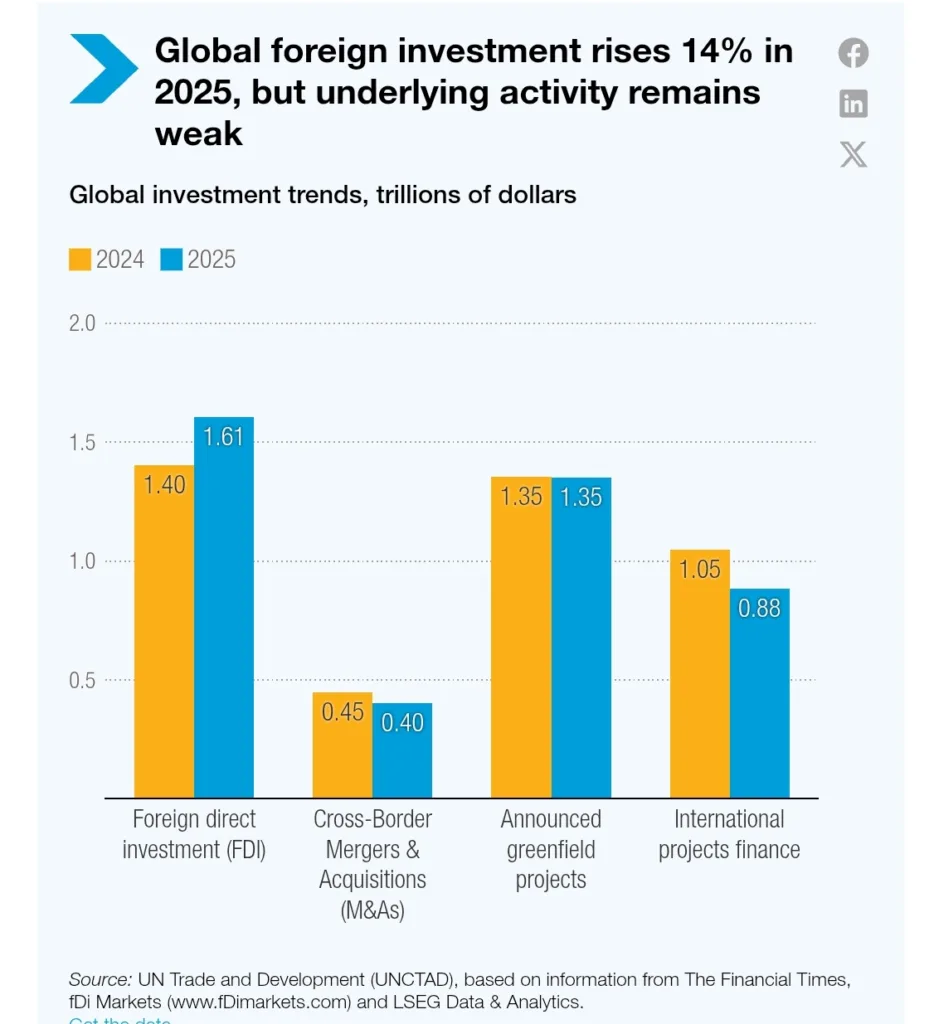

Global foreign direct investment (FDI) rose 14% in 2025 to about $1.6 trillion. At first glance, this looks like a strong recovery. But a closer look shows that most of the growth came from financial transactions routed through global financial centres, not from new factories, infrastructure, or job-creating projects.

For countries like India, this distinction matters. Real investment activity remains fragile, uneven, and increasingly concentrated in a few sectors and regions.

Key Global FDI Highlights in 2025

- Global FDI increased 14% to $1.6 trillion

- Without financial centre flows, growth was only about 5%

- Investor sentiment remained weak across most indicators

- Real economy investment struggled despite headline growth

Why Financial Centres Drove Most of the Growth

More than $140 billion of the global FDI increase came from money flowing through global financial hubs. These are often accounting or financing transactions that do not translate into real assets on the ground.

When these “conduit flows” are excluded, the recovery in global investment looks limited. This shows that companies remain cautious about long-term expansion.

What the Data Shows

- International mergers and acquisitions fell 10%

- Project finance declined for the fourth straight year, down 16% in value

- Greenfield project announcements dropped 16%

- Large mega-projects inflated total values but were few in number

This signals weak confidence in future growth, especially in developing and lower-income economies.

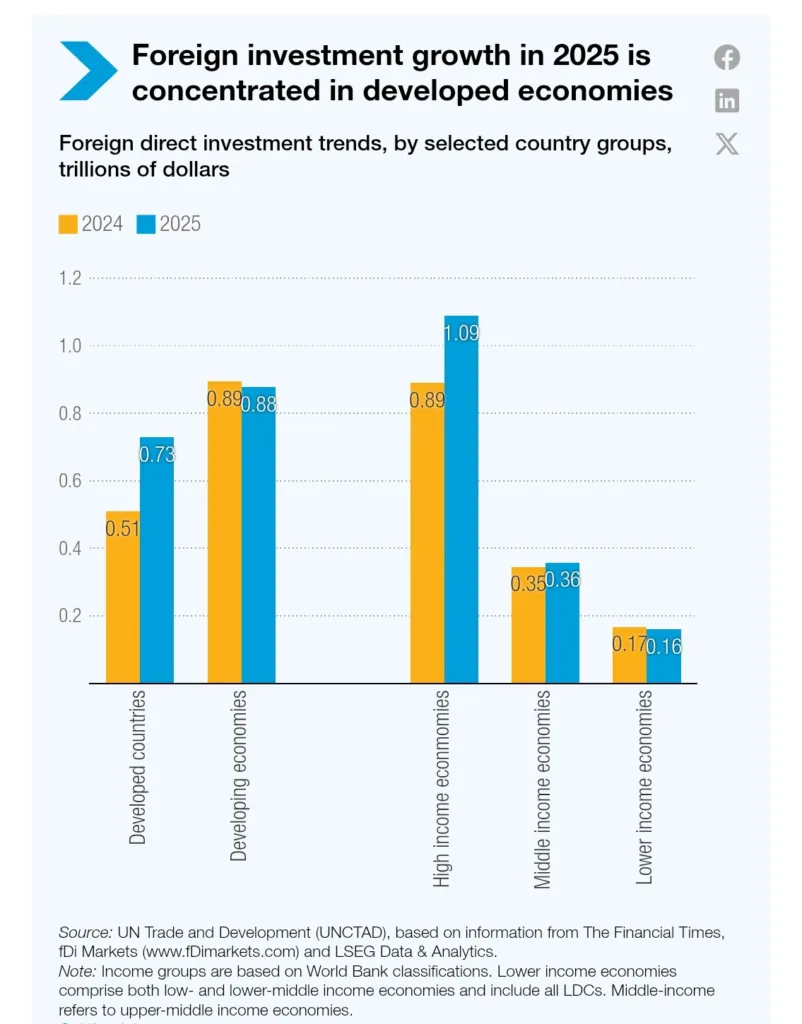

Developed vs Developing Economies: The Gap Is Widening

FDI flows to developed economies jumped 43% in 2025, reaching $728 billion. Europe led this surge, helped by large cross-border acquisitions and a rebound in major economies.

In contrast, developing economies saw FDI decline 2% to $877 billion. Although they still received 55% of global FDI, the trend is worrying.

Impact on Poorer Countries

- Three out of four least developed countries saw stagnant or falling FDI

- Capital-intensive projects are crowding out smaller economies

- Risk perception and financing constraints remain major barriers

This shift makes it harder for low-income nations to compete for investment that supports jobs, exports, and sustainable growth.

India’s Position in the Global FDI Landscape

India continues to attract global attention, especially in technology-linked sectors. While overall developing economy flows weakened, India stood out as a key emerging market destination.

Why Investors Are Looking at India

- Strong demand for data centres and digital infrastructure

- Large domestic market supporting scale

- Growing role in global technology and supply chains

- Policy focus on manufacturing and electronics

However, India also faces challenges. Global investors are becoming more selective, and capital is flowing into fewer, high-tech projects with limited spillovers.

