This BigBreakingWire report explains the latest US Treasury holdings by major foreign countries using official US Treasury TIC data. The numbers show clear buying and selling trends compared with last year, explained in simple words.

Key Question: Are Foreign Countries Selling US Treasuries?

The short answer is no overall panic selling. While some countries like China and India reduced holdings, Japan and Europe increased exposure. Total foreign holdings actually increased year on year.

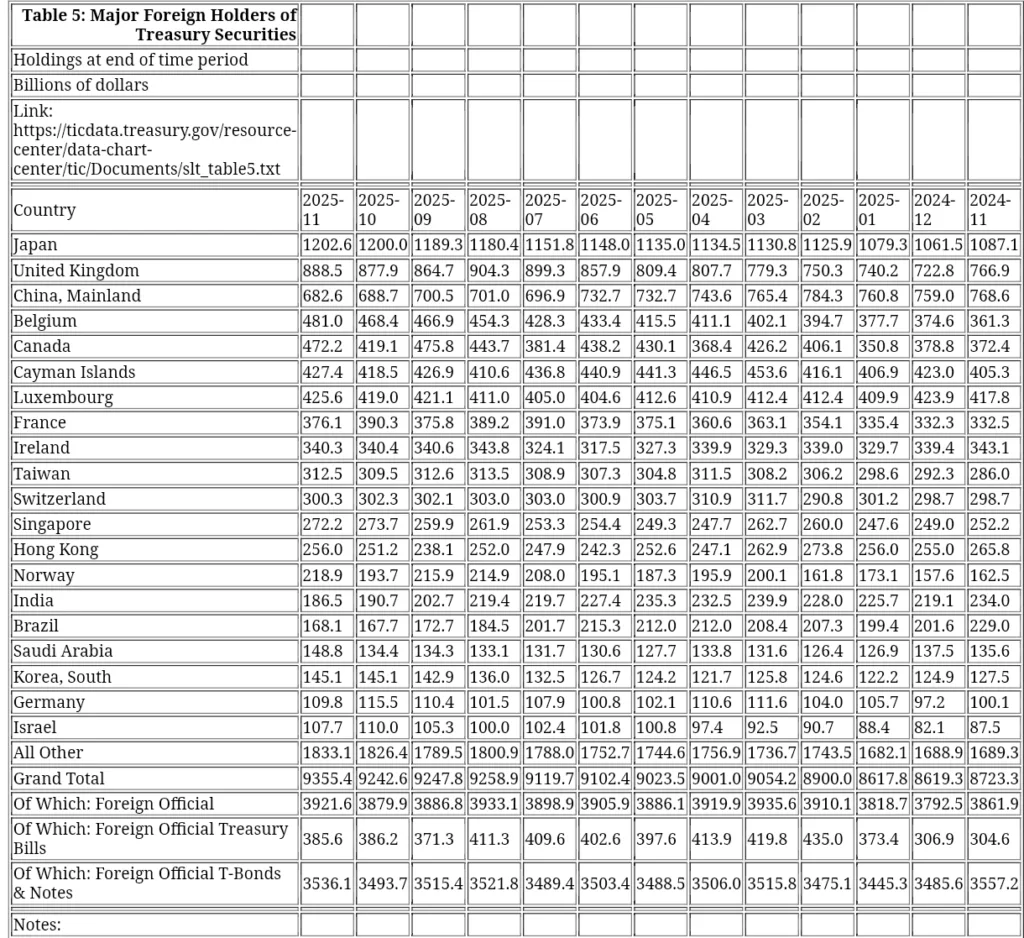

Grand Total: Overall Foreign Position

- Nov 2025 Total Holdings: USD 9,355.4 billion

- Nov 2024 Total Holdings: USD 8,723.3 billion

- Net Change: +USD 632.1 billion (net buying)

This confirms that foreign investors added US Treasuries overall despite geopolitical noise and rate volatility.

Country Wise: How Much Was Sold or Bought Since Last Year

China Mainland

- Nov 2025: USD 682.6 billion

- Nov 2024: USD 768.6 billion

- Net Change: -USD 86.0 billion (sold)

China continued its long term strategy of reducing exposure to US Treasuries, driven by diversification and currency management.

Japan

- Nov 2025: USD 1,202.6 billion

- Nov 2024: USD 1,087.1 billion

- Net Change: +USD 115.5 billion (bought)

Japan strengthened its position as the largest foreign holder of US Treasuries, supporting yen stability and reserve safety.

India

- Nov 2025: USD 186.5 billion

- Nov 2024: USD 234.0 billion

- Net Change: -USD 47.5 billion (sold)

India reduced holdings as part of reserve diversification and domestic liquidity management.

United Kingdom

- Nov 2025: USD 888.5 billion

- Nov 2024: USD 766.9 billion

- Net Change: +USD 121.6 billion (bought)

Belgium

- Net Increase:

- USD 481.0 billion vs USD 361.3 billion

- Change: Strong accumulation

What About Offshore Financial Centers

Countries like Cayman Islands and Luxembourg remain large holders. These locations often reflect custodial and institutional flows, not direct sovereign policy.

Foreign Official Holdings Breakdown

- Foreign Official Holdings: USD 3,921.6 billion

- Treasury Bills: USD 385.6 billion

- Treasury Bonds and Notes: USD 3,536.1 billion

This shows foreign central banks still prefer long duration US government bonds over short term bills.

Conclusion

Despite headlines about de dollarization, the data clearly shows:

- No global dump of US Treasuries

- China and India are trimming exposure gradually

- Japan UK and Europe are increasing holdings

- Total foreign ownership is rising year on year

US Treasuries remain the core global safe asset, especially during currency and geopolitical uncertainty.

Why This Matters for Investors

Tracking foreign Treasury flows helps investors understand:

- Dollar strength trends

- Global risk sentiment

- Bond yield direction

- Central bank confidence in US debt

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment