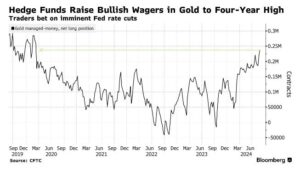

Hedge funds have raised their bullish bets on gold to the highest level in four years. This surge in confidence comes as many traders expect the Federal Reserve to cut interest rates soon, which could boost gold prices even further.

Gold Managed-Money Positions on the Rise

According to data from the Commodity Futures Trading Commission (CFTC), hedge funds have significantly increased their net long positions in gold. This means that more traders are betting on gold prices going up, rather than down. The current level of bullish positions is the highest it has been since mid-2020.

Why Are Hedge Funds Betting Big on Gold?

The primary reason for this increase in bullish sentiment is the expectation that the Federal Reserve will soon cut interest rates. When interest rates fall, the U.S. dollar often weakens, making gold—a safe-haven asset—more attractive to investors. A weaker dollar usually means higher gold prices because gold is priced in dollars.

In addition to potential rate cuts, ongoing economic uncertainties and concerns about inflation are also driving hedge funds to invest more heavily in gold. Gold is often seen as a hedge against inflation, and with inflation still a concern, more investors are turning to gold as a secure investment.

What Does This Mean for Gold Prices?

If the Federal Reserve does cut rates as expected, gold prices could continue to rise, rewarding those who have bet on the metal. However, if the Fed decides to keep rates steady, or if other economic factors come into play, the price of gold could fluctuate.

For now, it’s clear that hedge funds are optimistic about gold’s prospects. Their increased bets suggest that they believe gold will continue to perform well in the near future.

Conclusion

Hedge funds are now more bullish on gold than they have been in four years, driven by expectations of imminent Federal Reserve rate cuts and ongoing economic uncertainties. As a safe-haven asset, gold remains a key investment for those looking to protect their portfolios against inflation and currency fluctuations.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment