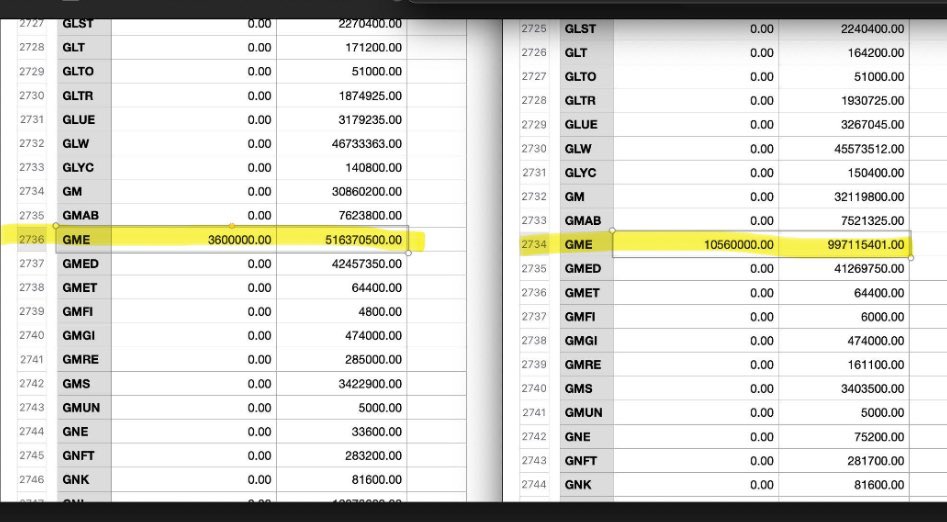

Gamestop stock, $GME, experienced two halts within a span of just 10 minutes after the market opened, followed by a surge of 70%.

The market capitalization of $GME now exceeds $9 billion, marking a staggering increase of over $5 billion in value over the past three weeks.

Currently, $GME is trading at its highest level since November 2022.

In parallel, AMC Entertainment’s stock has seen a rise of over 25% at the opening of the market.

Trading in $GME has been halted for the sixth time due to excessive volatility, with the stock soaring by 110%.

Gamestop is on the cusp of entering the ranks of the 500 largest companies in the United States, with just a 20% increase needed to achieve this milestone.

Whenever trading resumes following a halt, Gamestop’s stock consistently surges to reach new record highs.

The current market dynamics evoke a sense of déjà vu, reminiscent of the unprecedented trading frenzy that characterized the year 2021.

Short sellers of GameStop, have incurred around $1 billion in mark-to-market losses today.

Update:

Gamestop, $GME, on May 14th, Tuesday, is trading at $78 up 160% in Pre-market, for the first time since August 2022. With a staggering 31% surge in after-hours trading and a remarkable 130% increase throughout the day, Gamestop has soared in value. It now ranks among the top 600 largest public companies in the United States.

AMC Entertainment shares further extend their rally, climbing as high as 155%.

Update:

Today, short sellers of $GME and $AMC have incurred losses of $3.5 billion, bringing their two-day losses to $5 billion.

Update:

Jim Cramer says it is prudent to sell GameStop $GME, as he doubts it will maintain a trading value of $64 or even $44. Additionally, he describes AMC Entertainment $AMC as a “dead man walking.”

According to The Options Clearing Corporation (@OptionsClearing), over 1.5 billion shares of GameStop ($GME) are currently on loan, which is approximately five times the stock’s float.

Did you know?

The P/E ratio of GameStop $GME has soared to 1,210x.

This means it costs $1,210 to buy $1 of $GME’s earnings.

In comparison, Nvidia $NVDA has a P/E ratio of 34x.

$GME has surged nearly 400% this month, reaching its highest levels in over two years.

On Monday, over 175 million $GME shares were traded, which is 30 times the 1-year average, according to Bloomberg.

GameStop saw all 195.5 million shares of its full free float traded today, according to Dave Lauer.

Update:

Former SEC Chair Jay Clayton commented on $GME and $AMC, asking, “Is this something we should be tolerating in our markets? Whether it is legal or illegal, I don’t think so.” He also called on “Roaring Kitty” to “tell people why he did this.”

Why do you think “Roaring Kitty” did this?

Interestingly, “Roaring Kitty” hasn’t commented on any specific stock. Instead, all meme stocks are rallying on speculation that he is referring to them.

Update:

Robinhood, $HOOD, announced that their systems will undergo maintenance tonight for two hours prior to market opening, aimed at ensuring readiness for potentially increased traffic tomorrow.

According to Vlad Tenev, @RobinhoodApp achieved a milestone today by reaching $5 billion in equities trading volume, marking one of their most significant days in the last 12 months.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment