

The International Monetary Fund (IMF) has updated its economic growth forecasts for 2024, raising expectations for the U.S., Brazil, and Britain, while lowering them for China, Japan, and the euro zone. Despite these adjustments, the IMF maintained its global GDP growth prediction at 3.2%, unchanged from July. As world finance leaders meet in Washington for annual IMF and World Bank meetings, the report highlights ongoing risks from armed conflicts, potential trade wars, and the effects of strict monetary policies.

In its World Economic Outlook, the IMF revised its growth forecast for the U.S. upwards to 2.8% for 2024, an increase from the previous estimate of 2.6%. For 2025, the U.S. growth projection has also been raised to 2.2% from 1.9%. This positive outlook is attributed to stronger consumer spending driven by rising wages and asset values. Meanwhile, Brazil received a significant upgrade, with its growth forecast rising to 3.0% due to increased private consumption and investment.

The International Monetary Fund (IMF) announced that GDP growth in Latin America and the Caribbean is projected to be 2.1% this year, an increase of 0.3% from its July forecast. The IMF raised Brazil’s growth forecast for 2024 to 3.0%, up from 2.1%, but reduced Mexico’s forecast to 1.5%, a decrease of 0.7% from earlier estimates.

On the other hand, the IMF has lowered its forecast for Germany, predicting no growth (0% GDP) in 2024, down from 0.2%. The 2025 projection has also been cut to 0.8%, down from 1.3%. Japan’s 2024 growth estimate has been reduced from 0.7% to 0.3%, although a rebound to 1.1% is expected in 2025, supported by rising real wages. The IMF’s outlook for India remains stable, with growth projections held steady at 7.0% for 2024 and 6.5% for 2025.

China’s growth forecast for 2024 has been lowered by two-tenths of a percentage point to 4.8%, due to ongoing weakness in the property sector and low consumer confidence, despite some support from net exports. The forecast for China in 2025 remains unchanged at 4.5%. The IMF has also slightly reduced Mexico’s growth estimate to 1.5% due to tighter monetary policies.

For the UK, the growth forecast has improved to 1.1% for 2024, driven by falling inflation and lower interest rates boosting consumer demand. The IMF report also addresses risks, such as potential tariff increases and the ramifications of new trade wars, without specifically mentioning U.S. Republican presidential candidate Donald Trump’s proposed tariffs.

IMF has reduced its GDP growth forecast for Saudi Arabia in 2024 to 1.5%, down from 1.7% in July. The IMF expects Saudi Arabia’s growth to rebound to 4.6% in 2025. For the Middle East and Central Asia, growth is projected at 2.4% in 2024 and is expected to rise to 3.9% in 2025 as temporary disruptions in oil production and shipping ease.

The IMF warns that if significant tariffs are imposed between the U.S., euro zone, and China, it could lead to a global GDP decline of 0.8% by 2025 and 1.3% by 2026. Additional risks noted include the possibility of rising oil and commodity prices due to escalating conflicts in regions like the Middle East and Ukraine.

Despite these challenges, the IMF believes that the battle against inflation is largely won and expects inflation in advanced economies to return to the 2% target by 2025. However, the IMF also cautions countries against implementing industrial policies aimed at protecting domestic industries, as these often fail to provide long-term benefits for living standards. Overall, the IMF predicts that global growth will decline to 3.1% over the next five years, falling below pre-pandemic trends due to slowing output in China.

IMF Chief Economist Pierre-Olivier Gourinchas remarked that inflation improvements are more pronounced in advanced economies, which are projected to meet their targets by 2025. However, he highlighted that countries in Sub-Saharan Africa and the Middle East continue to face double-digit inflation and will take longer to align with the inflation rates of advanced economies.

When asked about changes to the UK’s fiscal rules, he emphasized the importance of stabilizing debt levels and stated that countries should maintain flexibility for fiscal action.

U.S. recession risks have somewhat diminished, according to the International Monetary Fund (IMF), which suggests a more optimistic outlook for the U.S. economy than in previous forecasts.

The IMF noted that the United States is benefiting from robust productivity growth and an increase in the labor force due to immigration, both of which are contributing positively to its economic performance.

Additionally, IMF Chief Economist Pierre-Olivier Gourinchas highlighted that progress in controlling inflation is more evident in advanced economies, which are expected to meet their inflation targets by 2025, indicating a positive trend toward economic stability for developed nations.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment