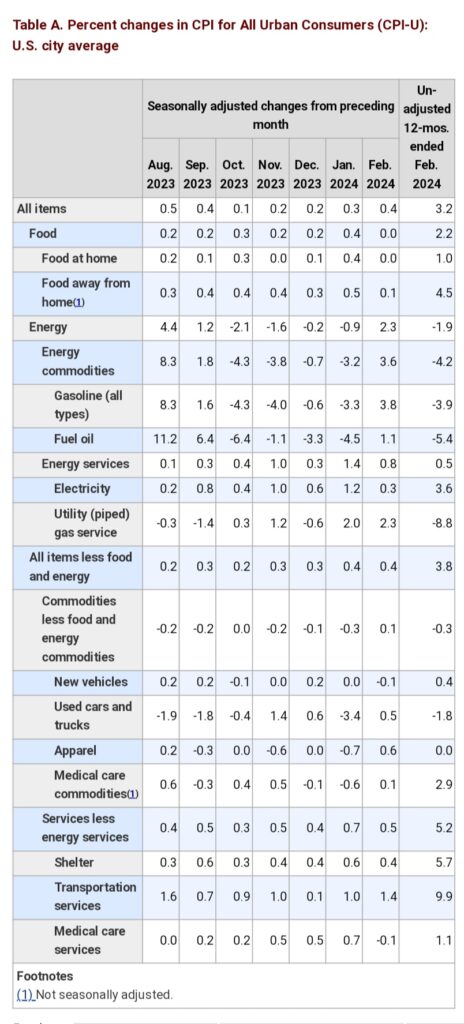

U.S. CPI for February, on a month-over-month basis, stands at 0.4%, in line with the previous month and meeting the estimated 0.4%. The year-over-year CPI is 3.2%, surpassing the previous 3.1% and aligning with the estimated 3.1%.

In terms of Core CPI, the month-over-month change for February is 0.4%, consistent with both the previous month and the estimated 0.3%. The year-over-year Core CPI is 3.8%, slightly below the previous 3.9% but exceeding the estimated 3.7%.

Analysts express concern over the persistent rise in prices, particularly when excluding food and energy, suggesting that the inflation observed in January is not merely an isolated occurrence.

The inflation rate for February sees an increase, reaching 3.2%, surpassing the anticipated 3.1%. Core CPI inflation has decreased slightly to 3.8%, still exceeding the expected 3.7%. This marks the 35th consecutive month with inflation surpassing 3%, and it’s the second consecutive month of an upward trend.

Two months ago, the market outlook anticipated six rate cuts in 2024, twice the number forecasted by the Federal Reserve. Currently, the prospect of three interest rate cuts is starting to seem optimistic, and it’s improbable that any cuts will take place during the initial two quarters of 2024.

Even after the release of inflation data, traders continue to view June as the most probable time for the initiation of Fed rate cuts.

Official predictions from the markets now indicate an expectation of fewer than three interest rate cuts in 2024. Following the second consecutive monthly increase in CPI inflation, prediction markets, anticipate approximately 65 basis points of rate cuts for the year, equivalent to around 2.6 rate cuts. This marks a significant decline from the six rate cuts projected just two months ago. Additionally, it’s noteworthy that, for the first time this year, market expectations for rate cuts are below the guidance provided by the Federal Reserve. Core inflation remains at 3.8%, nearly double the Fed’s long-term target.

The analyst notes that according to the BLS report, the core inflation rate experienced an upward push due to increased expenses in real estate, travel, vehicle insurance, clothing, and leisure activities.

Bringing you the latest updates on finance, economies, stocks, bonds, and more. Stay informed with timely insights.

Be First to Comment