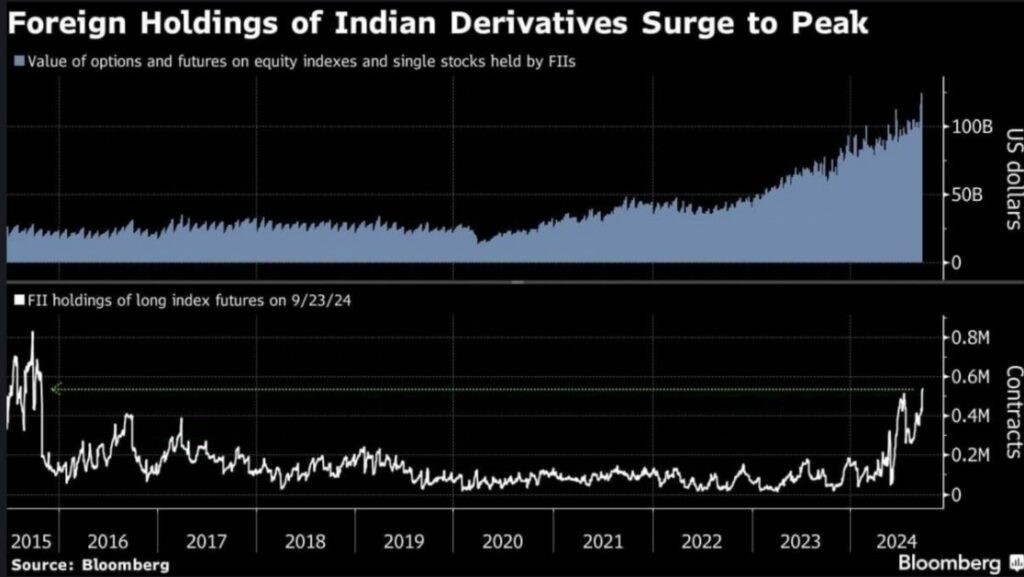

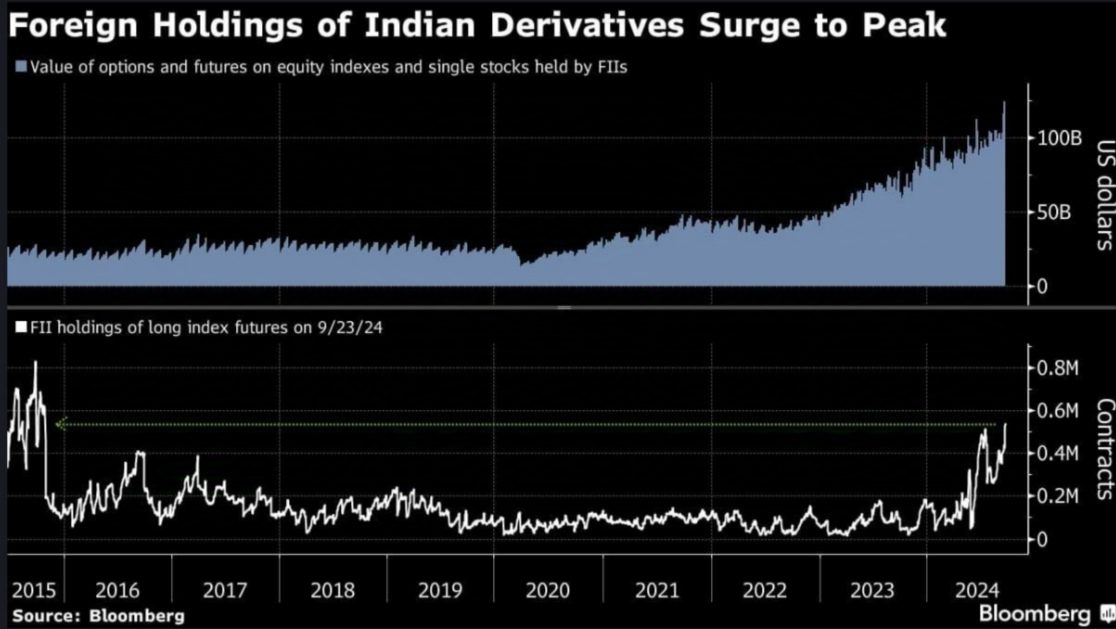

Foreign investors’ derivatives bets in India have surged to a record $124 billion, driven by the impressive performance of the Indian stock market. The Nifty 50 index has seen an 20% rally from its June low, positioning it as one of Asia’s top-performing indexes. This upward trend was further fueled by a positive global market sentiment following the Federal Reserve’s significant rate cut last week.

As of Monday, foreign institutional investors (FIIs) held more than 10 trillion rupees ($124 billion) in options and futures contracts on equity indexes and single stocks listed on the National Stock Exchange (NSE), according to Bloomberg data. Their bullish positions in index futures, including those linked to the Nifty 50, have reached nearly 540,000 contracts — the highest since 2015.

This surge in derivatives activity comes despite the initial market volatility triggered by political developments in June, when Prime Minister Narendra Modi’s party lost its parliamentary majority. Since then, Indian equities have rebounded sharply, with global funds investing a net $8.5 billion into local stocks between July 1 and the end of last week. This marks the largest quarterly inflow in over a year, even though Indian stocks are trading at higher valuations compared to other emerging markets.

External and Internal Factors Driving Derivatives Bets

India’s strong economic fundamentals, coupled with global liquidity and risk-on sentiment, have made it an attractive destination for foreign capital. The Federal Reserve’s rate cut has boosted risk appetite globally, which, in turn, has benefited emerging markets like India. Additionally, India’s relatively stable macroeconomic environment and pro-growth reforms continue to attract foreign funds.

The trend shows that foreign investors are becoming increasingly bullish on India, and this outlook is expected to continue for the foreseeable future.

The Indian stock market’s robust recovery and strong inflows reflect growing confidence in the country’s economic potential, signaling a favorable environment for further investment.

A Strong Outlook for Indian Equities

While Indian stocks are trading at high valuations relative to their emerging market peers, foreign investors’ derivatives bets continue to grow. This highlights the long-term confidence of global investors in India’s growth story.

India’s stock market rally, boosted by global inflows and strong domestic fundamentals, is likely to see further growth as FIIs continue to pour capital into the country.

Conclusion

The unprecedented rise in foreign investors’ derivatives bets to $124 billion underlines the bullish sentiment towards Indian equities. With strong market performance, increased global confidence, and favorable domestic policies, India’s stock market is well-positioned to attract sustained foreign investment.

Inputs from Bloomberg

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment