What’s Happening?

Normally, the value of a currency like the US dollar moves based on interest rate differences between countries. For example, if US interest rates go up while Germany’s stay the same, the dollar usually gets stronger compared to the euro. This has been a reliable pattern.

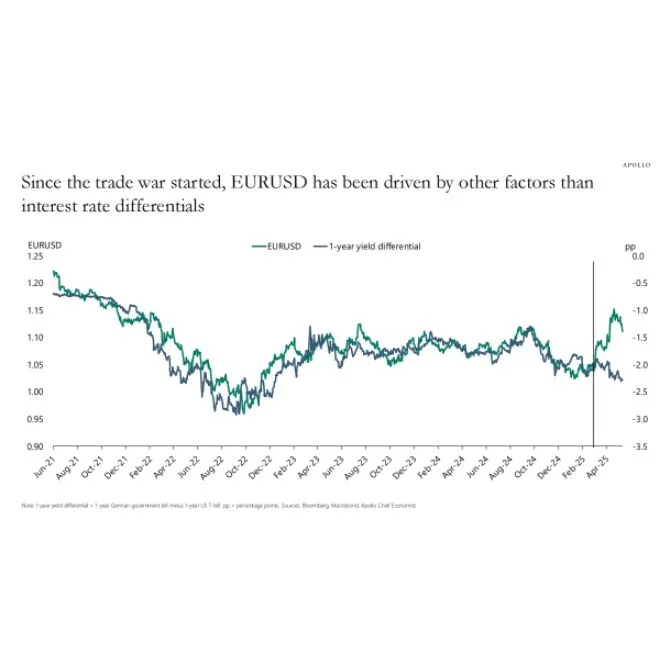

But since the trade war started, that pattern has changed.

What Is EURUSD?

EURUSD is the currency pair that shows how many U.S. dollars one euro can buy. It’s one of the most traded currency pairs in the world. Investors often watch interest rate differences between countries to predict currency movements.

Key Point

The US dollar is now about 10% weaker than expected when we compare it to the usual relationship with interest rates. This means something else is affecting the dollar’s value besides interest rate differences.

What the Chart Shows

The green line is the EURUSD rate (how many dollars you need to buy 1 euro).

The blue line is the 1-year interest rate difference between Germany and the US.

Normally, both lines move together.

But after the trade war began, they started to move apart.

According to the data, the EURUSD should be closer to 1.00 (parity), but it’s actually trading higher. This means the euro is stronger or the dollar is weaker than interest rates suggest.

Why It Matters

This shows that:

Other forces like trade policies or global demand are now moving currency markets.

Investors and businesses should not rely only on interest rate differences to predict exchange rates.

Conclusion

The EURUSD exchange rate is no longer following the traditional pattern linked to interest rate differences. There seems to be a “10% trade war premium” making the dollar weaker than expected. It’s a sign that global politics and trade issues are now playing a bigger role in currency movements.

BBW News Desk is the editorial team of BigBreakingWire, a digital newsroom focused on global finance, markets, geopolitics, trade policy, and macroeconomic developments.

Our editors monitor government decisions, central bank actions, international trade movements, corporate activity, and economic indicators to deliver fast, fact-based reporting for investors, professionals, and informed readers.

The BBW News Desk operates under the editorial standards of BigBreakingWire, prioritizing accuracy, verified information, and timely updates on major global developments.

Be First to Comment