This Stock Rally Is Different: Investment Opportunities in 2025

The stock market rally this year is different from previous bull markets. According to Peter Oppenheimer, Chief Global Equity Strategist at Goldman Sachs Research, investors will need to look beyond the small group of stocks that drove the market higher in recent years. With benchmark returns becoming more modest, new opportunities are emerging across a wider range of regions, sectors, and investment styles.

Challenges Facing the Stock Market

Equity markets face several challenges that were not present in past bull markets. These include:

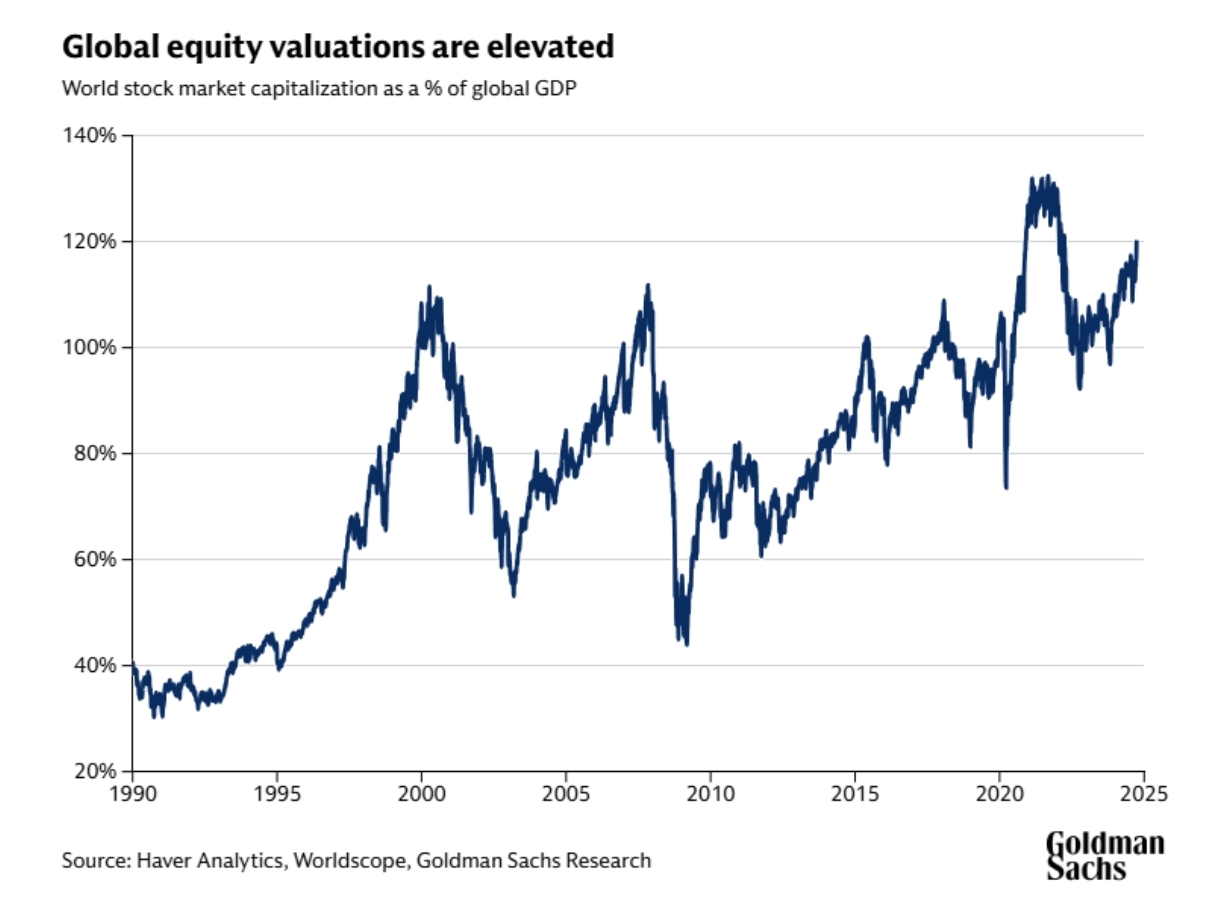

- High stock valuations

- Rising interest rates and inflation

- Slower global trade growth

- Sluggish economic expansion

- Increasing government spending demands

Together, these factors suggest that absolute returns may be lower than in previous market rallies. However, there are still ways investors can potentially outperform the broader market.

Opportunities for Investors

Diversification

Investors may benefit from spreading investments both within the technology sector and across different industries. This can reduce risks and create better growth opportunities.

Export-Focused Companies

With global trade slowing, companies and countries that specialize and dominate their export markets, especially in services, may offer strong investment potential.

Domestically Focused Companies

Higher trade restrictions, a weaker US dollar, and increased government support can create opportunities in domestic companies with strong market positions.

European Strategic Investments

In Europe, governments are focusing on strategic industries and self-reliance. This may improve profit margins and returns in certain key sectors, presenting attractive investment options.

Conclusion

This market rally is different from past trends. Investors who look beyond the top-performing stocks and focus on diversification, export leaders, and strong domestic companies may find better opportunities in 2025.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment