Morgan Stanley: The economy is growing strongly, but inflation is getting closer to the target, which leads the Federal Reserve to reduce the interest rate by 25 basis points. Chair Powell is expected to acknowledge the recent economic strength. Our strategists suggest maintaining a long position in the mortgage-backed securities (MBS) basis.

The Federal Open Market Committee (FOMC) lowers the federal funds rate by 25 basis points to 4.625%. The FOMC statement updates its outlook on economic growth and acknowledges the progress made in controlling inflation.

In the press conference, we don’t expect Chair Powell to commit to the size or timing of future rate cuts. Decisions will depend on economic data.

We expect 25 basis point cuts in both November and December.

Our rates strategists recommend staying neutral on U.S. Treasury duration and yield curve positioning ahead of the U.S. general election and the November FOMC meeting.

Our FX strategists don’t anticipate big moves in the U.S. dollar from the November FOMC meeting but believe the dollar’s risk premium is highest against the Australian dollar (AUD), Canadian dollar (CAD), and Japanese yen (JPY).

For agency MBS, our strategists remain long on the mortgage basis and prefer buying production coupon Ginnies and conventionals.

JP Morgan anticipates the Federal Reserve will reduce rates quarterly starting in December until the federal funds rate reaches 3.5%.

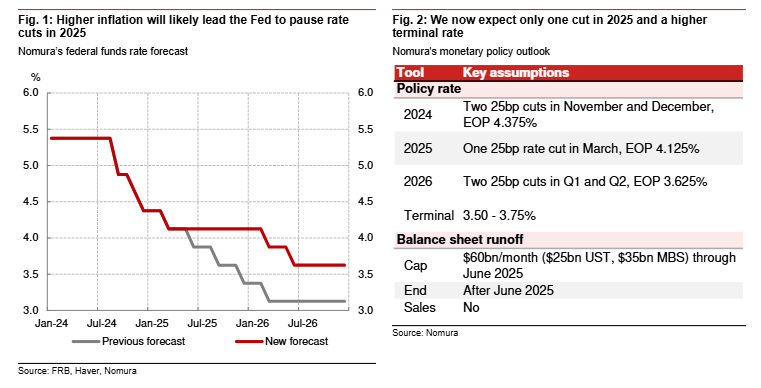

Trump Victory Means Fewer Fed Cuts – Nomura

Donald Trump has won the presidential election, and the Republicans are set to take control of the Senate. They are also likely to retain control of the House of Representatives, though an official confirmation for the House may be delayed.

We expect that tariffs and tax policy will be central to the economic agenda in a second Trump administration. Tariffs are expected to increase inflation and slow down growth.

We now forecast only one Federal Reserve rate cut in 2025, with the Fed holding off until the inflationary effects of tariffs have been fully realized (Fig. 1 & 2). We anticipate some further easing in 2026, but have raised our forecast for the terminal rate to 3.625% from 3.125%. A change in Fed leadership is likely by 2026, but it will be challenging for Trump to have a major impact on monetary policy.

With unified government, the fiscal outlook is expected to worsen. We anticipate higher debt and deficits than the current projections from the Congressional Budget Office (CBO). However, tariffs could bring in significant revenue in the short term.

Nick Timiraos: Fed May Revise Assumptions in December If Republicans Gain Control of Both Congressional Chambers

Officials are facing the key question: Does the election outcome lead to significant changes in economic demand or inflation that would require a shift in policy? The Fed is unlikely to alter its approach until they see how President-elect Donald Trump handles proposed changes to taxes, tariffs, and immigration. However, if Republicans win control of both chambers of Congress, the Fed’s economists might start revising some of their core assumptions at the December meeting. (WSJ)

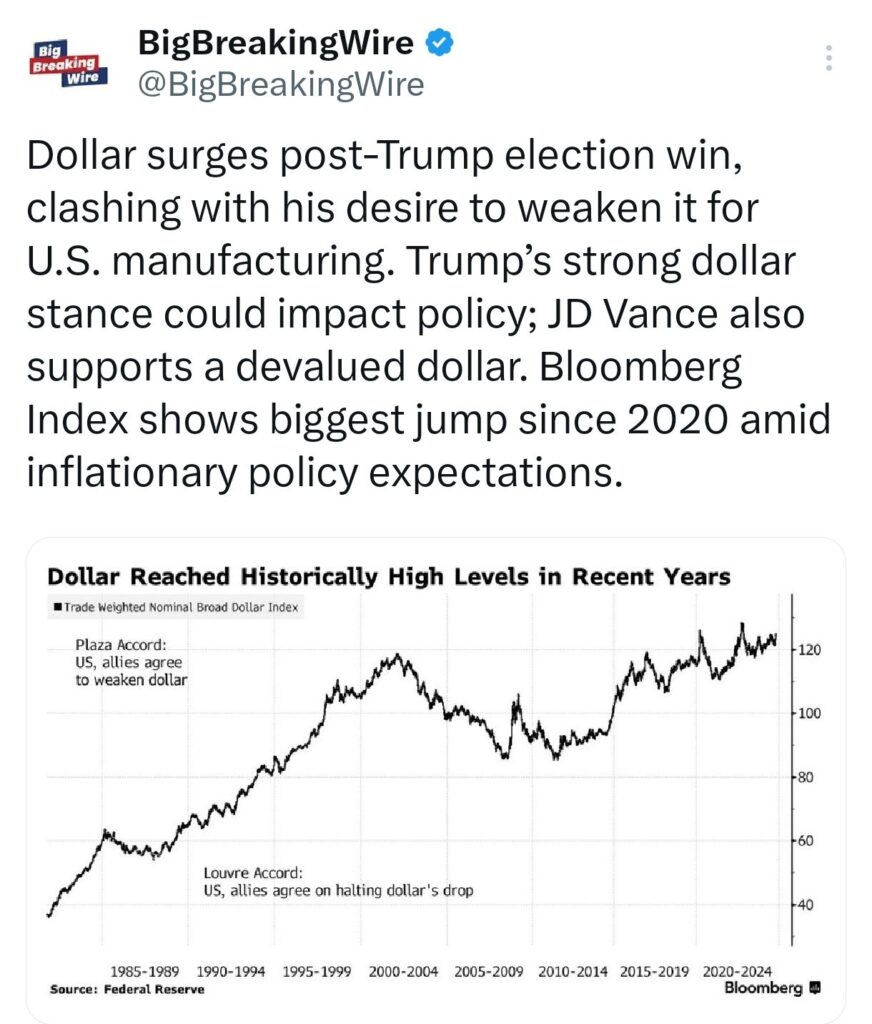

U.S. dollar surged following Donald Trump’s election win, which conflicts with his long-standing desire to weaken the dollar to support U.S. manufacturing. Trump’s stance on the dollar may have significant implications for economic policy. Additionally, JD Vance, a political figure, also advocates for a devalued dollar. According to the Bloomberg Index, the dollar experienced its largest increase since 2020, driven by expectations that inflationary policies will continue under the new administration.

Donald Trump’s anti-China stance is prompting investors to shift their focus toward stocks in India and Japan. India is benefiting from changes in global supply chains, as companies seek alternatives to China for manufacturing and production, alongside its large, skilled workforce. On the other hand, Japan is experiencing gains due to Trump’s economic policies, which are expected to support its exports. Both countries are increasingly viewed as attractive alternatives to China, given the risks associated with doing business in the Chinese market.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

2 Comments