Foreign investors continued to sell off Indian financial and energy stocks in November, leading to significant outflows and a decline in market value. In the first half of the month, foreign portfolio investors (FPIs) withdrew $2.6 billion, pushing their record streak of net selling to 39 sessions. This contributed to a steep drop in the value of their holdings in domestic stocks, which fell by $21.5 billion to $823 billion, a 2.5% decline since the start of the month.

Sector-wise, financial stocks have borne the brunt of the sell-off, with $3.39 billion exiting since October. Meanwhile, energy stocks, including oil, gas, and consumable fuels, saw even higher outflows of $3.9 billion. These outflows align with significant sectoral declines, as the Nifty Energy index fell 6.92% in November, and the Nifty Financial Services index dropped 2%. Key stocks like Shriram Finance Ltd. and Bajaj Finserv Ltd. were among the hardest hit.

Other sectors, such as automobiles, FMCG, and telecommunications, also saw heavy selling. However, IT and construction emerged as exceptions, attracting inflows of $366 million and $227 million, respectively.

Since October, foreign investors have withdrawn $13 billion from Indian stocks, according to data from CDSL. Despite this, they have poured $11.5 billion into initial public offerings (IPOs) and primary market sales. In 2024, India’s IPO proceeds reached a record $28.4 billion, more than double the amount raised in 2023. This surge in IPO activity contrasts with the broader market trend, as the NSE Nifty 50 experienced a correction amid substantial outflows from global funds.

Since September 27, FPIs have sold Indian stocks worth over ₹1.59 lakh crore ($19 billion), according to the National Stock Exchange. This has been partly offset by domestic institutional investors, who purchased stocks worth ₹1.52 lakh crore ($18 billion) during the same period.

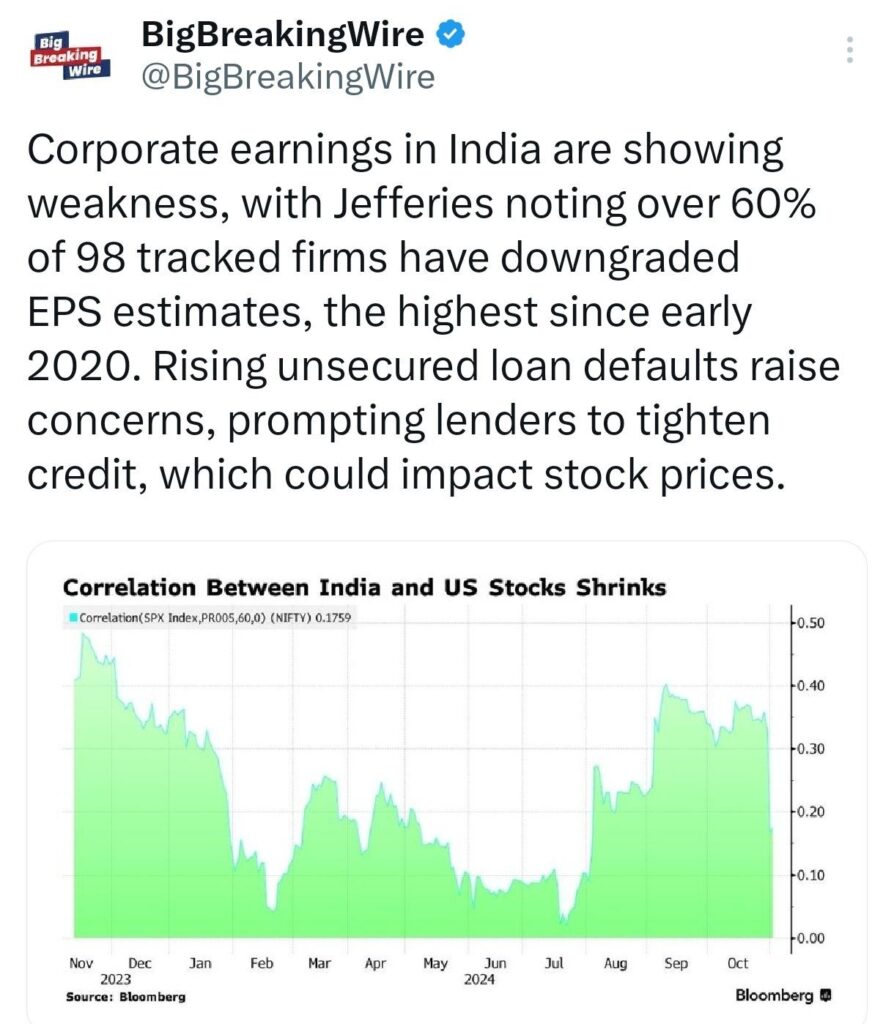

The sell-off has pushed India’s major stock indices into correction territory. The NSE Nifty 50 declined by 10.1% from its recent peak, while the mid-cap and small-cap indices fell by 9.4% and 8.4%, respectively. Weak earnings performance, fueled by economic slowdown concerns, remains a key factor. Global brokerage Jefferies downgraded fiscal 2025 earnings estimates for over 60% of 98 tracked companies—the highest downgrade ratio since early 2020.

India’s GDP growth is projected to decelerate to 6.3% in 2025, driven by the effects of fiscal tightening and slower credit expansion. Goldman Sachs has revised its outlook on Indian equities, citing these domestic challenges. However, Indian markets remain relatively shielded from global economic pressures, offering some resilience. Despite this, earnings growth expectations are subdued, reflecting cautious optimism amid a challenging economic environment.

Morgan Stanley remains optimistic about India’s economic prospects, forecasting a significant surge in household wealth, which is expected to reach $10 trillion. Over the past decade, Indian households have contributed $9.7 trillion to this wealth accumulation, driven by rising incomes and increased financial savings. The growing preference for equity investments, coupled with steady inflows of global capital, is anticipated to provide substantial support to Indian markets. However, this bullish outlook is not without challenges, as bureaucratic inefficiencies and regulatory hurdles could potentially slow down growth and market momentum.

India’s economic indicators are showing signs of moderation, but there is no significant downside risk to the country’s growth projection of 6.5-7%, according to Economic Affairs Secretary Ajay Seth. Although some sectors are experiencing slower growth, other sectors are witnessing increased demand, balancing out the overall economic picture. Despite the moderation in certain areas, the Reserve Bank of India (RBI) has maintained its growth forecast of 7.2% for the fiscal year 2024-25, reflecting confidence in the country’s economic resilience.

HSBC Cuts 2025 BSE Sensex Target to 90,520, Sees 15% Upside Amid Slower Earnings Growth

HSBC has revised its target for the BSE Sensex to 90,520 for 2025, citing a 15% potential upside from its current levels. The downgrade is driven by concerns over earnings revisions and high valuations, which could lead to a more sustainable but slower pace of growth. Despite these challenges, HSBC maintains a positive view on India as one of the fastest-growing markets for 2025.

The Sensex has already dropped by 8.46% from its peak, with mid- and small-cap indices experiencing even steeper declines. The banking sector is facing pressure from shrinking interest margins, while the IT sector is grappling with weaker demand. India’s economic growth is also projected to slow from 8.2% in 2023 to 6.5% in 2025, with weakening consumption demand and underperforming key economic indicators.

HSBC notes that, despite these headwinds, small- and mid-cap stocks in India are expected to outpace large-cap stocks in terms of growth. Meanwhile, HSBC forecasts a 21% upside for China’s equities but cautions that Japan’s market faces challenges due to a strengthening yen.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

One Comment