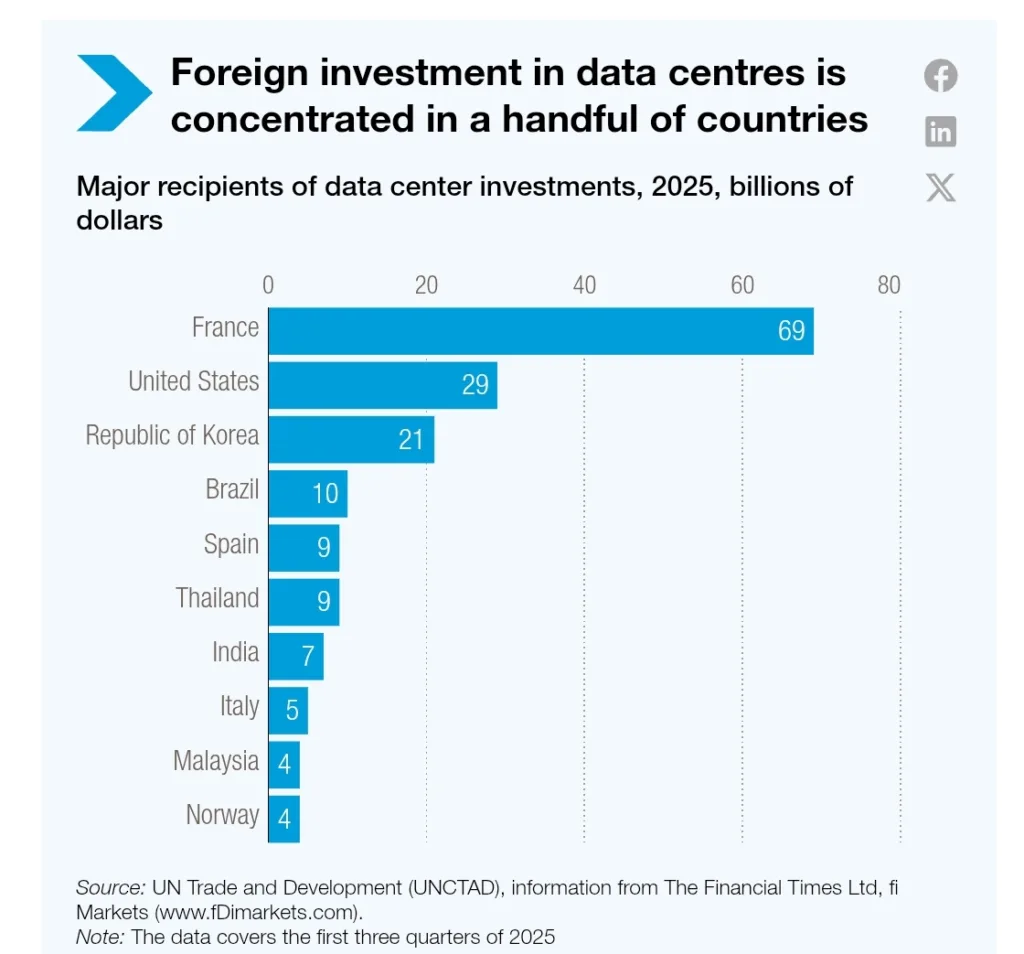

Data Centres and AI: The New Drivers of Global FDI

Data centres reshaped global investment in 2025. They accounted for more than 20% of total greenfield project values, with announced investments exceeding $270 billion.

The main driver was rising demand for artificial intelligence infrastructure and private digital networks.

What This Means for India

- India attracted major data centre announcements

- Growth supports cloud services, AI, and digital platforms

- Job creation is limited compared to traditional manufacturing

To maximize benefits, India needs stronger links between digital infrastructure, skills training, local innovation, and domestic value creation.

Semiconductors Rise, Traditional Sectors Struggle

The value of newly announced semiconductor projects rose 35% globally. At the same time, project numbers fell sharply in tariff-exposed sectors like textiles, electronics assembly, and machinery.

For India, this signals both opportunity and risk. Advanced manufacturing can bring technology and resilience, but traditional job-heavy sectors may see fewer new investments.

Infrastructure and Renewable Energy: A Weak Spot

International investment in infrastructure fell 10% in 2025. Renewable energy projects were hit hard as investors reassessed revenue risks and regulatory uncertainty.

Domestic investors stepped in to fill some of the gap, but this creates problems for countries that rely on foreign capital for large infrastructure and sustainable development goals.

India-Specific Takeaway

- Domestic capital is playing a bigger role

- Foreign funding for renewables needs policy clarity

- Stable regulations are key to long-term infrastructure investment

Outlook for 2026: What to Expect

The outlook for global FDI in 2026 remains highly uncertain. Flows could rise modestly if financing conditions improve and cross-border deals recover.

However, real investment activity is likely to stay under pressure due to geopolitical tensions, policy uncertainty, and economic fragmentation.

Direct Answers to Common Questions

Did global FDI really recover in 2025?

Headline numbers improved, but real investment activity remained weak once financial centre flows are excluded.

Is India benefiting from global FDI trends?

Yes, mainly in data centres and technology-driven projects, but benefits are concentrated and job creation is limited.

Which sectors are attracting the most FDI?

Data centres, AI infrastructure, and semiconductors are leading, while traditional manufacturing is losing ground.

What is the biggest risk going into 2026?

Rising concentration of investment in a few regions and sectors, leaving developing economies more vulnerable.

Conclusion

Global FDI growth in 2025 looks stronger than it really is.

For India, the challenge is not just attracting capital, but ensuring it supports jobs, skills, and sustainable development.

Clear policies, reduced uncertainty, and a focus on productive investment will decide whether India turns selective global interest into long-term economic gains.

Source: UNCTAD

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment