1. Interest Rate Decision:

– The Federal Reserve has decided to hold interest rates steady at the 5.25%-5.50% range for the seventh consecutive time during the June 11-12 meeting.

2. Future Rate Cuts Forecast:

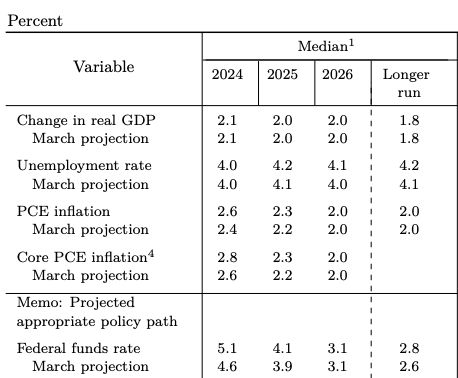

– The latest FOMC median forecast indicates only one 25 basis point (bps) rate cut in 2024, compared to the 75 bps in cuts projected in March.

3. Revised Expectations for 2024:

– U.S. central bankers now expect to cut interest rates just once this year, which is two fewer cuts than anticipated in March, due to a slower-than-expected approach to their 2% inflation goal.

4. Economic Projections:

– New economic projections, published at the end of the recent FOMC meeting, show that policymakers expect the policy rate to be 4.1% by the end of 2025, implying four additional quarter-point cuts next year.

5. Changes from Previous Projections:

– In March, the Fed projected at least three 25 bps cuts in both 2024 and 2025, which would have placed the policy rate between 3.75% and 4% by the end of 2024.

6. Inflation Forecast:

– Policymakers now predict a fourth-quarter inflation rate of 2.6% for 2024, up from the 2.4% forecast in March. This projection is based on the year-over-year change in the personal consumption expenditures (PCE) price index, which the Fed targets at 2%. Recent PCE inflation was 2.7% for the last two months.

7. Individual Expectations:

– These forecasts are the midpoint of the individual expectations from the Federal Reserve’s seven governors and 12 Fed bank presidents, providing guidance on the overall thinking of the policymakers.

8. Unemployment Rate Forecast:

– The unemployment rate is expected to rise to 4.2% by the end of 2025, slightly higher than the 4.1% forecasted in March. The current unemployment rate is 4%.

9. Economic Growth Outlook:

– Forecasts for U.S. economic growth remain unchanged at 2.1% for this year and 2.0% for next year.

10. Long-Run Neutral Rate Estimate:

– The Fed raised its estimate of the longer-run neutral rate to 2.8%, up from 2.6% in March and 2.5% in December. This increase suggests that the Fed may not cut rates as much as previously anticipated.

1. The Federal Reserve now anticipates only one 25 basis point (bps) rate cut in 2024 and a 100 bps cut in 2025.

2. Real GDP growth expectations remain steady at 2.1% for 2024.

3. The unemployment rate projection remains steady at 4.0% for 2024.

4. The PCE inflation forecast has been raised to 2.6% for 2024, while core PCE inflation expectations have been raised to 2.8%.

5. The Federal Funds Rate (FFR) is expected to be raised to 5.1% for 2024. The FOMC’s median forecast indicates a decrease to 4.1% in 2025 and 3.1% in 2026.

6. The FOMC’s longer-run median rate forecast has been increased to 2.8%, indicating expectations for higher Fed Funds in the longer term.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment