Global hedge funds have been aggressively buying Chinese stocks this year, with a sharp rise in purchases over the past week. A report from Goldman Sachs highlights that this surge is being fueled by optimism surrounding China’s artificial intelligence (AI) sector, particularly due to the success of a new startup, DeepSeek.

Goldman Sachs reported that Chinese stocks, both onshore and offshore, were the most heavily bought in its global prime brokerage book as of February 7, reports Reuters. Hedge funds made their biggest purchases in over four months between February 3 and 7. Prime brokerage desks, which lend to hedge funds and track their trades, saw 95% of last week’s buying in single stocks, mainly in consumer discretionary, technology, industrials, and communication services.

At the same time, hedge funds sold off stocks in energy, utilities, and real estate. Their overall exposure to Chinese equities rose to 7.6% of Goldman Sachs’ total prime book, placing it in the 23rd percentile over the past five years, up from around the 10th percentile in January.

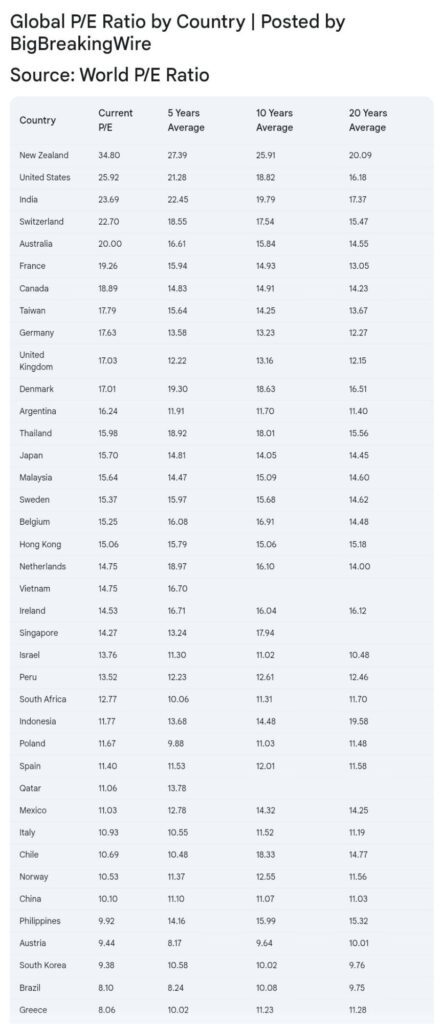

In the last month, China’s onshore and offshore stock markets have gained over $1.3 trillion in value, while India’s market has lost more than $720 billion. The MSCI China Index is set to beat the MSCI India Index for the third month in a row, the longest winning streak for China in two years.

Goldman Sachs has increased its target prices for Chinese stocks, expecting that artificial intelligence (AI) adoption will drive earnings growth. The investment bank predicts that AI could attract up to $200 billion in inflows to China’s stock market.

Chinese tech stocks have been performing strongly, with last week marking their best winning streak in over two years. This surge was fueled by DeepSeek’s AI breakthrough, which renewed investor confidence in China’s technological advancements.

On Monday, Goldman Sachs raised its 12-month target for the CSI300 index to 4,700 from 4,600. It also increased its forecast for MSCI China, setting a new target of 85, up from 75.

The Hang Seng has gained over 30% since September 2024, and the CSI is up over 24% from its September lows.

Emerging Markets See Strong Debt Inflows Despite Equity Outflows in January

In January, investors poured $45 billion into emerging market debt, with $36.8 billion going to countries outside China and $8.1 billion to China. Meanwhile, equities faced challenges, with $11.5 billion in outflows from emerging markets, excluding China, which saw $2 billion in inflows.

India experienced the biggest impact, with more than $20 billion pulled from its stocks since October, largely due to growing concerns around Donald Trump’s election. South Korea and Taiwan also saw over $1 billion each in outflows, while the overall debt market for emerging countries remained strong despite the equity struggles.

Key Factors Driving the Buying Spree

Hedge Funds Increasing Exposure: Data from Goldman Sachs’ prime brokerage book shows that Chinese stocks—both onshore and offshore—have witnessed the highest net buying activity globally. As of February 7, hedge fund purchases of Chinese equities had reached a four-month peak.

AI Breakthrough Shifting Perceptions: DeepSeek, a Chinese AI startup, has launched a cost-effective AI model that is reshaping global views on China’s role in AI development. A Hong Kong-based institutional sales director noted that this innovation challenges the idea that China is “losing the AI war.”

Market on the Rise: The MSCI China Index has been gaining momentum for four consecutive weeks since mid-January. In February alone, the index has climbed over 6%, outperforming many major global markets.

According to Bloomberg, investors are withdrawing funds from India-focused exchange-traded funds (ETFs) despite tax cuts and interest rate reductions failing to generate renewed enthusiasm. The iShares MSCI India ETF (INDA), which manages approximately $8.6 billion in assets, experienced outflows of $212 million last week alone. So far in 2025, investors have pulled more than $1 billion from the fund, marking its worst start to a year since the onset of the COVID-19 pandemic.

Policy and Trade Developments: Investor sentiment has improved due to policy easing from Beijing and a lower-than-expected tariff hike from U.S. President Donald Trump. Instead of imposing steep new tariffs, Trump opted for a moderate 10% increase on Chinese imports, alleviating some concerns among investors.

Major Players and Sector Trends

Big Names Increasing Stakes: Billionaire investor David Tepper’s hedge fund, Appaloosa LP, has been ramping up its investments in major Chinese tech giants like Alibaba Group and JD.com. This shift reflects growing confidence in China’s market potential.

Sector Preferences: Hedge funds have been buying heavily into consumer discretionary, information technology, industrials, and communication services stocks. In contrast, sectors like energy, utilities, and real estate have seen sell-offs.

Allocation Growth: Hedge fund allocation to Chinese stocks has now climbed to 7.6% of Goldman Sachs’ total prime book exposure. This marks a significant increase from January levels and places current allocations at the 23rd percentile of the highest in the past five years.

Why It Matters

This surge in investment signals renewed confidence in China’s economy, particularly in technology and consumer-driven sectors. With U.S. stock valuations nearing their peak, global investors are looking at China as a promising alternative. The performance of Chinese stocks in the coming months could serve as a key indicator of broader global market trends.

Looking Ahead

Investors will be closely monitoring how these bets on Chinese stocks play out amid global economic shifts, evolving trade relations, and China’s AI advancements. If positive trends continue, or if Beijing introduces additional supportive policies, Chinese equities may attract even more interest from global hedge funds.

Foreign Investors Shift from India to China on AI and EV Growth

Foreign investors are moving money from Indian stocks to Chinese stocks again. After lagging behind for five years, China’s small-cap stocks are now performing better than India’s this year. While investment funds focused on India are seeing money flow out, hedge funds bought Chinese stocks last week at the fastest rate in over four months. This shift isn’t just because of hopes for a government stimulus. According to Deutsche Bank analyst Peter Milliken, innovations in AI (like the DeepSeek product) and electric vehicles (EVs) are attracting global investors back to Chinese stocks.

India’s equity cash segment trading hit a 14-month low as a selloff continues amid slow growth and global volatility. Combined daily turnover on key bourses is around $10B this week, down sharply from a $26B peak in June, matching levels last seen in November 2023.

Update

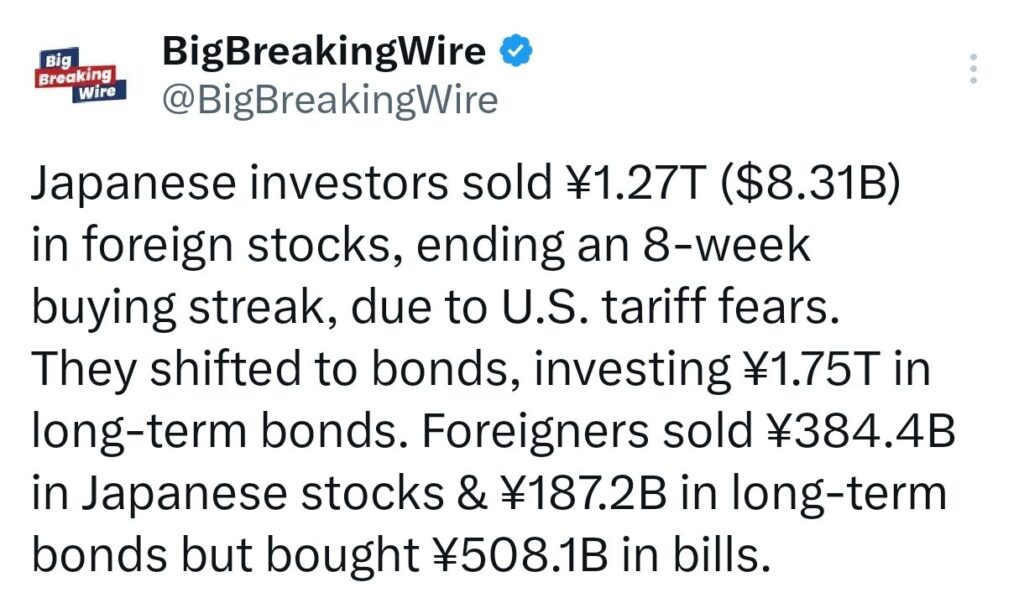

Japanese Investors Shift to Bonds as U.S. Tariff Fears Rise

Japanese investors sold ¥1.27T ($8.31B) in foreign stocks, breaking an eight-week buying streak, amid concerns over U.S. tariffs. Instead, they turned to bonds, investing ¥1.75T in long-term bonds. Meanwhile, foreign investors offloaded ¥384.4B in Japanese stocks and ¥187.2B in long-term bonds but showed interest in short-term assets, purchasing ¥508.1B in bills.

Foreign Investors Shift Focus to China, Leaving Indian Equities Under Pressure: Nomura

Global investors are shifting their focus to Chinese stocks, largely due to DeepSeek’s breakthrough in artificial intelligence. This has led to a movement of funds away from other emerging markets, including India. Hedge funds are aggressively buying Chinese shares, while foreign investors have been consistently selling Indian equities since late December.

According to Nomura, renewed optimism about China is making India less attractive to global investors. Additionally, concerns about a weak rupee, slower economic growth, tight liquidity in the banking sector, and the potential return of tariffs under Donald Trump’s presidency are adding to investor caution. Unless some of these challenges improve, foreign investments in India may remain subdued.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

[…] Hedge Funds Turn Bearish on U.S. Stocks Amid Market Concerns, Says Goldman SachsHedge Funds Bet Big on Asian Stocks, But Risks LoomHedge Funds Boost Investments in Chinese Stocks Amid AI and Policy Shiftsbigbreakingwire […]